In a video interview at the Greenwich Economic Forum in Hong Kong, Cathie Wood’s Ark Invest said her firm’s artificial intelligence assets continue to perform well. Wood argued that the firm is well-positioned in AI assets due to its diversification into emerging AI companies and its holdings of Nvidia shares in its dedicated portfolio and flagship fund.

Wood bought NVIDIA (NASDAQ:NVDA) for $4 in 2014 and the ARK Innovation ETF (NYSEARCA:ARKK), Mr. Wood sold most of his Nvidia shares last year before the company’s stock price soared.

Wood also called self-driving “the biggest AI project on the planet” and defended his bet on Tesla.NASDAQ:TSLAArk increased its Tesla stake in the first quarter despite declining sales and competition from Chinese rival BYD.OTC:BYDDYWood believes Tesla will gain market share as competitors like GM emerge.NYSE:GM) and Ford (New York Stock Exchange:F) backed away from its EV plans due to profitability concerns.

Wood skeptical of Nvidia’s high valuation

Since late 2022, Nvidia’s shares have soared more than eightfold, giving it a market capitalization of $2.9 trillion and surpassing $1,100 a share. Over the past year, NVDA’s shares have risen more than 200%, buoyed by strong first-quarter results and rising demand for AI chips.

Wood previously said he wasn’t convinced by Nvidia’s high valuation, calling it “a very cyclical stock.” He also warned that Nvidia’s over-ordering of GPUs could lead to inventory correction.

Is ARKK a good ETF?

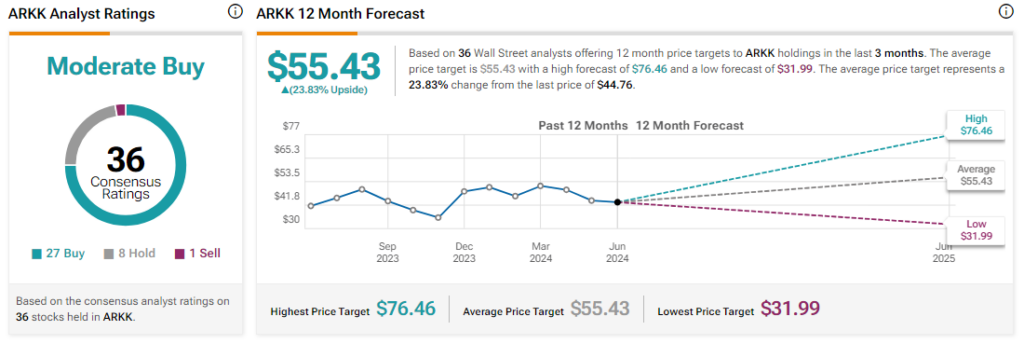

Analysts are cautiously optimistic on ARKK, giving it a Moderate Buy consensus rating based on 27 Buys, 8 Holds, and 1 Sell. Year-to-date, ARKK is down over 10%, and the average target price for ARKK of $55.43 suggests a potential upside of 23.8% from current levels.