Vivek Vishwakarma

Saving for retirement can be daunting for some investors, but it doesn’t have to be. Some of you might buy the S&P 500 (SPY) on a rolling basis and forget about it. Considering the index is currently trading at a historically high multiple, it is important to note that underperformance is possible.

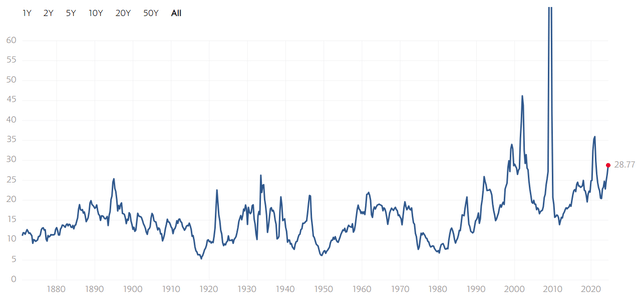

As you can see below, SPY’s current PE multiple of 28.9x is the highest it has been outside of the rise of the tech bubble in the early 2000s and the period leading up to the Global Financial Crisis.

multiple

No one knows how long the market will continue to rise, and with a five-year CAGR of just 4.8% and a dividend yield of 1.2%, the income won’t be much comfort to those holding the index during a long period of correction.

this So, we’ll look at the following two stocks that offer a good balance of high yield and dividend growth, and have a track record of market-beating returns: Both are trading at attractive valuations and have strong growth prospects, so let’s get started.

1st place: Sixth Street Specialty Lending

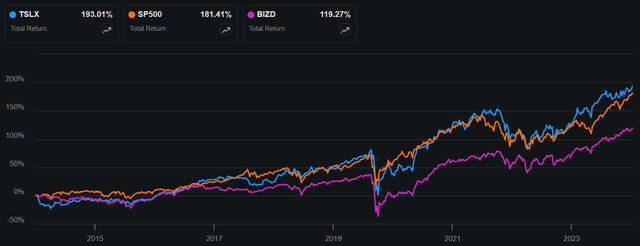

Sixth Street Specialty Lending (TSLX) is an externally managed BDC with an impressive track record of value creation: As shown below, TSLX has generated a total return of 193% over the past 10 years, outperforming the S&P 500’s 181% and the Van Eck BDC ETF (BIZD)’s 119%.

TSLX Total Return (10 Years) (Seeking Alpha)

I last covered TSLX in January, highlighting its impressive total return and strong fundamentals. Since then, the stock has fallen 1% (for a total return of 3.4%) despite continued solid performance.

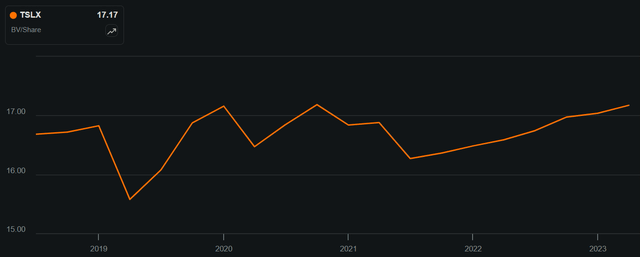

TSLX’s strong performance includes continued growth in its NAV of $17.17 in Q1 2024, driven largely by a $0.14 per share gain from a capital offering that was conducted above NAV during the quarter. As shown below, TSLX’s NAV per share has improved every quarter since mid-2021 and is just one cent shy of its all-time high of $17.18.

TSLX NAV/Stock 5 Year Trend (Seeking Alpha)

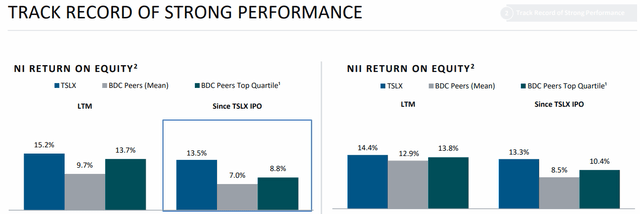

At the same time, TSLX has generated healthy returns with a trailing 12-month NII ROE of 14.4%, which is higher than the 12.9% average for all BDCs and 13.8% for the top quartile of BDCs (see below).

Investor Presentation

This allowed TSLX to generate $0.58 NII per share in Q1, above the regular dividend rate of $0.46 for a dividend coverage ratio of 126%. Including the $0.06 special dividend declared in Q2, the dividend coverage ratio remains at a safe 112%.

Meanwhile, TSLX maintains a safe investment profile with 92% of its portfolio consisting of first lien loans. The remainder is made up of second lien/subordinated debt at 3% of the portfolio and 5% equity as a potential kicker for NAV appreciation. The portfolio is also in good shape with non-accrual investments making up just 1.1% of the total portfolio.

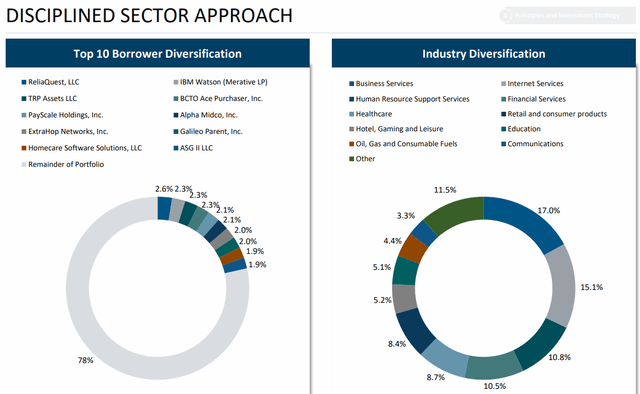

The portfolio has low cyclical risk due to its defensive nature and diversification, with no single investment exceeding 2.6% of the total portfolio value.As shown below, business services, e-commerce, financial services, and healthcare are the major segments for TSLX, accounting for 62% of the total portfolio value.

Investor Presentation

Management sees opportunities this year in helping clients restructure their balance sheets given the continued slowdown in IPOs this year, which is why 2024 is expected to be a “big year for exit deals, including continuation funds,” according to Tim Clark, principal analyst at Pitchbook, which will involve both private equity and venture debt players like TSLX.

Opportunistic transaction financing is supported by TSLX’s strong balance sheet, which is rated BBB-/BBB investment grade by S&P and Fitch, and has $764 million of liquidity, representing 2.9x TSLX’s unfunded commitments.

TSLX is not necessarily cheap at its current price of $21.72, a premium to NAV of 26%, however this does not seem unreasonable as premiums to NAV over the past five years have ranged from 0% to 40%.

TSLX Price vs NAV (Seeking Alpha)

While TSLX is not a bargain at present, I believe it deserves a premium price given its strong track record of value creation through above-market returns as mentioned above, as well as a well-covered 8.8% regular dividend yield and 9.7% yield including special dividends. Additionally, with it trading at a premium to NAV, any future share offerings would be favorable for shareholders and strengthen the value proposition. As such, I continue to view TSLX as a “buy at current levels.”

2nd place: Prologis

Prologis (PLD) is a self-managed REIT and global logistics leader focused on owning and leasing real estate in high-growth, high barrier-to-entry Tier 1 markets. With 1.2 billion rentable square feet in 19 countries, it serves 6,700 customers through B2B and retail/e-commerce fulfillment channels.

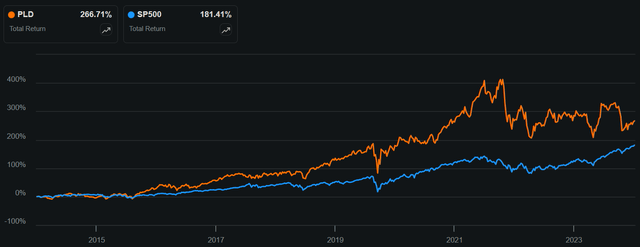

Like TSLX, PLD also boasts a track record of above-market returns due to strong lease spreads and high demand for properties driven by e-commerce growth. As shown below, PLD has generated a total return of 267% over the past 10 years, outperforming the S&P 500’s 181%.

PLD vs SPY Total Return (Seeking Alpha)

I last covered PLD in August of last year, highlighting its strong fundamentals and undervaluation, but the market remains wary of REITs in a high interest rate environment and the share price has fallen 4% since then (for a -1% total return including dividends).

Nonetheless, PLD is performing well in the current macroeconomic climate. This is reflected in same-store cash NOI growth of 5.7% year-over-year in the first quarter of 2024. It is worth noting that excluding one-time items, PLD’s SSNOI was 7.5%. PLD’s robust growth was driven by continued strong demand for properties, with new leases averaging 70% lease spreads in the first quarter.

Management now expects 2024 to be more challenging than previously expected, with occupancy forecast to decline 75 basis points to the midpoint of the range at 96.25% by the end of the year. Similarly, SSNOI is now forecast to decline 150 basis points from the previous forecast to 6.0%.

Despite the expected slowdown this year, I believe PLD’s long-term growth thesis remains intact, and this is supported by management’s expectation of reduced supply to the industry, which should lead to improved pricing next year.

Additionally, given the vast amount of acreage its properties offer, PLD has development potential across its portfolio, asset management opportunities, and greenfield solar opportunities. These points were stated by management at the recent NAREIT conference in June:

We own or manage about 12,000 acres worth of land, and that land portfolio incorporates about 225 million square feet of buildings, with a TEI value of about $39 billion. So we have a long way to go in our development business. Third, is our strategic capital business. We manage 11 different vehicles (public and private) around the world with AUM valued at about $60 billion. Cash flow from asset management fees has been very stable, at $2.5 billion per year.

The fourth bucket is what we call “essentials,” which is a collection of new lines of business that are built on top of this great platform that we have. We have 1.2 billion square feet of warehouse space, we have 1.2 billion square feet of rooftop space. We have about 540 megawatts of solar installed on those rooftops today. That covers less than 5% of the rooftops. So there’s a long way to go in building out the solar business.

Importantly, PLD has an “A” rating from S&P, the highest in the REIT industry. This rating enabled the company to raise $4.7 billion in debt in the first quarter at a relatively low interest rate of 4.7% with a 10-year maturity. This will bring PLD’s total liquidity to $5.8 billion to fund its development pipeline, which is forecast to earn a stable yield of 5.7%, above PLD’s cost of debt.

PLD’s current dividend yield is high at 3.4%, its dividend payout ratio is well protected at 70%, allowing it to retain ample capital to fund growth, and it has enjoyed 10 years of consecutive growth with a five-year average dividend annual growth rate of 12.6%.

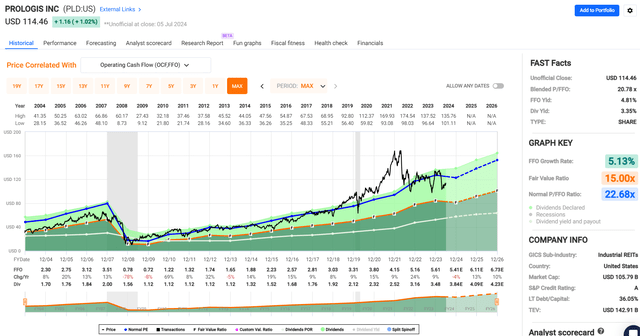

PLD isn’t cheap at its current price of $114 and forward P/FFO of 21.1, but as you can see below, this valuation is below the historical P/FFO of 22.7.

Fast Graph

Moreover, while PLD is expected to experience a reset year in 2024 due to slowing growth, sell-side analysts tracking the company expect growth to accelerate next year, with forecasting FFO/share growth of 10-12% per year over the 2025-2027 period.

I believe these estimates are reasonable given the expected price recovery next year mentioned above, as well as development and new business opportunities. Even with 3.4% growth and 6-7% SSNOI growth (low case based on 2024 projections), PLD has the potential to generate market-level total returns, with plenty of room to exceed them.

Investor View

Sixth Street Specialty Lending and Prologis are attractive investment options that balance high yields with strong growth potential, making them viable alternatives to the S&P 500 for retirement savings. TSLX, an externally managed BDC, boasts a solid track record of 193% total returns over the past decade and maintains a safe investment profile with a well-covered, high dividend payout.

Prologis, a leading global logistics REIT, delivered a total return of 267% over the same period and continues to grow with strong lease spreads and development opportunities, supported by an industry-leading “A” rating. Both companies are well-positioned for continued success, providing investors with solid income and growth prospects despite market volatility.