(Bloomberg) — Asian stocks fell after Meta Platforms’ disappointing outlook, raising concerns that the bull market has gone too far.

Most Read Articles on Bloomberg

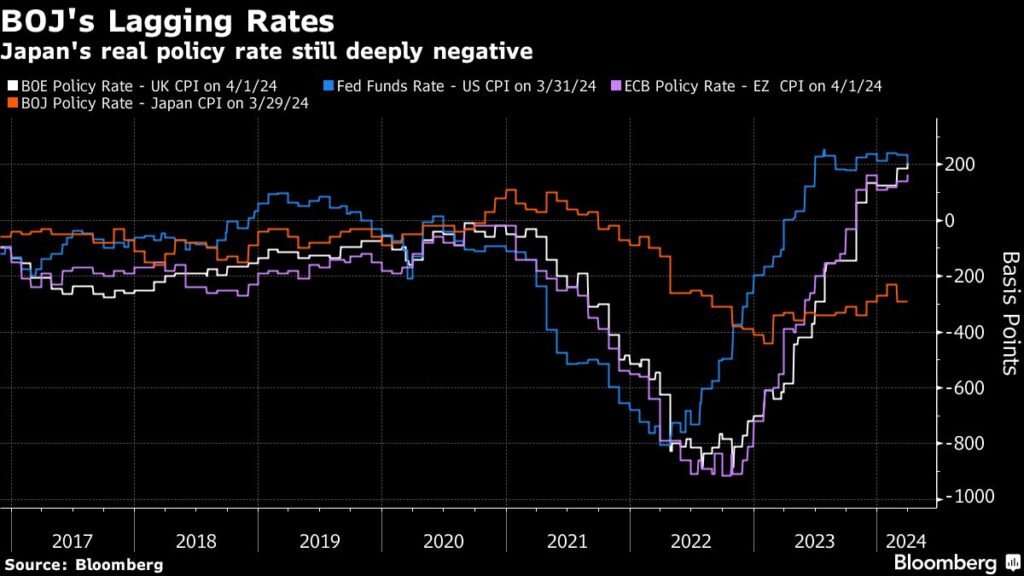

Stock indexes in South Korea and Japan fell, and US stock futures also fell. The yen widened its losses on Wednesday after falling above 155 yen to the dollar for the first time in more than 30 years, raising the possibility of intervention ahead of the Bank of Japan’s policy decision on Friday.

Facebook’s parent company Meta fell 15% in U.S. after-hours trading as it said second-quarter revenue would be lower than analysts expected and raised its spending forecast for this year.

“Meta’s less optimistic outlook sent markets into an after-hours frenzy. There is also an impending sense of caution in the market,” said chief Vishnu Varasan. Economist in charge of Asia excluding Japan at Mizuho Bank in Singapore.

On Thursday, the yen fell to 155.51 yen to the dollar, hitting a new 34-year low against the dollar. The Bank of Japan is expected to keep interest rates unchanged on Friday, but the sharp drop in the currency has raised the possibility that the Bank of Japan will weaken its stance on maintaining easing policy.

Eiji Michie said, “Mr. Ueda’s press conference is expected to have a hawkish tone, and even if the yen depreciation does not accelerate, there is a high possibility that the government will intervene at the same time and cause the yen to appreciate by around 5 yen.” . Strategist at SBI Securities. He said the initial intervention would likely be in the trillions of yen, followed by smaller long-term purchases.

Japan Airlines CEO Mitsuko Tottori said in a group interview that Japan’s weak currency is a “big problem,” adding that the exchange rate should be higher than the current rate of around 155 to the dollar.

In the corporate world, South Korea’s SK Hynix said it expects a full recovery in the memory market as it fuels demand for AI and posted the fastest pace of revenue growth since at least 2010. Despite this, stock prices plummeted.

Marcelo Songsu Ahn, portfolio manager at Quad Investment Management in Seoul, said the stock “sold on the news after Wednesday’s big rally, but Meta’s 15% decline also worsened investor sentiment.” “

BHP Group Ltd. has made a takeover bid for Anglo American Ltd., in a move that could spark the biggest change to the global mining industry in more than a decade.

In India, Kotak Mahindra Bank’s share price has fallen by up to 10% since April 2020 after the central bank restricted the acceptance of new customers through online and mobile banking channels citing risks in the technology system. reached its maximum value.

Also read: UBS analyst who bought Evergrande is bullish on Chinese real estate

Elsewhere, gold prices fell for a fourth straight day ahead of the release of inflation data that will shape expectations for US monetary policy and the dollar’s trajectory.

In recent weeks, markets have been scaling back the number of rate cuts expected by the Fed following a series of solid economic data. Economists surveyed by Bloomberg said gross domestic product (GDP) is likely to fall to around 2.5% in the first quarter, a figure that still potentially signals continued inflationary pressures. I predict that.

Government bond prices were little changed in Asia after yields rose on Wednesday. Hong Kong stocks rose as southbound investors may be using Hong Kong-listed stocks to diversify their currency exposure as pressure on the yuan weakens due to the U.S.-China interest rate differential, BNP Paribas said. .

BNP strategists including Jason Lui said in a note that mainland traders have snapped up a net $20 billion in Hong Kong stocks since March, pushing the market towards its biggest two-month inflow since 2021. He said he was on track.

Meanwhile, Secretary of State Antony Blinken said the world’s largest economy must “make clear our differences” as the threat of U.S. sanctions targeting China over Russia’s support for the war in Ukraine looms ahead of a visit to China. The two countries began two days of talks in China. .

This week’s main events:

-

US GDP, wholesale inventories, new unemployment claims, Thursday

-

Microsoft, Alphabet, Airbus earnings Thursday

-

Japanese interest rate decision, Tokyo CPI, inflation and GDP forecast, Friday

-

US Personal Income and Expenditures, PCE Deflator, University of Michigan Consumer Sentiment, Friday

-

ExxonMobil, Chevron earnings, Friday

The main movements in the market are:

stock

-

S&P 500 futures were down 0.7% as of 1:07 p.m. Tokyo time.

-

Nikkei 225 futures (OSE) fell 1.9%

-

S&P/ASX 200 futures down 0.8%

-

Japan’s TOPIX fell 1.4%

-

Hong Kong’s Hang Seng rose 0.6%

-

The Shanghai Composite rose 0.2%.

-

Euro Stoxx50 futures fell 0.1%

-

Nasdaq 100 futures fell 1.2%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0706.

-

The Japanese yen remained almost unchanged at 155.46 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2669 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6503.

cryptocurrency

-

Bitcoin rose 0.2% to $64,165.51

-

Ether rose 0.1% to $3,133.95

bond

-

The 10-year government bond yield was almost unchanged at 4.65%.

-

Japan’s 10-year bond yield remains unchanged at 0.890%

-

The Australian 10-year bond yield rose 14 basis points to 4.41%.

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Stephen Kirkland, Yukyung Lee, Masaki Kondo, and Tania Chen.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP