With the US presidential election due to take place later this year, Morningstar’s editorial teams in Chicago and New York have been considering possible outcomes for investors. In this article, we look at a range of scenarios and show how returns would be affected if investors “ignored” politics altogether. This article is adapted from the original US article and adapted for a UK audience.

The presidential election could cause short-term turmoil in the markets, as investors see fluctuations in their portfolios and become anxious about the election results.

But understanding how elections have historically affected markets can play Pepto-Bismol for investors with bad instincts.

Which is better for the stock market: Democrats or Republicans?

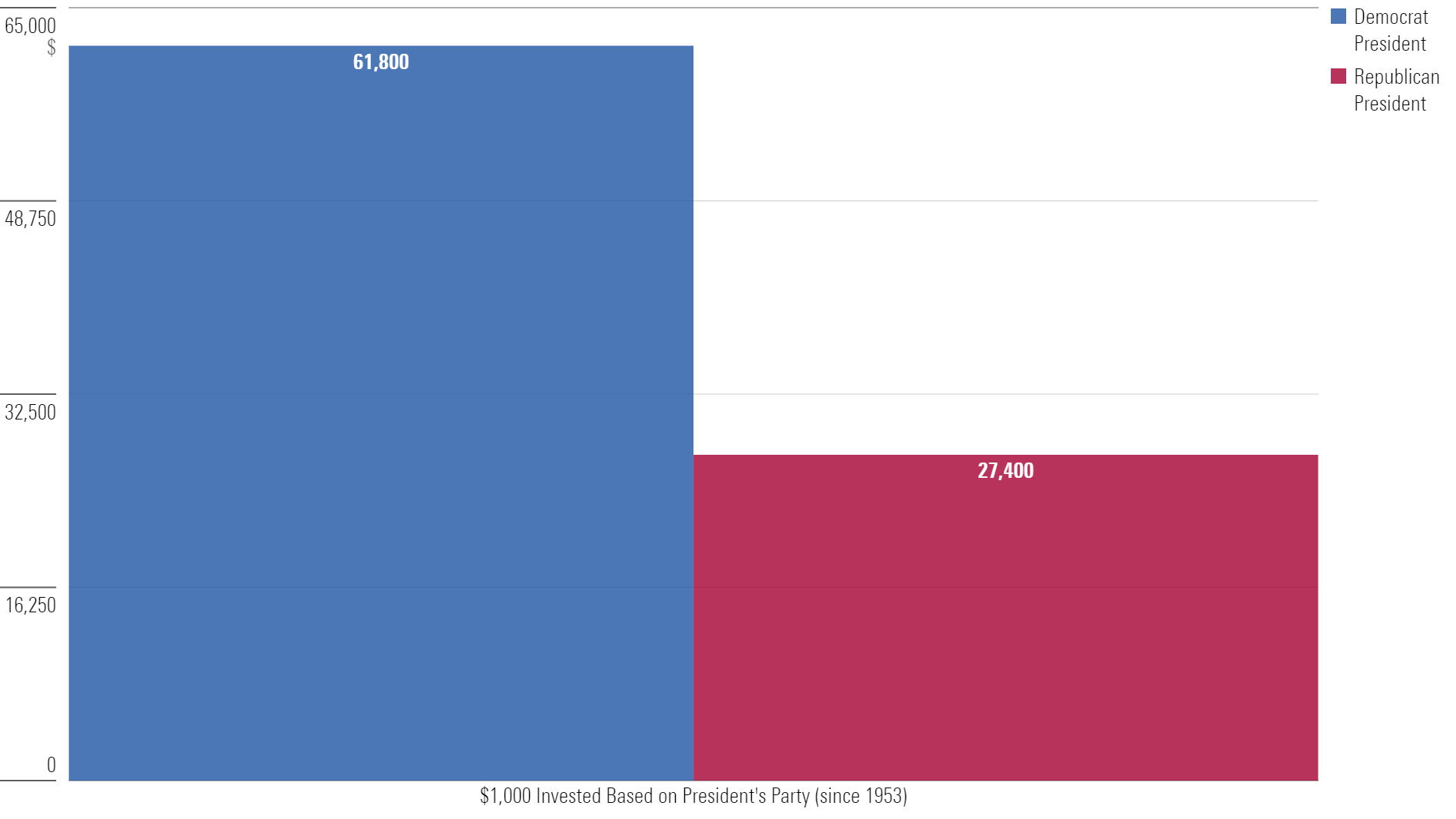

Looking at 70 years of returns, investors are better off with a Democrat in the White House. Since 1953, if you invested $1,000 (£789.79) when a Democrat was president, sold it for cash when a Republican was in office and reinvested it when a Democrat returned, you would have $62,000. The opposite strategy – investing only when a Republican was in the Oval Office – would have only grown to $27,000.

Return since Eisenhower took office in 1953

Invest $1,000 in the S&P 500 based on presidential party

Source: Bespoke Investment Group, 1953-2023

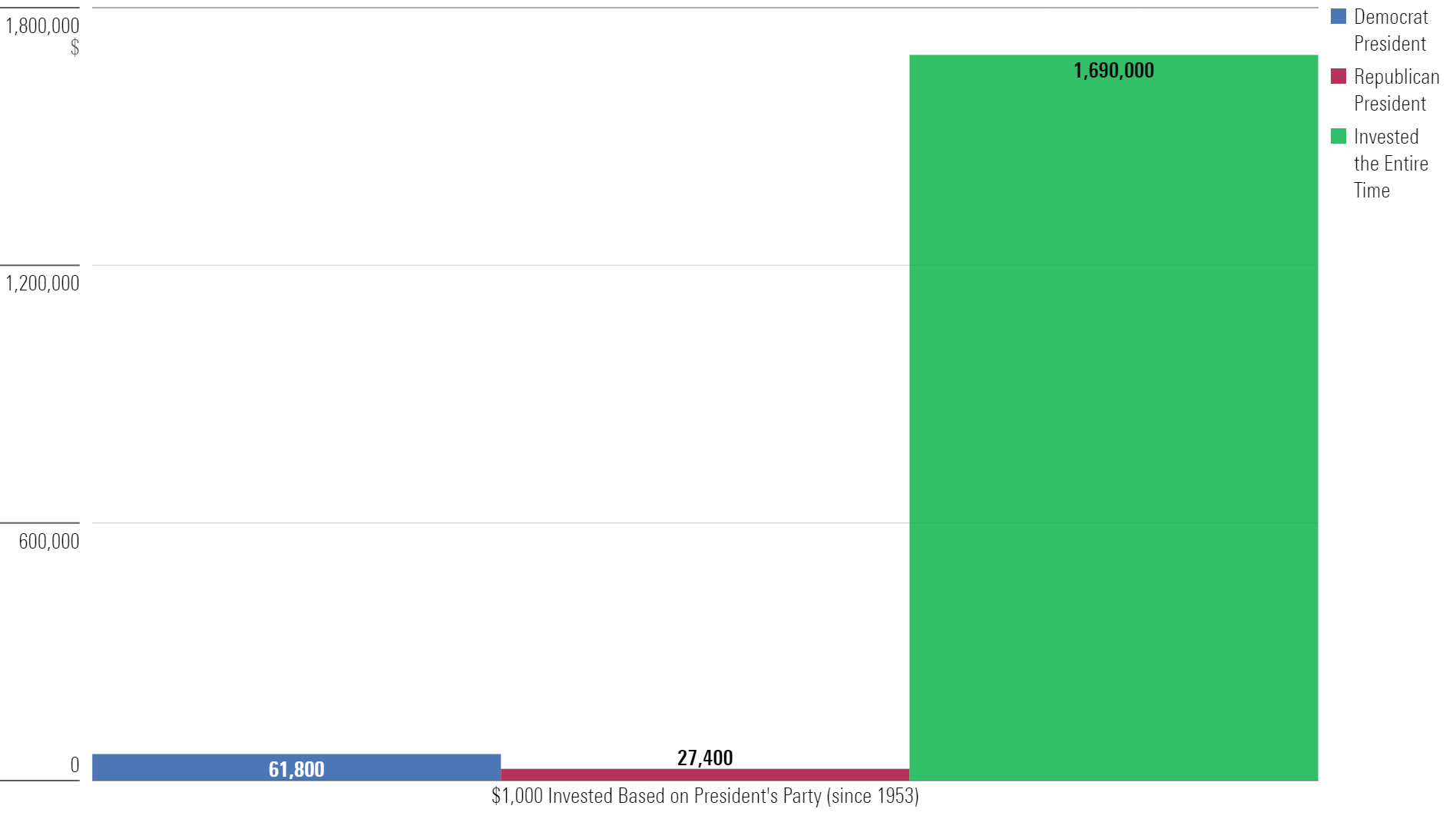

But this misses an important context: investors would have been better off ignoring Washington, D.C. entirely. For those who didn’t act on political preference and stuck with their money, that original $1,000 investment would have grown to nearly $1.7 million.

Return since Eisenhower took office in 1953

The same process is repeated, but with dramatically different results

Source: Bespoke Investment Group, 1953-2023

The stock market goes up and down under every president, but the path of least resistance is always up. There is no reason to think that the November election will change this. In short, politics can be a big drag on your portfolio. That’s why it’s important to treat politics and finance like oil and water. It’s easier said than done, and the coming months will be a busy time for political influence on financial markets.

Politics could affect the deal

Some of the key policy differences cited between President Joe Biden and former President Donald Trump include health care spending, immigration, and business regulation. One interesting example is the regulatory environment. One of the most well-known media brands, Paramount Global (PARA), has been in the spotlight for months over a possible sale. After months of “should we sell or not?” discussions, the company recently decided not to sell.

Paramount would likely have faced costly and time-consuming litigation to make the move happen. The Federal Trade Commission has been aggressive in blocking mergers, blocking four in January alone this year. The general consensus is that Paramount would like to sell, but would be better off waiting until after the election. A change in leadership could make the Federal Trade Commission, whose leaders are appointed by the president, more friendly.

But theory and reality are quite different: during the last two presidential terms, we can cite examples where common sense predicted one outcome, but another happened.

President Trump and China

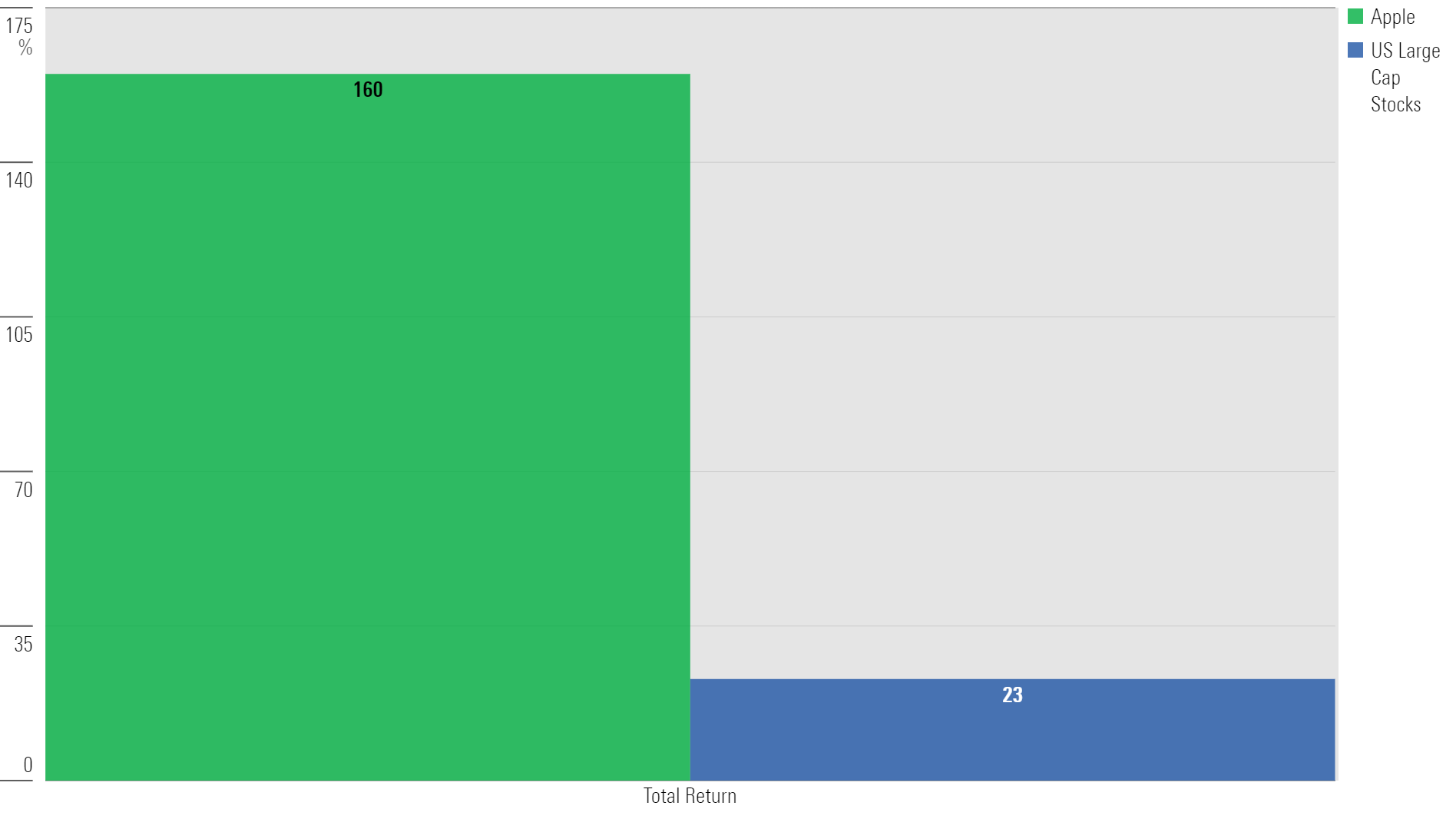

After Trump’s victory in 2016, it was widely believed that his policies would have dire consequences for companies that do business with China. No US company does more business with China than Apple Inc. (AAPL). A trade war would hurt its business. Several headlines at the time made this point.

But Apple did well: In the year after this article was published, its shares returned nearly eight times the return of the US stock market.

Apple vs. market returns, September 2019 to September 2020

Source: Morningstar Direct

President Biden and Energy Companies

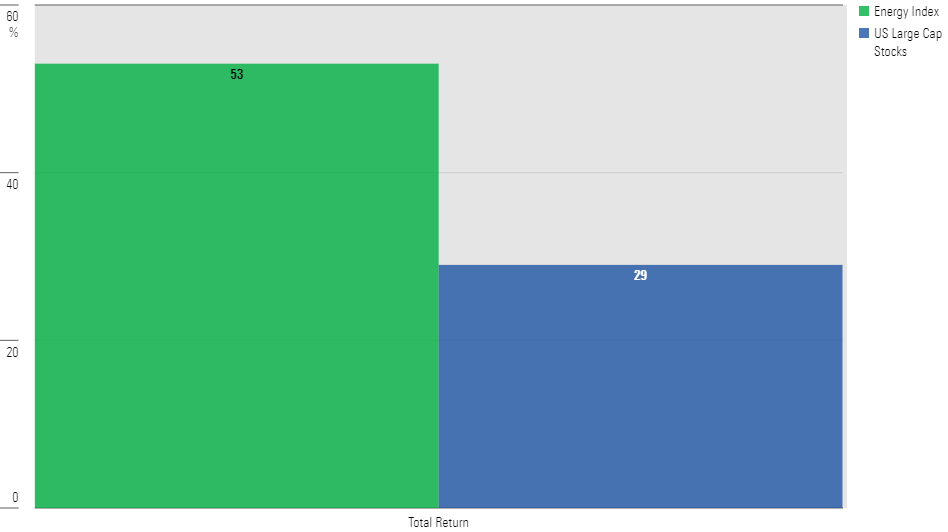

In the words of Rodney Dangerfield Caddyshack: “Be fair!” The Biden administration is a similar story. The administration is often seen as an enemy of the energy industry. One specific agenda item was to make it harder for energy companies to drill by reducing permits.

Headings include:

But like Apple, energy companies did well: Energy stocks’ earnings nearly doubled the U.S. stock market’s over the next year.

Energy Sector and Market Returns, December 2020 – December 2021

Source: Morningstar Direct

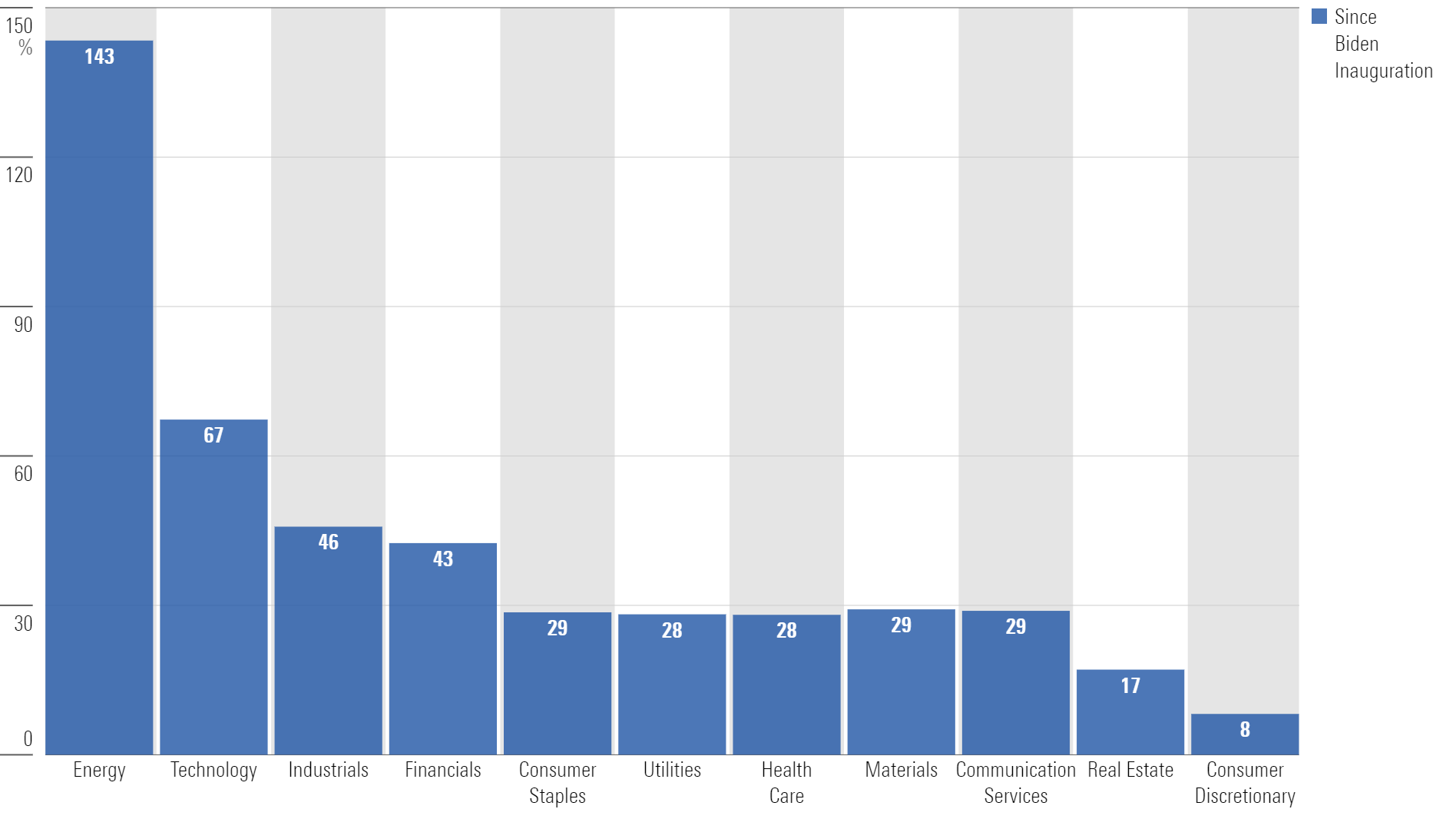

In fact, the energy sector has been the best-performing U.S. stock sector since President Biden took office in January 2021. The second-placed technology sector hasn’t even come close to matching those returns.

Biden’s total earnings since taking office

Source: Morningstar Direct, May 31, 2024

These and other examples remind us that conventional wisdom is often wrong, and that politics has less of an impact on the stock market than we think.

Not reacting to election uncertainty

Financial decisions are inherently fraught with emotion, biases, and blind spots. Politics doesn’t need to complicate things. They say life is 10% what happens and 90% how people react to it. The next few months will be the benchmark.

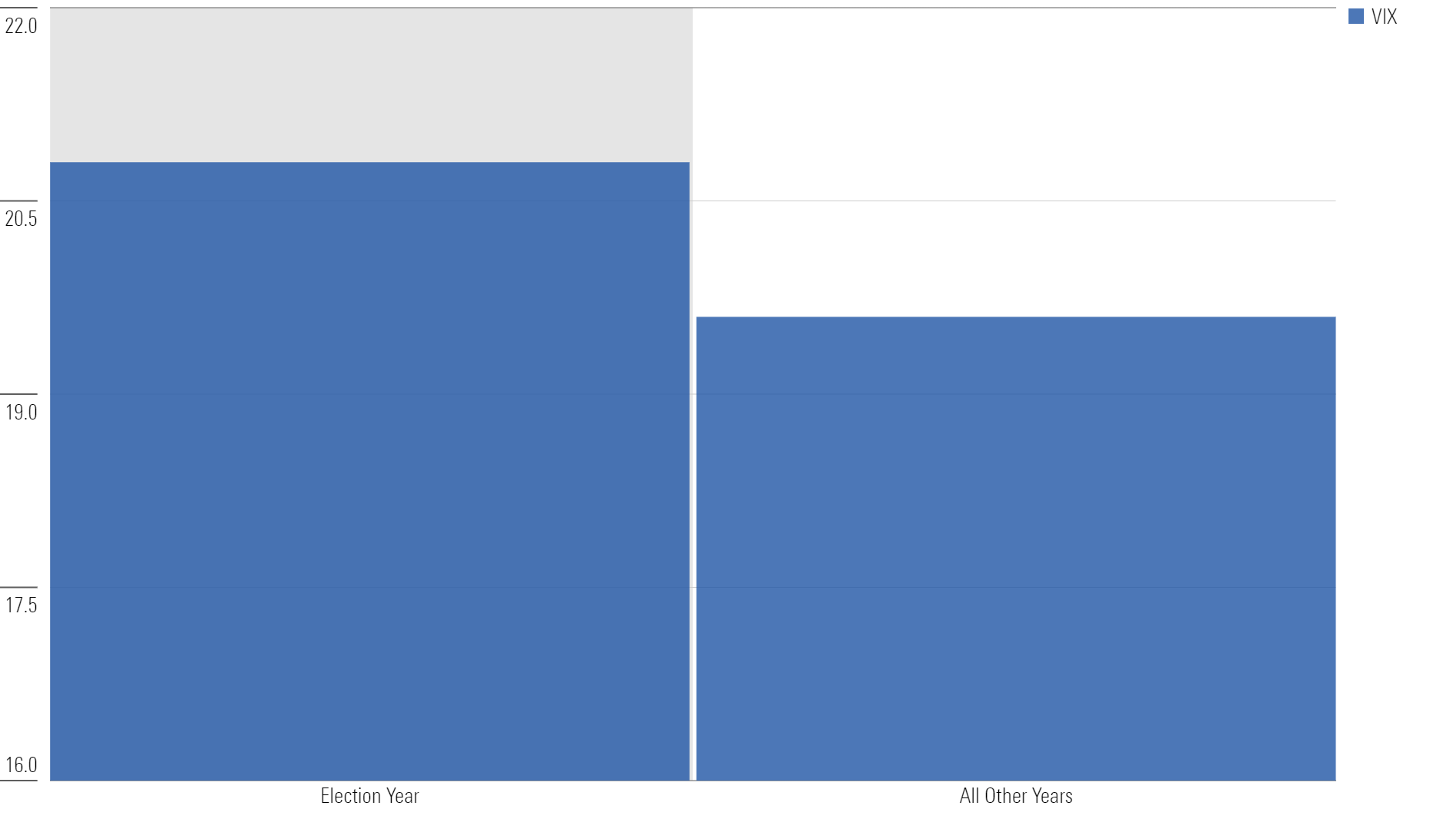

So far, markets have been calm. Perhaps too calm: The CBOE Volatility Index hit its lowest level in five years last month.

Trends in VIX

Elections could be a catalyst, as election years tend to be more volatile than other years.

The VIX rises in election years

Source: CBOE, January 2019 – May 2024

Add to that the fact that in a typical year, stock markets tend to fall by 14%. To date, the largest drop has been only 5%. It’s reasonable to assume that some sort of decline is on the way, but not just now. If a decline does occur, media coverage may prioritize sensationalism over a soothing long-term perspective and use politics to add fuel to the fire.

Remember, their fiduciary duty is not to you.