- “Buy low” chants were heard on social media, signalling confidence in a market rebound.

- While the fear and greed index suggests an accumulation phase, on-chain data shows that BTC is at risk of further decline.

After Bitcoin fell on July 3, market participants began calling for buying. [BTC] It fell below $60,000, but it was not the only coin that fell, as almost all other cryptocurrencies, including Ethereum, also fell. [ETH].

At the time of writing, BTC is trading at $57,598, which represents a 4.88% decrease over the past 24 hours. Despite the drop, it seems most of the market sees the correction as an opportunity to buy at a discount.

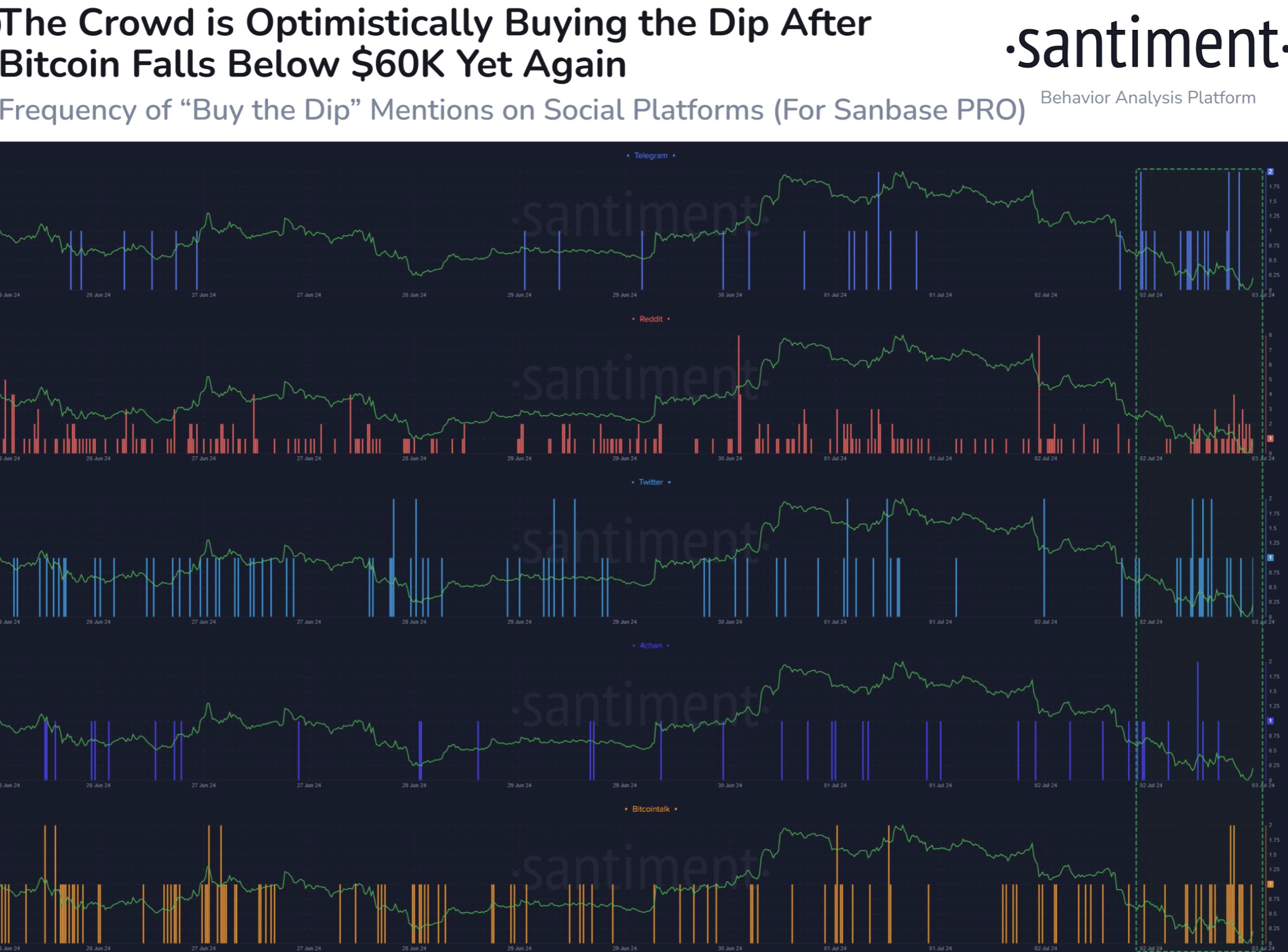

On-chain analytics platform Santiment provided evidence: Using social volume metrics, AMBCrypto noticed that “buy low” comments were spreading like wildfire.

Source: Santiment

Is fear enough to rebel?

However, such predictions don’t always pay off. Specifically, pullbacks occur when a large part of the cryptocurrency market doubts that prices will rise.

Santiment agreed with this theory in his post about X, stating:

“The crowd is showing signs of seeing this as an opportunity to buy low. Ideally, you should wait for their enthusiasm to die down. When they get impatient and skeptical, that’s the time to buy.”

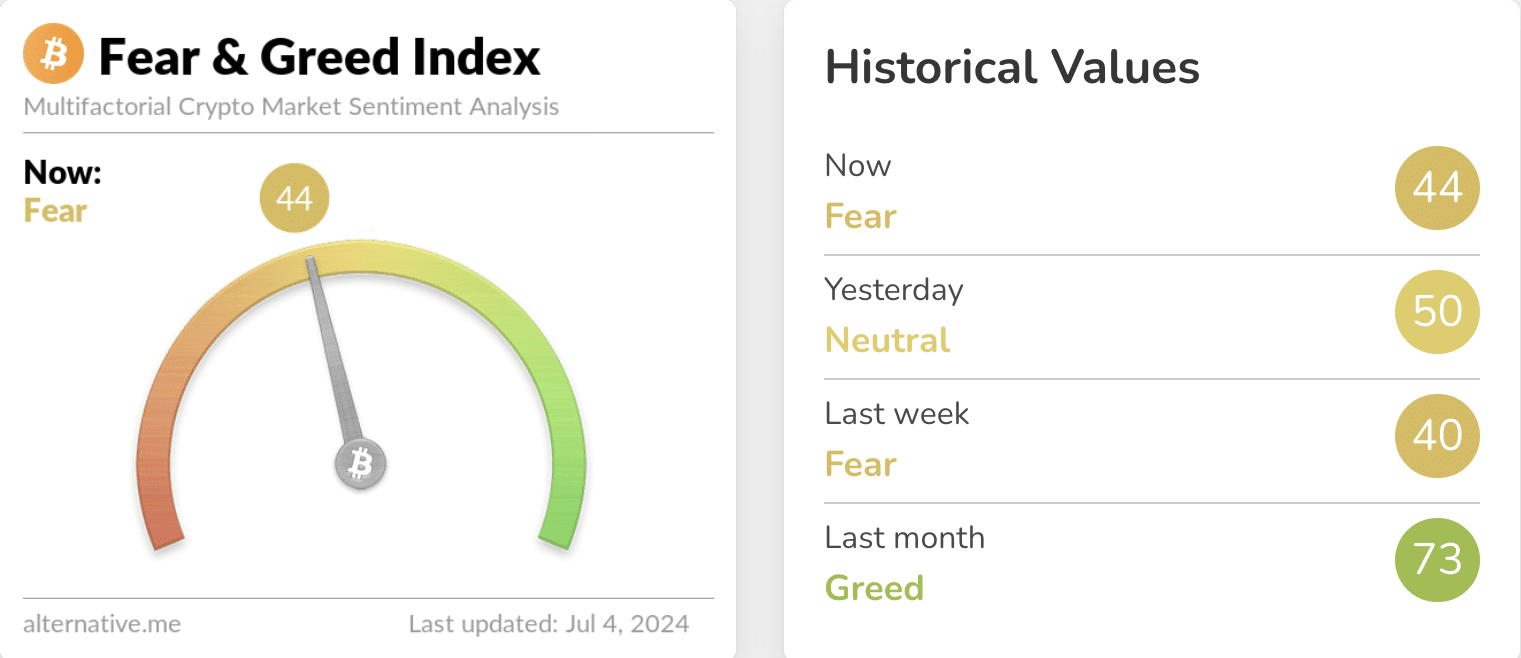

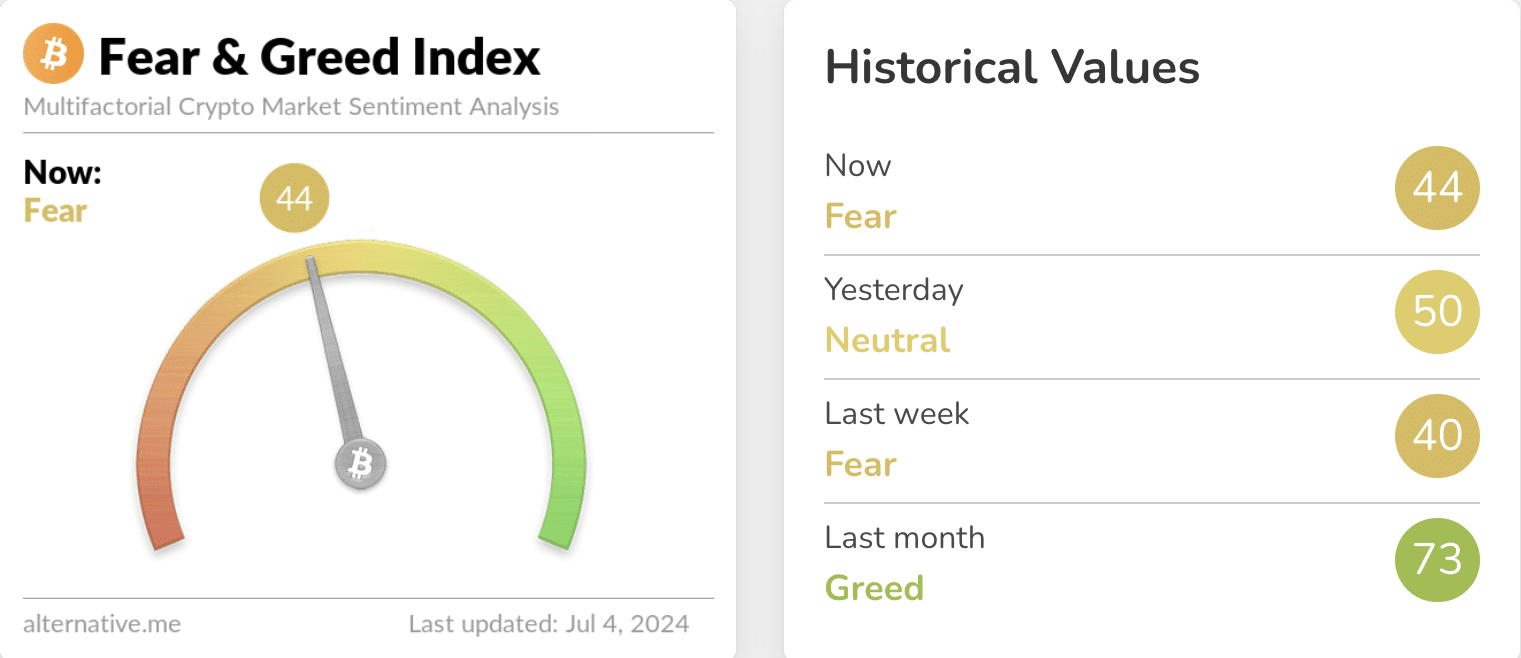

To get an idea of whether the market as a whole is skeptical or confident, we looked at the Cryptocurrency Fear and Greed Index. The Fear and Greed Index for Bitcoin and other cryptocurrencies measures the emotional behavior and sentiment of participants.

Values range from 0 to 100. Usually, when the market corrects and prices hit new red lines, people tend to get scared. But when prices rise incredibly high and people don’t want to miss out on the opportunity, greed shows up.

However, when the index is in a state of extreme greed, it means that Bitcoin and the market as a whole may be going through a period of correction. However, when it is in a state of extreme fear, the market provides an opportunity to “buy low”.

At the time of writing, the Fear and Greed Index is at 44, indicating that the market is feeling scared. At this stage, it may be time to slowly buy more, but that doesn’t mean the price won’t reach new lows.

Source: Alternative.me

If that were to happen, it would create extreme fear in the market, creating a great opportunity to buy low.

Bitcoin continues to face pressure

Meanwhile, blockchain analytics platform IntoTheBlock revealed that Bitcoin has broken out of the critical demand zone of $60,000, and therefore the next major demand level is between $40,000 and $50,000.

“Bitcoin has broken through the $60,000 support level, a key demand zone. The move has caused over 16% of BTC holders to take losses. Historically, demand just below $60,000 has been weak, suggesting further downward pressure. The next key demand zone is between $40,000 and $50,000.”

If Bitcoin continues to fall, perhaps below $56,000, it could drop to the aforementioned area, which could result in losses for many holders. To avoid this happening, bulls need to defend BTC from falling below $55,000.

But that may be hard to achieve as long as institutional investors continue to sell BTC.

Read Bitcoin [BTC] Price Forecast 2024-25

For example, Lookonchain revealed that the German government sent a combined $249.5 million worth of Bitcoin to Coinbase, Kraken and Bitstamp.

When this happens, the coin faces selling pressure and the price may not be able to recover, therefore market participants may have no choice but to continue buying the dip until the price stabilizes.