(Bloomberg) — Asian stocks rose as U.S. stocks rebounded from a $2 trillion decline on optimism that big tech companies will report huge profits this week.

Most Read Articles on Bloomberg

Hong Kong’s stock benchmark rose, along with Japan and South Korea, while mainland Chinese stocks fell. U.S. stock futures traded mixed as the S&P 500 index topped 5,000, ending a six-day slide, while the Nasdaq 100 rose 1% and Nvidia led gains among big tech stocks. led. Apple has been named Bank of America’s top pick for 2024 due to optimism about its future performance.

Investors are waiting to see if their returns live up to high expectations for artificial intelligence, as some 180 companies representing more than 40% of the S&P 500’s market capitalization are scheduled to report earnings this week. The stakes are high, with earnings for the Magnificent Seven mega-cap stocks expected to rise nearly 40% from a year ago, according to Bloomberg Intelligence. The focus on earnings suggests the Federal Reserve is in no hurry to cut interest rates after the selloff fueled by geopolitical concerns.

“Yesterday’s bailout rally in Asia is likely to continue today,” said Tony Sycamore, market analyst at IG Australia in Sydney. “However, we expect the pace of increase to slow as we approach the end of the week in the form of Big Tech earnings and important macro data.”

In Asia, U.S. Treasuries were firmer, while Australian and New Zealand bonds rose ahead of a flurry of bond auctions that will test investor appetite after yields hit a record high in 2024.

In Asia, China’s role as a major lender to developing countries comes after reports that central bank governors are asking creditors working on debt restructuring to agree on how to fairly share the burden of bailouts. The focus is back on. Meanwhile, UBS Group AG upgraded Chinese and Hong Kong stocks to overweight, citing the country’s wealth and strong earnings despite macro concerns.

Elsewhere, the Bank of Japan is widely expected to keep benchmark interest rates unchanged on Friday, and investors are watching for signs of less dovishness as the yen hovers near a 34-year low. The Japanese currency briefly appreciated against the dollar after Japan’s Finance Minister Shunichi Suzuki said that the environment was in place to intervene in the foreign exchange market if necessary.

In corporate news, Sichuan Baicha Baidao Industrial Co., Ltd., also known as Tea Baidao, plunged 10% in its Hong Kong trading debut, indicating a drop in demand for shares of the company that makes the hugely popular bubble tea. Ta.

Oil prices edged higher as traders considered next steps between Israel and Iran, amid signs of easing in hostilities following last week’s exchange of attacks. Gold prices edged higher after falling 2.7% on Monday due to weaker haven demand.

Improving profits

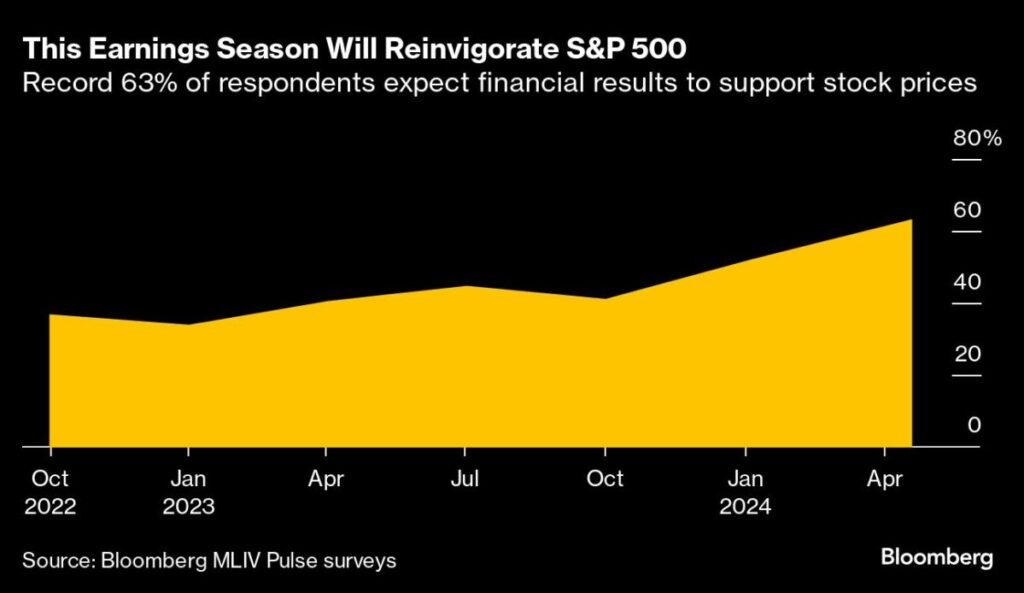

Nearly two-thirds of 409 respondents to Bloomberg’s Markets Live Pulse survey said they expected the gains to boost U.S. stock benchmarks. This is the highest vote of confidence in profits since the poll began asking the question in October 2022.

The challenge for S&P 500 returns this earnings season is that companies must generate earnings and prospects to support already rising multiples, said Megan Hornman of Verdence Capital Advisors.

Indeed, the stakes are high for the U.S. tech giant to begin delivering on the promise of artificial intelligence amid the prospect of slowing revenue, according to Bank of America strategists.

Microsoft, Alphabet, Metaplatforms, and Tesla all report earnings this week, marking the start of the so-called “Magnificent Seven.” AI is seen as the key to future profits, and its contribution to the revenue mix is a focus for traders, said the BofA team, which includes Oson Kwon and Savita Subramanian.

This week’s main events:

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Tuesday

-

U.S. new home sales Tuesday

-

Tesla, PepsiCo earnings results Tuesday

-

BOE Chief Economist Hugh Pill speaks on Tuesday

-

Germany IFO Business Environment, Wednesday

-

US Durable Goods Wednesday

-

IBM, Boeing, Metaplatform earnings Wednesday

-

US GDP, wholesale inventories, new unemployment claims, Thursday

-

Microsoft, Alphabet, Airbus earnings Thursday

-

Japanese interest rate decision, Tokyo CPI, inflation and GDP forecast, Friday

-

US Personal Income and Expenditures, PCE Deflator, University of Michigan Consumer Sentiment, Friday

-

ExxonMobil, Chevron earnings, Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 10:31 a.m. Tokyo time.

-

Nikkei 225 futures (OSE) rose 0.3%

-

Japan’s TOPIX rose 0.2%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Hang Seng rose 0.9%

-

The Shanghai Composite fell 0.3%.

-

Euro Stoxx50 futures rise 0.5%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0658.

-

The Japanese yen remained almost unchanged at 154.70 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2525 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6456.

cryptocurrency

-

Bitcoin rose 0.7% to $67,010.85

-

Ether rose 0.7% to $3,213.84

bond

-

The 10-year government bond yield was almost unchanged at 4.61%.

-

Japan’s 10-year bond yield remains unchanged at 0.880%

-

Australian 10-year bond yield falls 3 basis points to 4.29%

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Jason Scott.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP