(Bloomberg) — China’s Trina Solar Ltd. is considering building a factory in the United States to make cells used to make solar panels as the U.S. raises trade barriers on imports.

Most read articles on Bloomberg

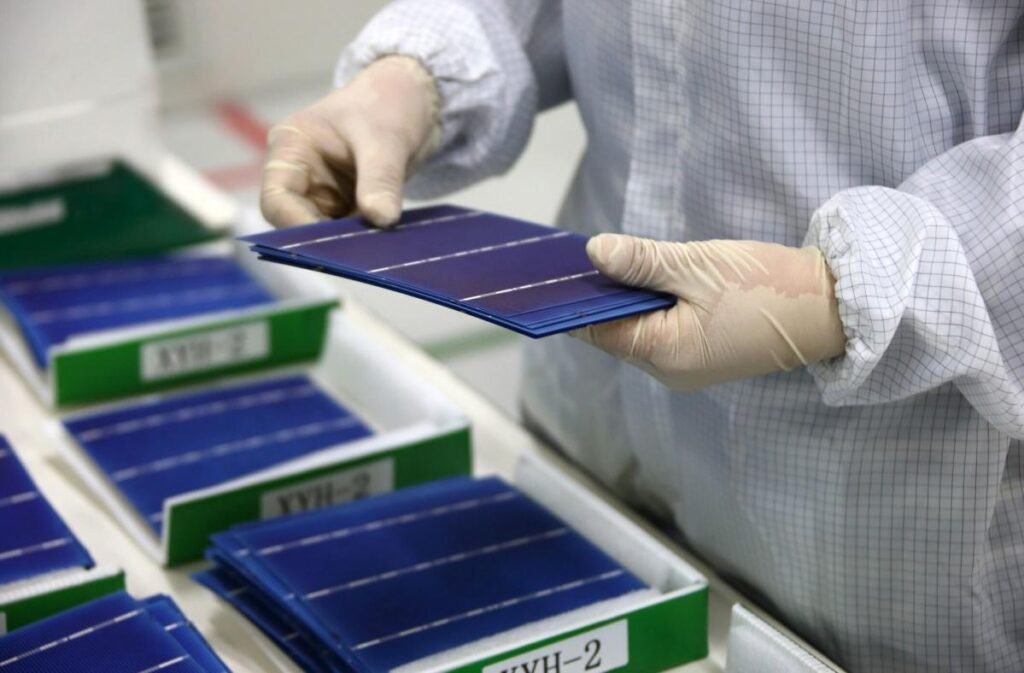

Steven Chu, Trina’s chief executive officer for North America, said the company is looking at a facility capable of producing 5 gigawatts of cells per year to supply its panel manufacturing plant in Willmar, Texas, which is expected to reach full production by the end of 2024 and create 1,500 local jobs.

The Texas plant will initially use solar cells from Southeast Asia, but Trina wants to move quickly to build up its U.S. production capacity given the U.S. government’s push to expand production in the U.S., Chu said in an interview on Thursday. The company plans to make a final decision on the new factory by the end of the year, with it expected to start operating in late 2025 or early 2026.

“We’re doing research and looking at opportunities,” he said.

Trina, based in Changzhou, Jiangsu province, is the world’s third-largest solar-panel maker. It is one of many Chinese companies expanding production capacity in the United States to escape slumping profits at home after the Biden administration passed a bill in 2022 providing incentives to boost domestic clean-energy manufacturing.

Chinese-made solar equipment has been subject to U.S. tariffs for more than a decade, which has led manufacturers to set up factories in Southeast Asia. But new measures to tighten import controls announced by the U.S. government last month and the possibility of higher tariffs on Southeast Asian products are prompting rethinks, with Trina among those closing production capacity in countries such as Thailand and Vietnam.

Meanwhile, the United States is lacking cell-making capacity, leaving Chinese companies to fill the gap.

“The United States is big enough, and the demand for renewable energy is big enough,” Chu said. “Customers are willing to pay a premium if it’s made in the U.S..”

–With assistance from Jennifer A. Dlouhy.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP