(Bloomberg) — Robot investors are increasingly taking over the credit market.

Most Read Articles on Bloomberg

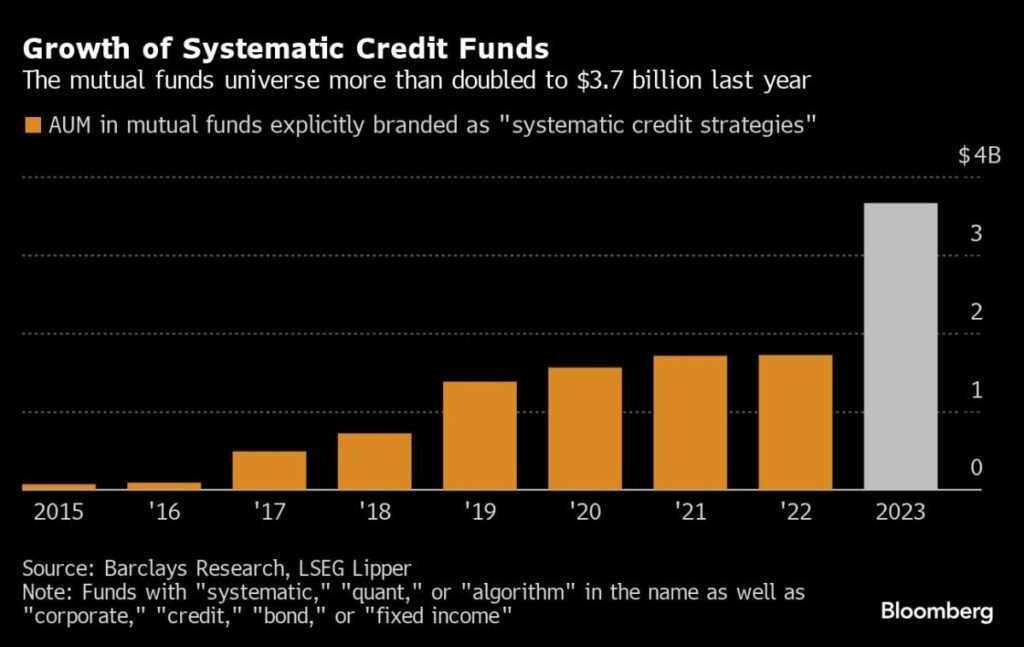

Systematic money managers use complex algorithms to quickly decide to buy or sell corporate bonds, and assets have more than doubled in one measure in the last year, Barclays strategists say. Another measure suggests there could be between $90 billion and $140 billion in these strategies in the U.S. high-grade and junk bond markets.

It’s the latest sign that bonds are increasingly being traded in credit markets, thanks in part to exchange-traded funds. Barclays says this increased liquidity is allowing innovations that have powered equity trading for decades, such as black-box trading models, to gain further foothold in the corporate bond market.

“The number of funds and total assets under management associated with systematic strategies have recently surged,” Barclays strategists Andrew Johnson and Dominic Toubran said in a note to clients on Friday. “Until the past few years, systematic strategies occupied a relatively small part of the credit market. This situation is rapidly changing and the impact on liquidity and price volatility is already evident.”

This change pits investors with technical Ph.D.s against traditional portfolio managers with business degrees. Systematic investors use computer models to scan the entire market and select securities that fit their strategy. This allows you to investigate much more than fundamental investors, who can only sift through vast amounts of data, and also helps you find more obscure opportunities hidden in the market. But computers aren’t always able to pick up the nuances of legal documents, hear the tone of earnings calls or track relevant news the way humans can, strategists said.

Nevertheless, we expect the systematic upsurge in credit markets to continue as electronic and portfolio trading become more popular and liquidity improves. About $3.3 trillion in cash was traded electronically last year, about 16% of which came from institutional accounts, according to Barclays strategists. Because systematic companies seek investment broadly, they will likely find opportunities that other companies are missing, thereby providing liquidity to less visible parts of the market.

“This breadth-first approach is therefore likely to create demand for bonds in less liquid areas of the market, resulting in additional price discovery,” they write.

Traditional asset managers “fail to evolve or risk being left behind,” they write.

Automated margin trading has been growing for years, especially among brokers and dealers, with a focus on helping traders buy and sell securities more efficiently. What’s different now is that robots can now make more decisions about which securities to buy or sell.

To derive their ratings, the Barclays team uses U.S. investments that include the terms “systematic,” “quantitative,” or “algorithmic” in addition to “corporate,” “credit,” “bonds,” or “bonds.” I counted all my trusts. And it turns out that their assets under management have doubled to his $3.7 billion in the past year. They also spoke to Barclays’ algorithmic trading desk and found that one in six electronic quote requests come from systematic accounts. Based on that material, they derived an estimated range of total assets under management.

The strategists offered several caveats in their report, noting how difficult it is to assess the size of systematic trades because so many investors combine quantitative and fundamental strategies. A survey of investors at the Barclays Hedge Fund Symposium found that almost three-quarters of investors supported its “quantamental” approach.

They also outlined the risks associated with increased systematic trading, particularly the potential for trend followers to create “herd behavior” around certain stocks, amplifying volatility. Similarly, factor models that try to build momentum, look for undervalued bonds, or take advantage of bid-to-ask spreads can cause rapid price fluctuations, as can tactical strategies that trade individual bonds. There is a possibility.

“Credit investors from all walks of life need to understand the signals that bring systematic investors into the market and drive real price action,” the strategists wrote.

(Updated liquidity details in 6th and 7th paragraphs. A previous version of this article corrected the volume numbers in the 6th paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP