Investing money in the stock market is one of the most effective ways to grow your wealth, but is there a “right way” for Americans to invest?

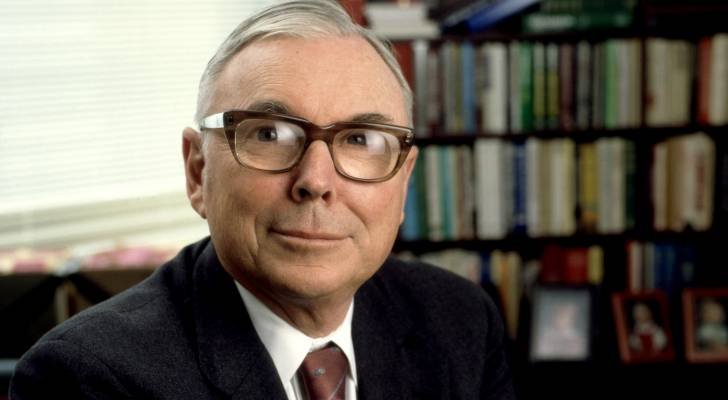

While investing always involves a certain amount of risk, some of the most successful investors invest in a special way. One person in particular who figured out some of the most effective investment strategies was the late billionaire investor Charlie Munger.

do not miss it

At the time of his death in November 2023, Munger had an estimated net worth of about $2.2 billion, according to Forbes magazine. He was vice chairman of Berkshire Hathaway and a longtime friend and business partner of Warren Buffett, a dynamic duo that enjoyed huge investment success over the years.

In 1994, Munger spoke at the University of Southern California Business School, where he expressed his belief that there were relatively few quality companies in the market. He believed that investors should focus their time, energy, and money on a small number of companies that fit into these categories.

Here are some of Charlie Munger’s tips and tricks revealed in his famous speech.

Understand your business

Munger stressed the importance of understanding the business you are investing in. You need to have a thorough understanding of the company’s functions, competitive position and related industry trends. Munger suggested that investors focus on businesses that are “in your league,” meaning they have a strong understanding of them and are focused on areas where they can make informed decisions.

“So you have to figure out where you’re at. If you play a game that other people are at and you’re not at, you’re going to lose. And that’s more certain than any prediction you can make. You have to figure out where your advantage is. And you have to play within your capabilities,” Munger stressed.

Staying in this “circle” means betting on quality companies that increase the likelihood of picking the right investment. A prime example is Berkshire Hathaway’s investment in Coca-Cola. Berkshire Hathaway and Buffett saw Coca-Cola as a company with a durable competitive advantage in the soft drink industry. Buffett generally advises against investing in companies outside of this “circle” because it only exposes investors to unnecessary risk.

read more: Who says you can’t beat the market consistently? Meet the team of market experts who picked the stocks that outperformed the S&P 500 by 12% for four consecutive years

Evaluation Discipline

Another point that Munger emphasized was the need for valuation discipline. It is important not to overprice a stock even if the company appears to be outstanding, but to focus on quality. He stressed the importance of a “margin of safety” – buying securities at a cost significantly lower than their actual value as a hedge against unpredictable market fluctuations.

“We’ve really made our money out of quality businesses. In some cases we’ve bought whole businesses. In other cases we’ve bought large amounts of stock. But if you analyze what’s happened, the big money has come from quality businesses. And so have most other people who’ve made the big money,” Munger said.

Implementing an investment strategy that focuses on company quality and cost will result in better investment outcomes overall.

Maintain a long-term mindset

Having a long-term mindset when it comes to investing leads to greater financial success. Being patient and sticking to good investments over the long term has been a key pillar of success for Berkshire Hathaway.

“So there are risks. Nothing is automatic or easy. But if you can find good companies at the right price and buy and hold, that tends to work out very well, especially for individuals,” Munger explained.

This strategy allows investors to enjoy compounded returns and capital growth over time, but Munger also advised them to avoid the dangers of short-term thinking and frequent trading, which can increase losses and reduce profits as a result of trading costs and market timing mistakes.

Munger put it metaphorically: “You have to eat your carrots before you can eat your dessert.”

What to read next

This article is for informational purposes only, should not be construed as advice, and is provided without warranty of any kind.