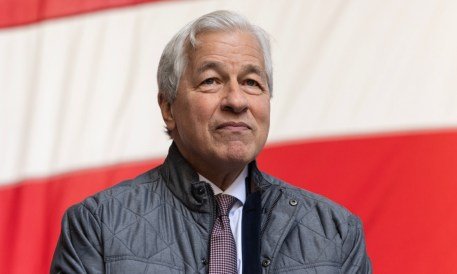

JPMorgan Chase & Co. CEO Jamie Dimon touched on a wide range of topics in his latest annual letter to shareholders, with particular focus on the changing competitive landscape in financial services.

It warned that the regulatory framework for banks could make it more expensive to provide these services.

PYMNTS focused on Dimon’s sentiments regarding artificial intelligence (AI). Previous post on Monday (April 8th).

Daimon I also commented on “The banking system as we know it is shrinking compared to the growing and increasingly competitive private market and fintech,” the letter states.

Additionally, these digital and private companies “do not have the same level of transparency and do not have to follow extensive rules and regulations as traditional banks, even though they may offer similar products. , with significant advantages,” Dimon wrote, pointing to emerging and emerging banks. fintech bank. Citing tech giant Apple as an example, he wrote that it “effectively functions as a bank, storing money, moving money, lending money, and so on.”

competitive advantage

There are several advantages here, Dimon said. Mainly in the form of “dynamism and churn.” [that] It lends itself to innovation and invention, where successes and failures are just part of a robust process. Innovations will be carried out across payment systems, budgeting, digital access, product enhancements, risk and fraud prevention, and other services. ”

Regarding JPMorgan’s own technology efforts, Dimon said the company will invest approximately $2 billion in 2023 to build four private cloud-based data centers in the United States and currently has 32 data centers worldwide. I wrote that there is. To date, approximately 50% of banking applications perform the majority of their processing in public or private clouds. Approximately 70% of JPMorgan’s data currently runs in public or private clouds.

“We aim to move 70% of our applications and 75% of our data to public or private clouds by the end of 2024,” Dimon said in the letter.

The CEO also sounded the alarm on private credit, specifically stating that “new financial products that grow very rapidly are often areas of the market with unforeseen risks. Weaknesses in a product, in this case private credit loans, can only be discovered and exposed in bad markets that private credit loans have not yet faced.” It is difficult for private creditors to defer loans during macro stress. There is even a possibility that a “credit crunch” will occur.

Regulatory risk

In light of the discussion about Basel III, the proposal that would serve as a regulatory framework for bank capital requirements and stress testing, Mr. Dimon said:

“Everyday consumer goods may be affected. Households battling inflation may also feel the impact of increased capital requirements on market-making activities when shopping. Need to manage aluminum costs.” From beverage companies to farms that need to be protected from environmental risks, the increased cost of hedging these risks will be reflected in the prices consumers pay for everything from soda cans to meat products. There is a possibility that

Dimon said the cost of securitizing loans, including small business loans, “will rise for banks, nonbanks and government agencies.” Not only that, the proposal would likely lead to a reduction in unfunded credit card lines, which would put pressure on FICO scores. ”