-

Bank of America says the ongoing “everything but bonds” bull market is driving the stock market’s extreme upside.

-

The firm is watching real 10-year yields and credit spreads for signals on when the AI-driven bull market will end.

-

BofA said rising yields and narrowing spreads could signal a recession and send stocks lower.

Bank of America has coined the term “non-bond bull market” to describe what’s currently happening in the market.

The company notes that the fourth quarter of 2023 was led by equities and cryptocurrencies. His first three months of 2024 were all about commodities and…well, still cryptocurrencies. And the second quarter has been a bright spot for the dollar so far.

While this has been a boon for well-positioned traders across a variety of asset classes, BofA says it is a byproduct of massive government spending and could eventually be rolled back if a few key conditions are met. They warn that they may be returned.

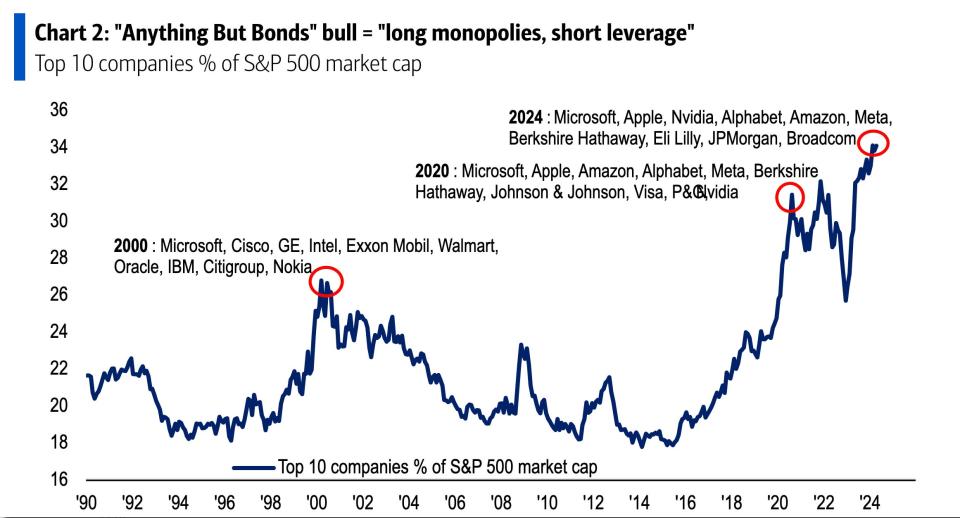

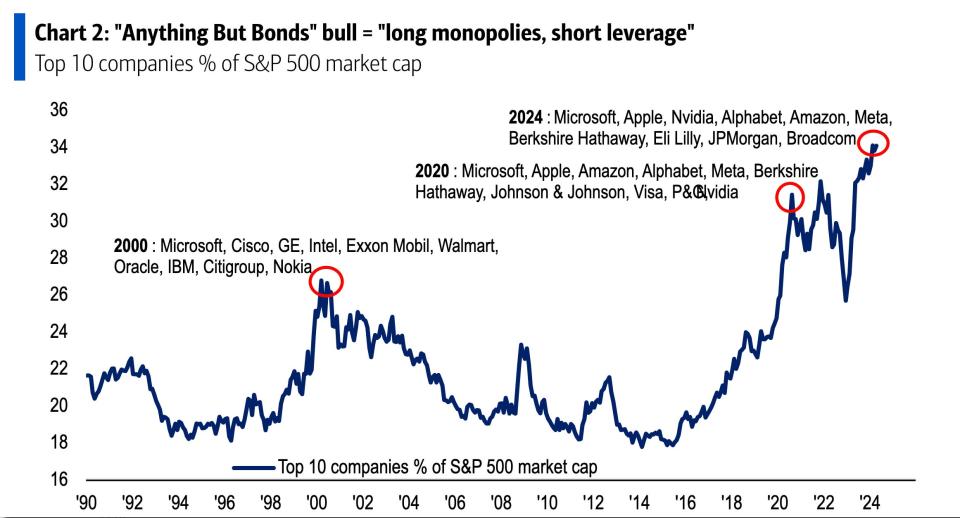

The key is a group of big-cap tech companies that have long dominated stock market performance, largely through their connections to AI. BofA said the rise in “everything but bonds” particularly fueled the market’s biggest stocks, with the top 10 accounting for 34% of the S&P 500 market capitalization, an all-time high, as shown in the chart below. was recorded.

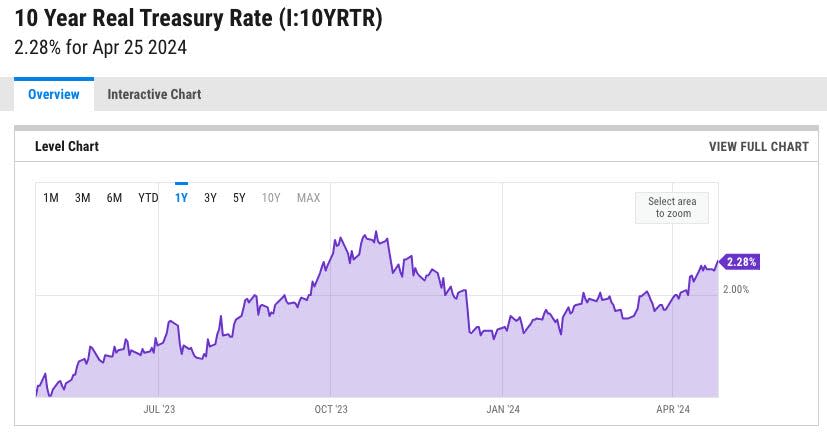

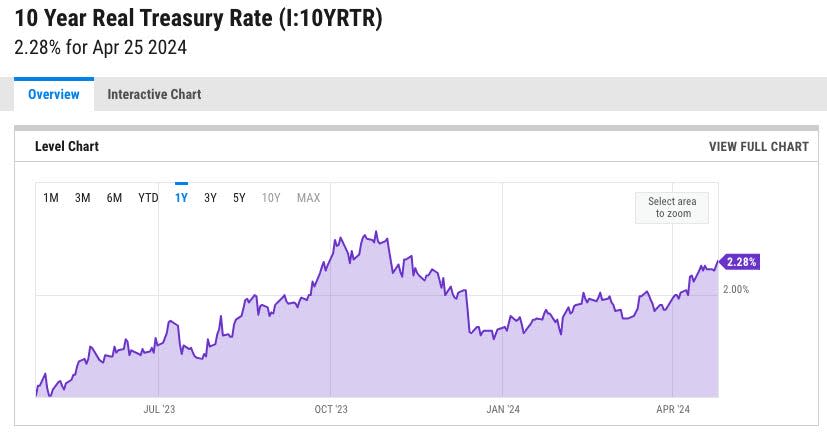

But BofA doesn’t think this bull market will last forever. The firm outlines scenarios that could derail the rally and ultimately damage the giant’s growth stock leadership. That is, either the real 10-year yield rises into the 2.5% to 3% region, or it is stimulated by a combination of higher yields and wider credit spreads. Fear of recession.

The real yield on the 10-year bond currently stands at 2.28%, meaning it will take more time to trigger an eventual decline in the mega-cap stocks that dominate major indexes. According to the graph below, it has not exceeded 2.5% since October 2023, and only briefly after that.

There’s also the idea that mega-cap tech companies are no longer rising like an unstoppable monolith. AI-focused Magnificent Seven stocks are at a turning point as Tesla and Apple have a tough start to 2024, while giants like Nvidia and Microsoft show no signs of slowing down. ing. Second, while Meta Inc. has gained more than 40% this year and made a profit, its stock price has taken a big hit because it hasn’t been growing fast enough to satisfy investors.

These divergences reduced concentration risks that could limit the ultimate decline. In the meantime, if you agree with BofA’s view, you should keep an eye on the 10-year real yield to know when such a downturn is coming.

Read the original article on Business Insider