(Bloomberg) — Asian stocks rose on a rally in U.S. tech stocks and new economic data that reignited hopes for a U.S. interest rate cut.

Most Read Articles on Bloomberg

The MSCI Asia-Pacific index rose the most in the past month, with benchmarks from Hong Kong to Japan and South Korea posting gains. Chip stocks in the region followed the performance of their U.S. peers. US futures also rose.

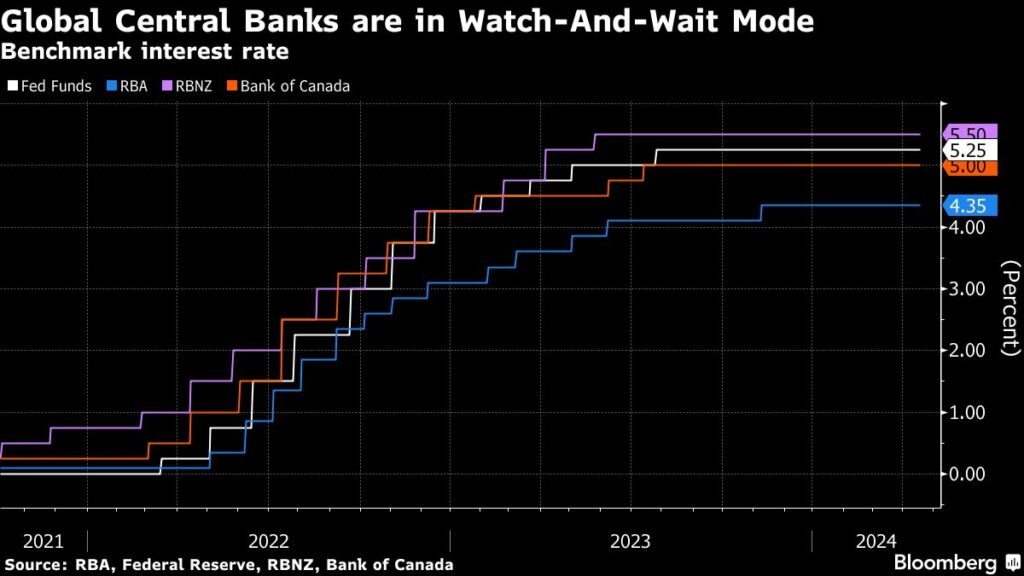

The Australian dollar rose 0.5% against broader dollar weakness as inflation reports pointed to persistent local price pressures and the central bank strengthened its insistence on keeping interest rates at 12-year highs. The South Korean won led the rise in Asian currencies. U.S. Treasuries were largely stable.

Strong results from big U.S. tech companies, as well as weak indicators of business activity in the world’s largest economy, helped maintain the Federal Reserve’s easing forecast for this year. Similar to Wall Street, the performance of tech companies is in the spotlight in Asia as the region enters its busiest week for corporate earnings.

“We saw a nice rally on Wall Street ahead of the big tech earnings, and that should spill over into Asian stock markets today,” said Matt Simpson, senior market strategist at City Index. At this stage, it’s a risk-on rally, but there is some comfort in the fact that the ECB and BOE seem happy to “decouple” from the Fed. ”

The S&P 500 index posted its highest consecutive rate of increase in the past two months. His Nvidia Corp., a symbol of the artificial intelligence boom, led a surge of chipmakers. Texas Instruments Inc. gave a bullish earnings forecast. This is a good sign for the chip industry on Wednesday, which could lead to a boost for Asian producers.

Oil sustained gains as industry reports showed U.S. crude inventories falling and traders tracked progress toward new sanctions against Iran. The bottom has gold trim.

Elsewhere, the yen is hovering just below the key level of 155 yen to the dollar, with Japan’s former top foreign exchange official warning that the country is on the brink of currency intervention.

In the corporate world, London-based Silchester International Investors, which has been an advocate of corporate reform in Japan, announced that it had acquired a stake in Nikon, pushing the stock price up by the most in nearly three years.

Revenue under monitoring

Tesla, the first of the “Magnificent Seven” large stocks to be reported, soared late in the day in the US, as electric car giant Tesla struck a positive note despite sluggish sales. The stock ended a seven-day slide and rose in line with the rest of the group.

Morgan Stanley’s Mike Wilson said the hurdles to profitability are high for U.S. companies, especially mega-technology companies that face tough comparisons with last year’s growth rates.

In addition to Tesla, Microsoft, Metaplatforms, and Alphabet are also scheduled to report earnings this week. Profits for the Magnificent Seven, which includes Apple Inc., Amazon.com Inc. and Nvidia Inc., are expected to rise about 40% in the first quarter from a year ago, according to data from Bloomberg Intelligence.

The group of high-tech mega-cap stocks is extremely important to the S&P 500 because they make up the most weight in the index. Valuations are sky high after this year’s rise. Even after this decline, the Magnificent Seven still trades at a combined forward P/E of 31 times, according to data compiled by Bloomberg.

This week’s main events:

-

Indonesia interest rate decision Wednesday

-

IBM, Boeing, Metaplatform earnings Wednesday

-

Malaysia CPI, Thursday

-

South Korea GDP, Thursday

-

Turkey interest rate decision Thursday

-

US GDP, wholesale inventories, new unemployment claims, Thursday

-

Microsoft, Alphabet, Airbus, Caterpillar earnings results Thursday

-

Japanese interest rate decision, Tokyo CPI, inflation and GDP forecast, Friday

-

US Personal Income and Expenditures, University of Michigan Consumer Sentiment, Friday

-

ExxonMobil, Chevron earnings, Friday

The main movements in the market are:

stock

-

As of 11:30 a.m. Tokyo time, S&P 500 futures were up 0.3%.

-

Nikkei 225 futures (OSE) rose 2.1%

-

Japan’s TOPIX rose 1.4%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Hong Kong’s Hang Seng rose 1.5%

-

The Shanghai Composite rose 0.2%.

-

Euro Stoxx50 futures rose 0.4%

-

Nasdaq 100 futures rose 0.7%

currency

-

The Bloomberg Dollar Spot Index fell 0.1%.

-

The euro was almost unchanged at $1.0710.

-

The Japanese yen remained almost unchanged at 154.80 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2569 yuan to the dollar.

-

The Australian dollar rose 0.6% to $0.6523.

cryptocurrency

-

Bitcoin rose 0.3% to $66,570.63

-

Ether rose 0.5% to $3,225.87

bond

-

The 10-year Treasury yield rose 2 basis points to 4.62%.

-

Japan’s 10-year bond yield remains almost unchanged at 0.880%

-

The Australian 10-year bond yield rose 13 basis points to 4.40%.

merchandise

-

West Texas Intermediate crude oil is little changed.

-

Spot gold fell 0.1% to $2,319.04 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rita Nazareth and Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP