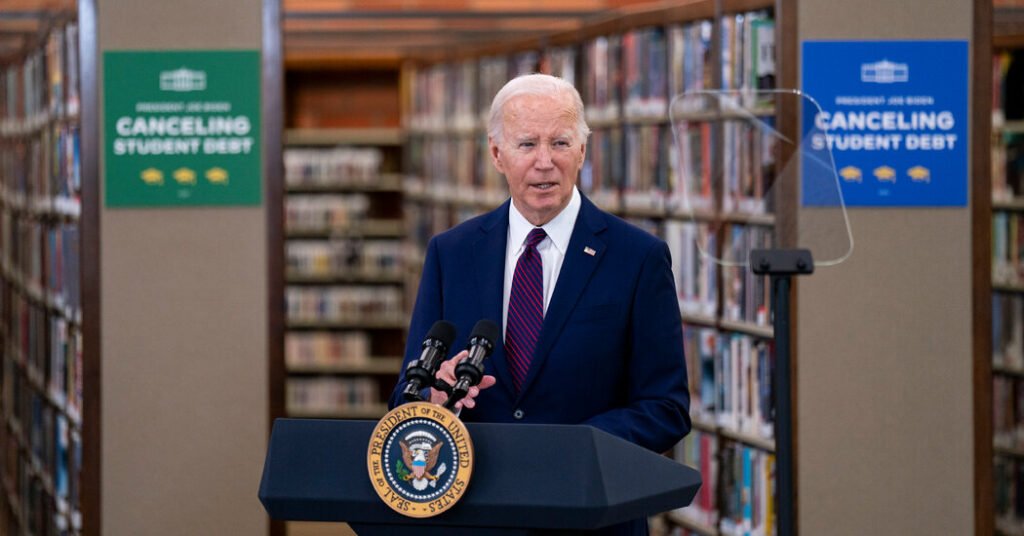

President Biden on Wednesday announced new student loan forgiveness, canceling $7.7 billion in debt for 160,000 people, as a centerpiece of his re-election campaign.

The announcement builds on Biden’s strategy to chip away at college debt by improving existing programs, even as his administration pushes ahead with even larger plans over Republican opposition. It is something.

The Department of Education said in a statement that many of the borrowers in this round of forgiveness qualified through Public Service Loan Forgiveness, the President’s SAVE Plan or another income-driven repayment plan and have already received an electronic notification of approval. He said he is starting to receive emails.

The Biden administration has so far forgiven about $167 billion in loans to 4.75 million borrowers, or about 1 in 10 federal loan holders. The president has a much larger goal of canceling debt for nearly 30 million borrowers as early as this fall. But this broader program has not yet been finalized and could fall victim to legal challenges, as Biden’s first, much more ambitious, attempt at mass debt cancellation was. be.

Forgiving student loan debt is a key part of Mr. Biden’s outreach to younger voters, who overwhelmingly supported him in 2020 but were showing signs of drifting away.

“From day one, I pledged to fight to make higher education a ticket to the middle class, not a barrier to opportunity,” the president said in a statement.

To keep loan forgiveness going despite court challenges, the Biden administration has in many cases overhauled or made better use of already planned programs.

In some cases, borrowers have found that their monthly payments have been incorrectly calculated and are higher than what they actually owe.

The total $5.2 billion in forgiveness announced Wednesday was met through adjustments made by the Department of Education to the Public Service Loan Forgiveness Program, which supports teachers, firefighters and other government and nonprofit employees. Approximately 66,900 borrowers were granted the loan.

Congress created the public service program in 2007, but it has been plagued by a lack of coordination between the department and loan servicers, resulting in an overwhelming percentage of applicants being denied for more than a decade. When Biden took office, only 7,000 people applied for relief through the program and were approved, according to administration officials.

About $600 million in relief will go to about 54,300 borrowers who took out small loans for graduate school and are enrolled in the SAVE plan, which links monthly payments to income and household size. All borrowers enrolled in the plan can qualify for forgiveness after up to 25 years, but borrowers who took out loans of $12,000 or less can qualify after 10 years of making payments.

An additional 39,200 borrowers enrolled in other income-driven repayment plans also received $1.9 billion in forgiveness through “administrative adjustments” to the number of payments they are required to make. The ministry said these adjustments are primarily to correct the abuse of moratoriums by certain debt collection companies.

The department is also extending debt forgiveness in other ways, such as forgiving loans for students who were found to have been defrauded by their colleges. Just this month, for example, the department forgave federal loans for 317,000 students attending arts colleges.

A sizable portion of the strategy, including waiving steep interest on loans that have grown far beyond the original amount borrowed, is still on hold as the administration works to approve new rules. The administration says more than 25 million people could be eligible for relief under these regulations.