Biden administration officials have noted that inflation has fallen from previous peaks, but the latest numbers show that inflation has not completely cooled. So far, it is trending in the wrong direction and remains above the Fed’s 2% goal.

Despite the unemployment rate being at a half-century low, the president’s economic jobs approval is significantly negative. RealClearPolitics averages give him a net negative rating of 18 percentage points on his handling of the economy and 27 percentage points on his handling of inflation.

Political strategists from both parties reported that voters repeatedly pointed to high prices as a cause of dissatisfaction with the current state of the country. The cost of everyday necessities like gas, food, and housing hits them all the time.

It is difficult to persuade voters who feel their household budgets are being squeezed by high prices to look on the bright side. The common language of voters can be summarized as follows: “Prices are too high.”

As is often the case when summer approaches, gas prices are rising again. Although this is below the peak during the Biden presidency, it is still a significant increase compared to when Biden took office. The average gas price at the beginning of 2021 was his $2.42. The current price is about $3.50, according to the U.S. Energy Information Administration.

Food prices are putting further pressure on household incomes. According to the U.S. Department of Agriculture, food prices rose 25% from 2019 to 2023.

According to USDA’s latest analysis, food costs as a percentage of disposable income in 2022 were 11.3%. This is the highest amount since 1991, when households spent 11.4% of their disposable income on food.

According to one index, the average price for 12 eggs is currently about $2.99. This compares to an inflation-adjusted price of $2.09 per dozen in 2020.

Rising interest rates have also made mortgage repayments higher. Mortgage rates started falling, but they have stalled or are starting to reverse. The Wall Street Journal published an article Friday examining the impact on middle-income households. The headline was “Stay or pay up: Homebuyers lose hope of lower interest rates.”

According to the article, a household with an average income as of March could buy a home for less than $416,000, assuming current interest rates and a 20% down payment. Three years ago, when mortgage rates were low, the family could have bought her home worth $561,000.

Other unexpected and unavoidable expenses are straining family finances. Auto insurance is one example, with premium rates rising 22.2% last year, the biggest increase since 1976. According to a CNN report, auto insurance rates in Nevada, a presidential battleground state, rose 38% from a year ago.

my colleague heather long Posted in X According to an announcement earlier this year, as of February, home repair costs had increased by 18% from a year earlier, and over-the-counter drug costs had increased by 9%. She noted that both are the highest increases ever recorded on the social media platform, officially known as Twitter.

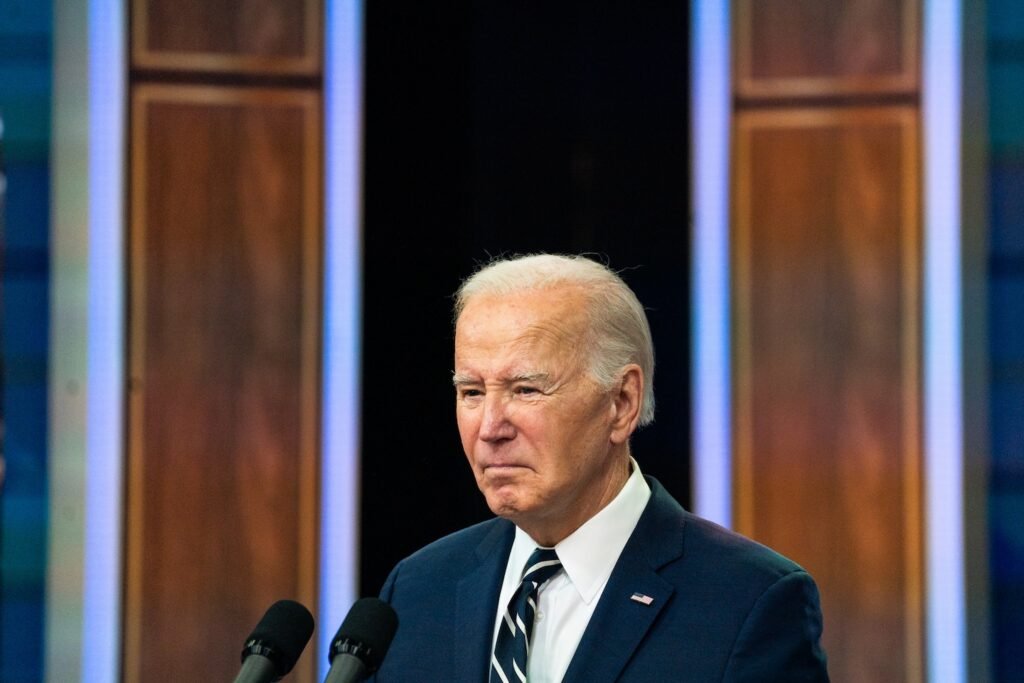

Biden issued a statement last week following the March Consumer Price Index report. “We still have work to do to lower costs for hardworking families,” he said, stressing that inflation has fallen by more than 60% since its peak. He added: “Fighting inflation remains my top economic priority.”

But the president has few weapons in the fight against inflation. Jason Furman, a Harvard University economist and chairman of the Obama administration’s Council of Economic Advisers, said 90% of controlling inflation is the Federal Reserve’s job. “For the most part, the White House has figured out the best message to get us through this without having many tools to change the reality,” he said.

Mr. Biden has promoted policies aimed at lowering prescription drug prices and is targeting junk fees that companies add to things like airline tickets, rental cars and event tickets. He announced efforts to provide assistance to homebuyers during his State of the Union address, but nothing has come of it.

The administration twice last week announced measures to reduce student debt and announced initiatives aimed at strengthening support among young voters. But these policies only affect the pockets of eligible people and add future costs to the government. And it has been criticized for aiding those who have gone to university at the expense of those who have not.

There are two reasons why the Fed lowers interest rates. One is to prevent a recession if it looms, and the other is to ensure that inflation has eased enough so that authorities can be confident that lower interest rates won’t reignite new inflation. Body.neither state It still exists.

Although there have been long-standing predictions that higher interest rates could or would cause a recession, there is no recession in sight. And now prices are rising faster than expected.

Economists believe it is doubtful there will be a rate cut in June, as was expected months ago. September’s rate cut, although probably economically justified by then, may be too close to the election, and Fed Chairman Jerome H. Powell said the Fed was politically supportive of Biden. They may be exposed to criticism that they are acting in order to do so.

The 2024 election will be fought over more than economic issues. Last week’s biggest political story was the Arizona Supreme Court’s decision to reinstate an 1864 law that bans abortions except in cases where the mother’s life is in danger and imposes penalties on those who perform them.

The decision ensures that abortion will be a key issue in one of the most important battleground states in November, with a referendum on abortion likely to be held. Vice President Harris, who has led the administration’s messaging on abortion for the past two years, flew to Arizona on Friday to highlight the state court case.

Biden also made it clear that he would continue to focus on former President Donald Trump as a threat to democracy. President Trump has said a second term will be an opportunity for revenge against his opponents and has not backed away from his false claims that the 2020 election was stolen.

In the 2022 midterm elections, pre-election polls suggested that inflation and the economy were top concerns for voters, leading to predictions of a landslide victory for Republicans.

Ultimately, however, a combination of abortion and threats to democracy motivated Democratic voters. Republicans had a disappointing midterm election, winning only a slim majority in the House of Representatives, losing control of the Senate, and losing several contested gubernatorial races.

Biden is hopeful that something similar could happen this November. But for him, the rise in inflation happened at exactly the wrong time. Many Americans say they think the economy is better off under the Trump administration. The current president doesn’t have much time to change these perceptions, even if he wants to. Force elections into another realm.