(Bloomberg) — Asian stocks poised for gains on Thursday after Chairman Jerome Powell reaffirmed his view that the U.S. Federal Reserve is likely to cut interest rates this year. Ta.

Most Read Articles on Bloomberg

Japanese and Australian stock futures rose. Hong Kong contracts also rose on Thursday, when markets will be closed for public holidays along with mainland China and Taiwan.

U.S. stocks ended the day higher. The S&P 500 index rose 0.1%, and the tech-heavy Nasdaq 100 index rose 0.2%.

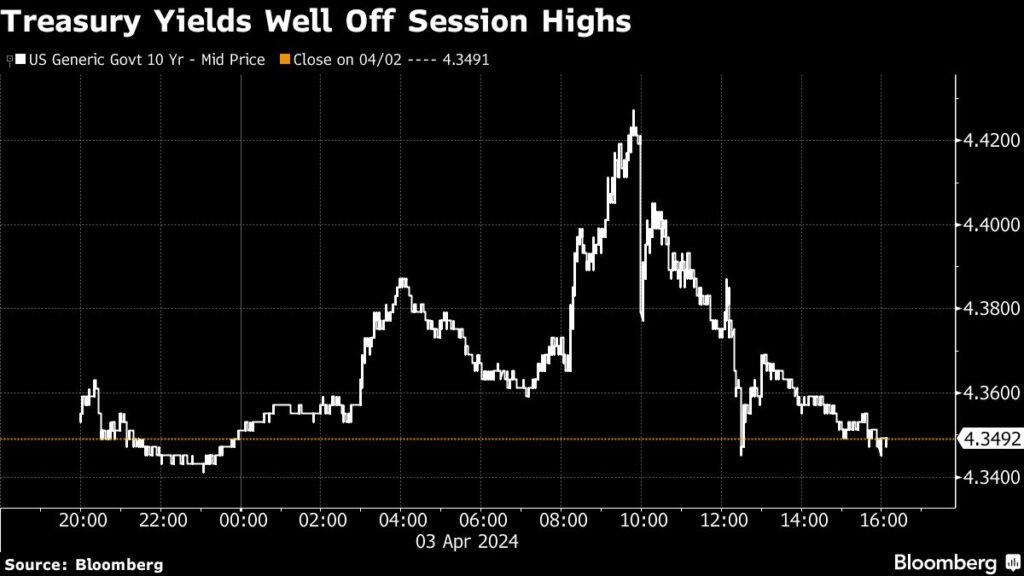

U.S. Treasuries also showed renewed vigor during trading, reversing an early selloff and ending mostly higher after a small rebound tilted toward the front end of the curve. The policy-sensitive 2-year yield ended the day up 2 basis points, while the 10-year yield rose less than 1 basis point.

Fed Chairman Jerome Powell reiterated that the Fed will take a wait-and-see approach before cutting borrowing costs. However, his view that recent inflation data did not “significantly change” the picture supported risk assets.

Traders had been scaling back their rate cut expectations in recent days amid signs of economic recovery and Fed officials’ increasingly cautious tone. This has led to widespread skepticism about whether the central bank will be able to realize its plan to cut interest rates three times this year.

“Powell said recent data doesn’t show things have changed significantly,” said Evercore’s Krishna Guha. “We read this as confirmation that market fears that the economy is too strong for the Fed to cut rates in June are overblown, and the base case remains June. There will be only three interest rate cuts this year.

Gold prices rose on Wednesday to a new record, topping $2,300 an ounce, helped in part by Chairman Powell’s support for a potential rate cut this year. West Texas Intermediate extended its gains, poised for a fifth consecutive rally, with the U.S. benchmark price at about $85 a barrel.

Investors were also assessing the impact of the strongest earthquake to hit Taiwan in a quarter century. The impact killed at least nine people and disrupted semiconductor production. Taiwan Semiconductor Manufacturing Co., Ltd., a major chip supplier to Apple and Nvidia, said it had moved some staff from its production center, but “no critical tools were damaged.”

In currencies, the yen was little changed in Asia as former Bank of Japan board member Makoto Sakurai said on Wednesday that the Bank of Japan would likely wait until around October before considering further rate hikes. An indicator of dollar strength fell by the most in two weeks.

us economy

Despite a “robust” outlook for a soft landing in the US, equity investors’ expectations remain wide open, according to a note from Morgan Stanley’s Global Investment Committee. This dynamic provides an opportunity to seek opportunities outside the S&P 500.

Lisa Charette, chief investment officer at Morgan Stanley Wealth Management, said this week that the rise in U.S. equity benchmarks is being driven by widening multiples and that investors expect earnings to improve despite slowing growth. He said there was.

Investors appear to be exhibiting “robust” demand for U.S. stocks, suggesting there is room for a rally to resume after the recent pullback, Citigroup strategists said.

Strategists led by Chris Montague said this week that more than $16 billion in net long positions were added to S&P 500 futures, while exchange-traded funds saw net inflows.

This week’s main events:

-

Eurozone S&P Global Services PMI, PPI, Thursday

-

U.S. new jobless claims, Challenger layoffs, Thursday

-

Fed’s Loretta Mester, Albert Moussallem, Thomas Barkin, Patrick Harker and Austan Goolsby speak Thursday

-

European Central Bank releases report on March interest rate decisions on Thursday

-

Eurozone retail sales Friday

-

U.S. unemployment rate, nonfarm payrolls, Friday

-

Fed’s Michelle Bowman, Thomas Barkin and Laurie Logan speak on Friday

The main movements in the market are:

stock

currency

-

The Bloomberg Dollar Spot Index fell 0.3%.

-

The euro was almost unchanged at $1.0837.

-

The Japanese yen remained almost unchanged at 151.59 yen to the dollar.

-

The offshore yuan remained unchanged at 7.2488 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6566.

cryptocurrency

-

Bitcoin rose 0.4% to $65,974.79

-

Ether rose 0.4% to $3,321.6

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP