(Bloomberg) – Asian stocks are up for a six-week week as traders grapple with tensions in the Middle East, disappointing bank earnings and the prospect that the U.S. Federal Reserve will keep long-term interest rates high. It fell to an all-time low.

Most Read Articles on Bloomberg

Stock markets in the region fell on Friday’s decline in U.S. stocks. Benchmarks in Hong Kong, Japan and South Korea all fell, but mainland Chinese stocks rose, led by the energy sector.

However, global markets showed signs of stabilization even after the unprecedented attack on Israel over the weekend. Iran said “this issue can be considered settled,” and President Joe Biden reportedly told Israeli Prime Minister Benjamin Netanyahu that the United States would not support Israel’s counterattack against Iran.

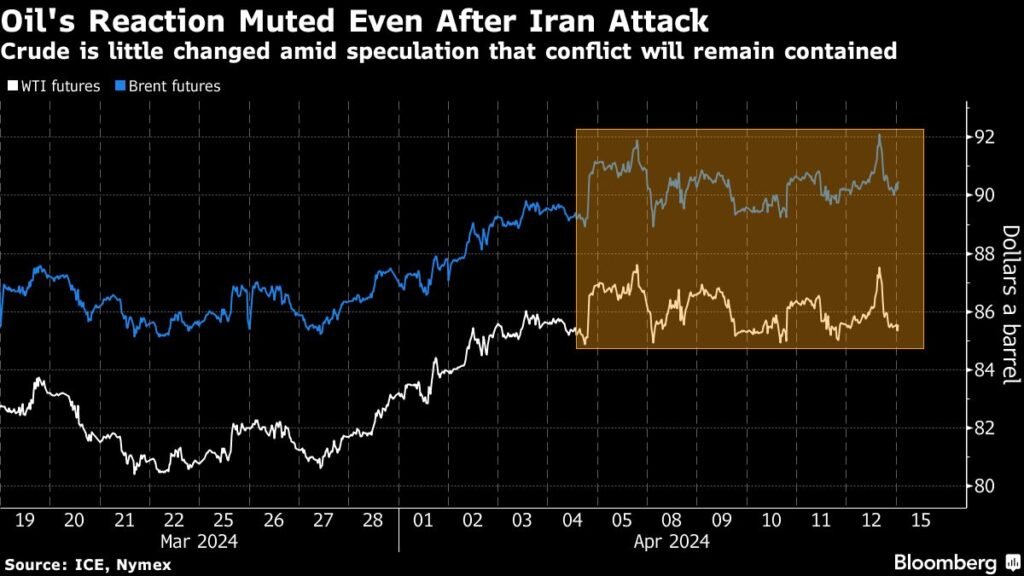

U.S. stock futures edged higher in Asian trading on Friday after the S&P 500 index suffered its worst trading since January amid a flight to safety. With Brent crude oil, the world benchmark, hovering around $90 per barrel, oil prices have softened on expectations that conflicts will continue to be contained.

Meanwhile, aluminum and nickel soared following new U.S. and U.K. sanctions banning deliveries of supplies from Russia after midnight Friday.

“Iran’s missile and drone attacks on Israel have brought geopolitical risks back into the spotlight,” said Redmond Wong, market strategist at Saxo Capital Markets. “Market reaction was subdued in Asia early on, but volatility and tensions are likely to rise as we look to new headlines coming out of the Middle East.”

Most G10 currencies rose against the dollar on Monday, but U.S. Treasuries were little changed after yields fell in the previous session in Asia.

Meanwhile, Chinese authorities withdrew cash from the banking system for the second straight month while keeping key interest rates unchanged. The measures come even after price increases stalled last month, prompting calls for more stimulus.

Developer China Vanke also faces liquidity pressures and short-term operational difficulties as China’s top leaders grow wary of the protracted real estate crisis and its impact on the struggling economy. He said he is making plans to resolve the issue.

Investors are already spooked by persistently high inflation and the prospect of rising long-term interest rates, and the escalation of the Middle East crisis could inject fresh volatility into the market. As the conflict escalates, many say oil could soar above $100 a barrel, leading to a flight into U.S. Treasuries, gold and the dollar and further declines in stock markets.

Bitcoin fell nearly 9% following the attack before rebounding. Stock markets in Saudi Arabia and Qatar recorded modest declines on Sunday amid thin trading volumes. The Israeli stock benchmark fluctuated between gains and losses at least nine times before closing with slight gains.

As Wall Street’s earnings season begins, results from major banks are the latest indicator of how the U.S. economy is faring as persistent inflation clouds the trajectory of interest rates.

JPMorgan Chase & Co. and Wells Fargo both reported lower-than-expected net interest income (profits earned on loans) as funding costs rose. Citigroup’s profits beat analysts’ expectations as companies tap markets for financing and consumers turn to credit cards. This is a sign that a prolonged period of rising interest rates will benefit major banks.

“Many economic indicators remain positive. However, as we look to the future, we remain cautious of a number of significant elements of uncertainty,” said Jamie Dimon, chief executive officer of JPMorgan. CEO) said. He cited the effects of war, rising geopolitical tensions, sustained inflationary pressures and quantitative tightening.

Traders will soon turn their attention to looming economic data as they narrow down their expectations for central bank easing cycles and the International Monetary Fund and World Bank’s spring meetings in Washington. This week, growth figures for China and inflation rates for Japan, the euro area and the UK are expected to be released.

This week’s main events:

-

Eurozone industrial production, Monday

-

US Retail Sales, Imperial Manufacturing, Corporate Inventories, Monday

-

Federal income tax paid on Monday in the United States

-

The spring meetings of the IMF and World Bank begin in Washington on Monday.Major ministerial meetings will be held from April 17th to 19th

-

Canadian Consumer Price Index, Tuesday

-

China real estate prices, retail sales, industrial production, GDP, Tuesday

-

UK unemployment insurance claims, unemployment rate, Tuesday

-

New Zealand Home Sales, CPI, Wednesday

-

Eurozone CPI, Wednesday

-

UK CPI, Wednesday

-

Australian unemployment rate Thursday

-

Japan CPI, Friday

-

Indian elections begin on Friday

The main movements in the market are:

stock

-

As of 10:51 a.m. Tokyo time, S&P 500 futures were up 0.2%.

-

Nikkei 225 futures (OSE) fell 1.1%

-

Japan’s TOPIX fell 0.6%

-

Australia’s S&P/ASX 200 falls 0.6%

-

Hong Kong’s Hang Seng fell 1.3%.

-

The Shanghai Composite fell 0.2%.

-

Euro Stoxx50 futures little changed

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0648.

-

The Japanese yen fell 0.2% to 153.56 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2612 yuan to the dollar.

-

The Australian dollar rose 0.1% to $0.6475.

cryptocurrency

-

Bitcoin rises 2.3% to $65,322.76

-

Ether rises 2% to $3,130.31

bond

-

The 10-year government bond yield was almost unchanged at 4.53%.

-

Japan’s 10-year bond yield fell 1 basis point to 0.840%.

-

Australian 10-year bond yield falls 4 basis points to 4.22%

merchandise

-

West Texas Intermediate crude oil fell 0.3% to $85.41 a barrel.

-

Spot gold rose 0.4% to $2,354.29 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Yongchang Chin.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP