(Bloomberg) — Asian stock markets were set to rise early Tuesday after U.S. benchmarks traded weakly and U.S. Treasuries underperformed to start the week ahead of key inflation data.

Most Read Articles on Bloomberg

Stock futures in Tokyo, Hong Kong and Sydney showed gains. The yield on the US 10-year Treasury note rose to its highest level since November, moving closer to the psychologically important 4.5% level. Trader confidence in the Fed’s three quarter-point rate cuts this year has quickly evaporated, and the market now supports just two cuts.

Economists surveyed by Bloomberg expect Wednesday’s consumer price index to ease some inflationary pressures. But the core measure, which excludes food and energy costs, rose 3.7% from a year earlier, exceeding the Fed’s 2% target.

“After Monday’s eclipse, U.S. core inflation will determine whether the market’s expectations for a June rate cut grow larger or pass,” said Morgan Stanley strategists including Matthew Hornback. Probably.”

The benchmark 10-year bond yield, which was initially recorded at 4.46%, rose 2 basis points to 4.42%. The S&P 500 index is hovering around 5,200. Megacaps were mixed, with Nvidia down and Tesla up about 5%. Oil prices fell after Israel announced it would withdraw some troops from Gaza. Bitcoin has surpassed $71,000.

Read: Bearish trade in government bond options aims for 10-year yield above 5%

Read: Fed’s Goolsby says high interest rates will increase unemployment

Chris Larkin of Morgan Stanley’s E*Trade said some Fed officials are questioning the wisdom of cutting interest rates when inflation is in a “sticky” maintenance pattern, and this week’s inflation data will be It is said that it may have an impact.

“The Fed has been hesitant to read too much into several consecutive months of better-than-expected inflation data, but it may change its mind in the third month,” he said.

Economists at JPMorgan Chase & Co., led by Michael Feroli, postponed expectations for the Fed to cut interest rates for the first time in the cycle after the strong March jobs report. They now expect the US central bank to begin monetary easing in July rather than June.

“Investors seem to be looking forward to easy monetary policy, but the current environment is not enough to scream ‘rate cut!’,” said Jason Pride of Glenmede. “With a strong labor market, expanding manufacturing and rising commodity prices, the Fed will be in no hurry to cut rates.”

Swap contracts suggest about 60 basis points of U.S. monetary easing this year, with two rate cuts most likely, the first coming in September, according to Bloomberg pricing. It means that it is expected by. As of Friday, the probability of a third rate cut remained above 50%.

JPMorgan strategists led by Mislav Matejka said a rise in bond yields could be driven by “the wrong reasons” and would put pressure on stock prices.

The team expects U.S. 10-year bond yields to fall as geopolitical risks rise, while pointing to the risk that inflation will remain high. Stocks with high financing costs could remain under pressure given the potential for inflation to overshoot, the strategists wrote.

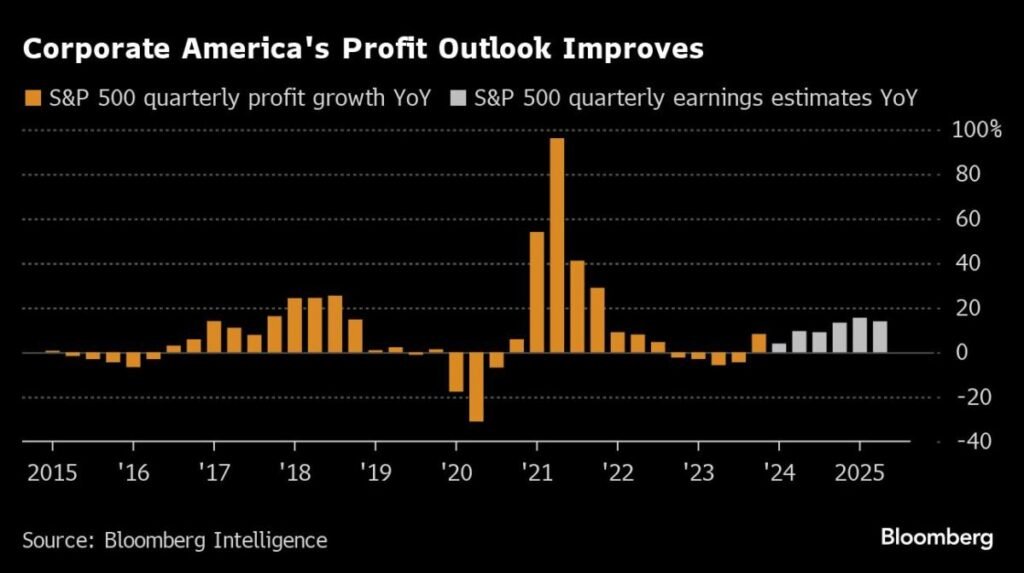

Wall Street expects a subdued earnings season for American companies despite the stock market fireworks in the first quarter.

Strategists expect first-quarter earnings growth for S&P 500 companies to be only 3.9% year over year, the lowest since 2019, according to data compiled by Bloomberg Intelligence. But in this case, the market may be onto something. These forecasts can be overly pessimistic, as in the fourth quarter, when growth was expected to be around 1%, but the actual result turned out to be more than 8%. This is because it is highly sensitive. %.

“The recent resilience of inflation has made rate cuts less immediate, putting more pressure on earnings to fuel future market gains,” said Richard Saperstein of Treasury Partners. “Given rising market multiples and rising bond yields, we remain cautious on stocks until earnings season shows clear evidence of earnings growth.”

Wells Fargo Securities’ Christopher Harvey just set a high target for Wall Street’s S&P 500 index in 2024, based on his expectations that the rally in U.S. stocks will continue through the rest of the year.

Mr. Harvey raised his year-end forecast for the benchmark to 5,535 from 4,625, making him the biggest bullish among strategists tracked by Bloomberg. In a note Monday, Harvey said he sees growth potential from artificial intelligence technology and improved earnings prospects as catalysts for the upside, along with longer time horizons and higher valuation metrics from investors. He said there was.

Company highlights:

-

Tesla Inc. plans to unveil its long-promised robotaxi later this year as it struggles with weak sales and competition from cheaper Chinese electric cars.

-

99 Cents Only Stores LLC filed for bankruptcy in April after announcing plans to wind down its operations.

-

Shares of apartment landlords rose after Blackstone, the world’s largest commercial real estate owner, stepped up investment in the industry.

-

United Airlines Holdings Inc. has delayed two new routes due to growth restrictions imposed while U.S. aviation regulators conduct a safety review of the airline.

-

Spirit Airlines announced a major cost-cutting program less than three months after antitrust concerns derailed plans to merge with JetBlue Airways.

-

The United States plans to give Taiwan Semiconductor Manufacturing Co. $6.6 billion in subsidies and up to $5 billion in loans to help the world’s top chipmaker build a factory in Arizona, bringing domestic production of key technologies. Expanding President Joe Biden’s efforts to expand the

-

Alibaba Group Holding Ltd. has cut prices for cloud customers from the U.S. to Singapore to reflect deep discounts at home, as the once-high-flying unit struggles to fend off rivals and restore growth. Up to 59% price reduction.

This week’s main events:

-

China’s comprehensive lending, money supply, new yuan lending, Tuesday

-

Japanese PPI, Wednesday

-

Canadian interest rate decision Wednesday

-

US CPI, Fed Minutes, Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

China PPI, CPI, Thursday

-

Eurozone ECB interest rate decision Thursday

-

U.S. new unemployment insurance claims, PPI, Thursday

-

New York Fed President John Williams speaks Thursday

-

Boston Fed President Susan Collins speaks Thursday

-

china trade friday

-

University of Michigan Consumer Sentiment, Friday

-

Citigroup, JPMorgan and Wells Fargo are scheduled to report earnings on Friday.

-

San Francisco Fed President Mary Daley speaks on Friday

The main movements in the market are:

stock

-

As of 7:08 a.m. Tokyo time, Hang Seng futures were up 0.3%.

-

S&P/ASX 200 futures up 0.5%

-

Nikkei 225 futures rose 0.2%

-

S&P500 has little change

-

Nasdaq 100 almost unchanged

currency

cryptocurrency

-

Bitcoin is little changed at $71,748.48

-

Ether remains almost unchanged at $3,689.65

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP