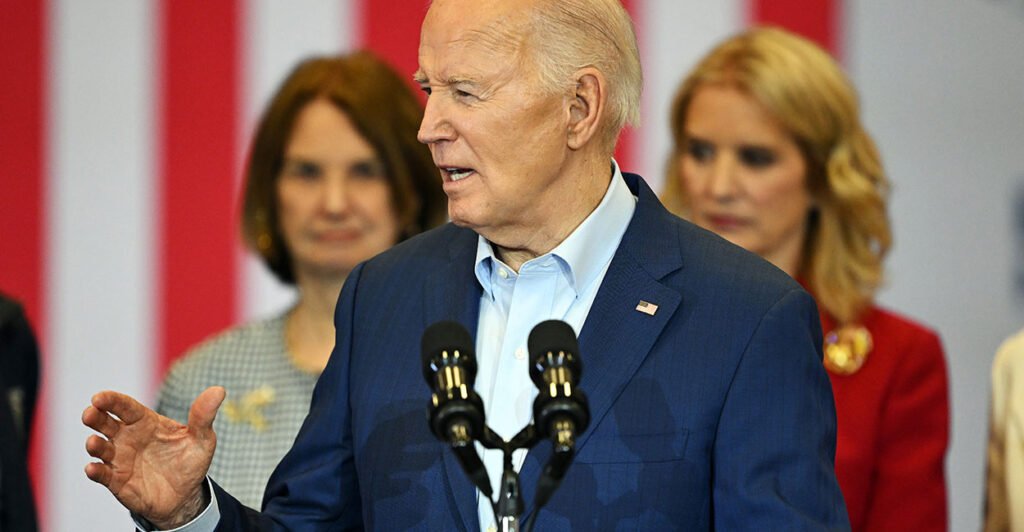

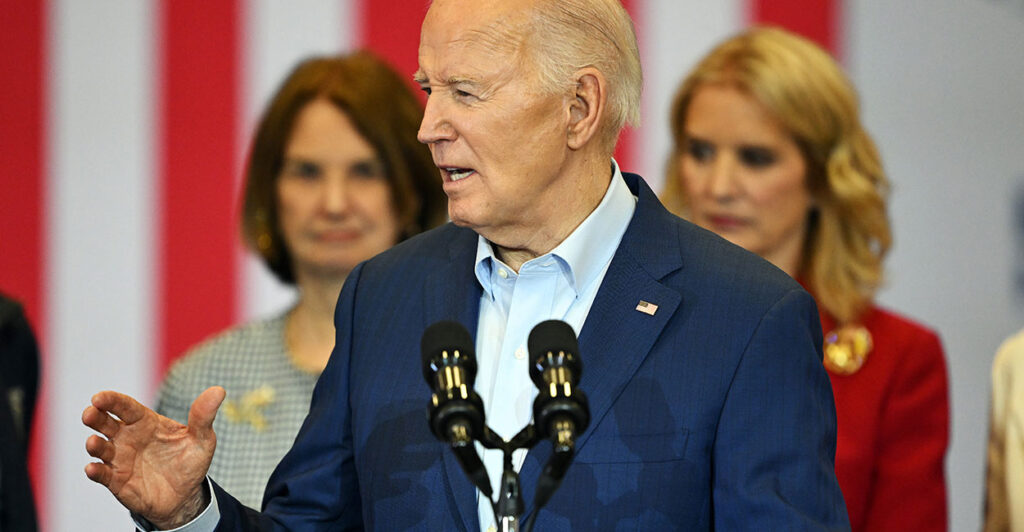

President Joe Biden vowed to raise taxes on the wealthy and corporations during a campaign rally in Philadelphia on April 18. (Drew Hallowell/Getty Images)

One of the Biden administration’s most egregious budget proposals would impose a new tax of at least 25% annually on unrealized gains on Americans with income and assets over $100 million.

Taxing unrealized gains would be an entirely new prospect, and if the Biden administration is successful, it would impose penalties on individuals who hold assets that have appreciated in value, regardless of whether the assets are sold.

But the tax proposal is included in President Joe Biden’s 188-page fiscal year 2025 U.S. government budget and the accompanying 256-page general description of the administration’s fiscal year 2025 revenue proposals.

Such taxes are rarely adopted due to the complexities of asset valuation, liquidity concerns, and overall implementation challenges and risks. If such taxes were introduced, they would lead to an exodus of taxpayers.

For example, when Norway introduced a similar tax in autumn 2022, more than 30 Norwegian billionaires and multimillionaires left the country and moved to Switzerland, a number that exceeded the total number of billionaires and multimillionaires who had left Norway in the previous 13 years.

Entrepreneurship is the engine of the American economy, and the proposed tax on unrealized gains would act as a stop switch in several ways.

First, wealthy Americans put a lot of their money into high-risk, high-volatility investments in early-stage startups and small businesses, and under the proposed tax plan, investors would have to pay a tax on every big move, making the highs even higher and the lows even lower.

Therefore, investors may be less likely to invest in growth-oriented ventures due to greater valuation volatility compared to larger, more established companies.

For example, let’s say you have roughly $100 million in assets and you want to invest $1 million in a promising new biotech startup.

BioNTech, a biotechnology immunotherapy company, began its initial public offering at $13.82 a share ($1 million = 72,368.9 shares), peaked at $389.01 and ended the year at $257.80.

In this scenario, the investor would have owed the federal government 25% tax on the gain of $243.98 per share ($17,656,564.22), or $4,414,141.05, even if he had not sold the stock.

Now, fast forward to today, BioNTech’s stock price has been declining and is currently trading around $100. There are no taxes on unrealized losses.

Moreover, investors will now be thinking much more deeply about the time element of the equation and the expected future behavior and valuation of exits. The new tax on unrealized gains could spur investors to sell assets for tax reasons rather than for legitimate business reasons.

The tax would also hit entrepreneurs who typically hold large amounts of stock in their startups, which can increase in value significantly if the company is successful. Even if the entrepreneurs never sell their shares in a successful company, they would still be taxed on that increase in value.

One example is Fanatics, an online sports memorabilia and collectibles retailer based in Jacksonville. As of its most recent investment round in December, Fanatics was valued at $31 billion.

Under Biden’s proposal, Fanatics founder and CEO Michael Rubin would be hit with a huge tax bill on the unrealized gains from the stock price appreciation.

The combination of these pressures will lead to less entrepreneurial capital and a much lower investment in startups, which will result in slower rates of innovation and productivity and stagnation in startups.

We publish articles from a variety of perspectives, and the content expressed here does not necessarily represent the views of The Daily Signal.