(Bloomberg) — Asian markets rallied, especially for tech companies, as U.S. markets rose after inflation announcements eased concerns about a more hawkish Federal Reserve. The project is attracting attention and is expected to start trading in a positive manner.

Most Read Articles on Bloomberg

Stock futures in Australia, South Korea and China are pointing to early gains, while Hong Kong stock futures are down. U.S. contracts edged higher after the S&P 500 rose 1% on Friday. Japanese markets are closed for the holiday, but yen traders remain wary of efforts to prop up the currency, the weakest in more than 30 years.

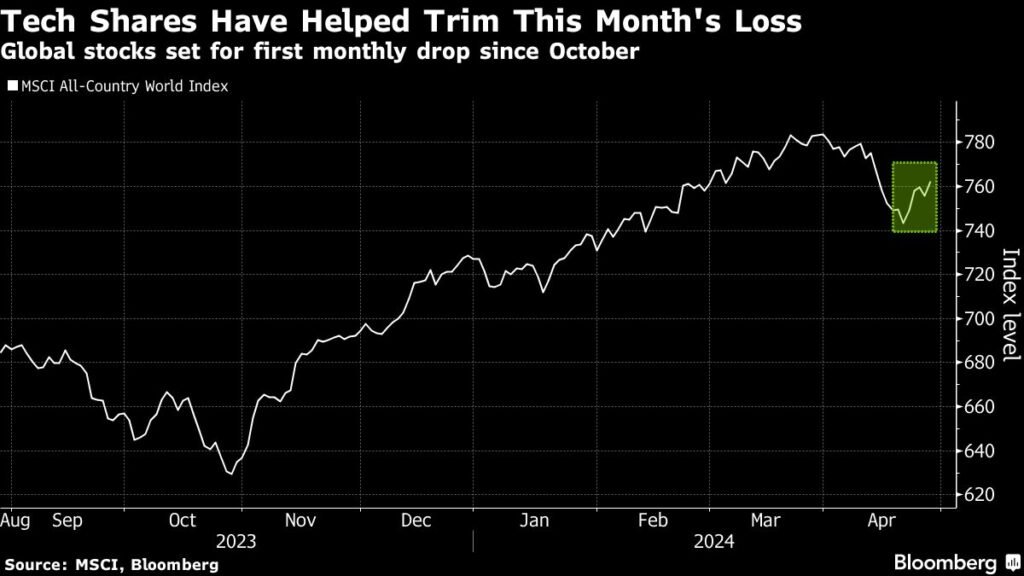

Asian technology stocks rise in early trading after Microsoft and Google’s parent company Alphabet released results last week, sending a clear message that spending on artificial intelligence and cloud computing is paying off. there is a possibility. A rally in tech stocks capped the decline in global stocks to 2.7% this month, the first monthly decline since October, on the back of lingering inflationary pressures and concerns about conflict in the Middle East.

Shane Oliver, chief economist and head of investment strategy at AMP, said that while the correction may be over, “there is a significant risk that this is just a rebound from an oversold situation.” Still, further declines are unlikely to be severe, and the stock price is likely to fall. He said in a note to clients that further gains are expected “as disinflation resumes, central banks eventually cut interest rates, and recession is averted or easing is demonstrated.”

Traders will also be keeping an eye on Wednesday’s Federal Reserve policy meeting after the central bank’s recommended inflation measure rose in March at a faster pace, more or less in line with expectations. Officials are likely to keep interest rates on hold at their highest levels in more than 20 years, and all eyes will be on how the tone of the post-meeting statement and Chairman Powell’s press conference changes.

“All measures of U.S. consumer prices have shown a sharp acceleration over the past three to four months, and the FOMC has no intention of significantly easing policy this year,” Société Générale economists, including Klaus Bader, said in a note. It is inevitable that we will significantly retract our previous predictions.” To the client. “However, the market has already significantly reduced its pricing in a rate cut, so unless Powell weighs the possibility of a rate hike, the damage to the market will be minimal.”

A measure of U.S. Treasury returns is on track to fall 2.3% this month, the biggest monthly decline since February of last year, as hawkish FedSpeak and strong economic data dented expectations for rate cuts. Swap traders now expect the Fed to cut rates only once in 2024, far less than the roughly six quarter-point cut they had expected in early 2024.

Read more: When will Fed rate cut discussions shift based on inflation data?

Elsewhere this week, European inflation data will be released, and Amazon.com and Apple will report earnings. The U.S. Treasury also plans to keep long-term bond sales steady with a new plan this week.

The main movements in the market are:

stock

-

Hang Seng futures were down 0.3% as of 7:11 a.m. Tokyo time.

-

S&P/ASX 200 futures rose 0.3%

-

S&P 500 futures rose 0.1%

-

Nasdaq 100 futures rose 0.1%

currency

-

The euro was almost unchanged at $1.0698.

-

The Japanese yen rose 0.3% to 157.89 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2682 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6532.

cryptocurrency

-

Bitcoin remains almost unchanged at $63,692.01

-

Ether fell 0.1% to $3,306.26.

bond

merchandise

-

Spot gold fell 0.2% to $2,333.20 an ounce.

-

West Texas Intermediate crude oil fell 0.4% to $83.61 a barrel.

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP