Since retiring to the First Coast 25 years ago, Linda Nottingham has made it her mission to help local businesses succeed, including selling two companies she co-founded in Chicago – an independent insurance brokerage and a managed care company.

A Texas native, she has helped hundreds of Northeast Florida businesses start, grow and thrive as a volunteer with the business mentoring organization SCORE Jacksonville and through her own coaching practice.

“She’s made a monumental difference, especially in our North Florida community,” said Jackie Perreault, executive director of the Association of Women’s Business Centers.

Perreault said she benefited from Nottingham’s guidance when she sought career advice: “She’s one of the most transparent and open mentors I’ve ever come across.”

Business Coaching

Nottingham also serves as president of CEO Focus, a business coaching firm.

She hosts peer-to-peer mentoring roundtables, providing a confidential environment for business owners from startups to multi-million dollar companies to help them solve their toughest business challenges.

During her roundtables, each member asks a question about a challenge and helps business owners solve the problem through facilitated group discussion.

Participants learn from each other’s mistakes and successes, and Nottingham offers advice when asked, as well as one-on-one mentoring.

The unintentional entrepreneur

How did a former social worker and educator become a business advisor?

Nottingham’s path to entrepreneurship was not planned: She started out as a social worker in Riverside, California, but was unable to make a living as an educator, so she divorced at age 37 and started anew as a mother of two in Chicago.

Previously, she taught Native American children in Arizona and worked as a public school counselor, earning two master’s degrees in education along the way.

Then in 1983, despite having no previous business experience, she persuaded a Chicago acquaintance to hire her as a consultant to run a laundry facility that was being relocated off the hospital’s campus.

“He told me I couldn’t do it,” Nottingham recalled. She was described as “unemployable.” Nottingham, who comes from an education background, presented a plan of action and responded: “If you don’t have anyone who can do it, why don’t you hire me?”

He did, and it led to more contract work and eventually full-time work as marketing director for a preferred provider organization (PPO) and an executive for a health maintenance organization (HMO).

When the new owners of the HMO laid off all of her staff, she feared she wouldn’t be able to find a similar position any time soon, so she and a colleague started their own business.

They set up an independent health insurance brokerage from their basement in Nottingham.

“It was a really desperate move. We were scared to death,” Nottingham said. “My security and safety depended on my work. It was terrifying to start a business and not have work at first because I had no income.”

Nottingham relied on unemployment insurance until her business grew, and continued to make calls from a rotary phone at home until she could set up a commercial office. “It really wasn’t an option. It was the only thing we had to do,” she said. And so they did.

Nottingham says not lying about pre-existing conditions on health insurance applications helped her company differentiate and grow: “Honesty was still at a premium back then, because there wasn’t much of it,” she says.

That led to a successful underwriting career that she later built on to co-found another business: a managed care company that helped physician groups contract with insurance companies at a time when managed care was just starting to take off.

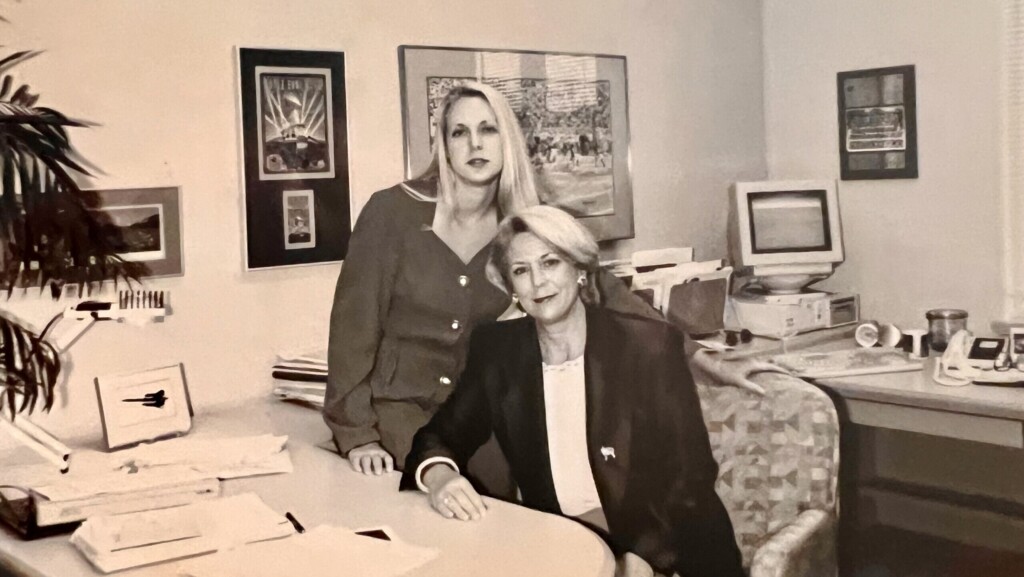

When the company was sold in 1996, it was Chicago’s largest privately held company, with 100 employees, Nottingham said.

As a female business owner in the 1980s, she faced little resistance, other than letters addressed to “Dear Gentlemen” and banks requiring her business partner’s husband to cosign a company car lease because married women couldn’t get loans at the time.

Promoting Guidance

“I don’t think I would be where I am today if I hadn’t had the opportunity to have her as a part of my life,” said Harold Boyette, president and CEO of Blue Streak Courier, who participated in the peer-to-peer mentoring roundtable, which is aimed at companies with annual revenues of $1 million to $50 million.

“The reason Linda was so good was because she had the life experience to back it up. When you have someone who’s been through the same thing and can help you achieve something, you have the ultimate respect for that person,” Boyett said.

He praised the intimate and confidential space Nottingham created, where participants felt safe to think deeply about their biggest business challenges.

Teaching Through Stories

“Linda has made me a better business woman,” says Patty Peoples, founder of HealthEconomics.com.

Peoples attended a roundtable hosted by the Jacksonville Women’s Business Center about 20 years ago and credited Nottingham with helping her grow and sell her business.

She benefited from Nottingham’s storytelling coaching approach. “It’s a powerful technique, and she has a story for almost every situation from her years of experience,” Peoples says. “Instead of telling me what to do, she would tell me a story about another company that had failed and the outcome.”

One story sticks in Peoples’ mind: A local business that was hit with a huge tax bill by the IRS due to poor record-keeping and went bankrupt.

Upon audit, the IRS determined that some of the company’s expenses were unreasonable because they were not reported on the annual minutes and resolutions, resulting in the company owing a large amount of tax that it could not pay.

“You can imagine that people would have a different reaction if they were just told, ‘fill out this boring form,’ than if they were told, ‘if you don’t fill it out, this is what might happen,'” Peoples said.

“I have a great horror story,” Nottingham says, “where I know, in my bones, where I’ve messed up.”

When Peoples wanted to sell the company, Nottingham used his insights from experience to guide him through the risky process.

She connected Peoples with knowledgeable professionals in Northeast Florida to help grow HealthEconomics.com and find the right buyer.

One of those experts was a former CFO of ExxonMobil and a volunteer with SCORE Jacksonville. He met with Peoples for two years and expanded his product line. “He made me more profitable, which made a big difference in the acquisition price,” Peoples said.

Other Victories

Nottingham supports established businesses as well as startups, and as a volunteer with SCORE Jacksonville, she consults with aspiring entrepreneurs.

She recalls meeting with a couple who wanted to open a gym, but after working through their business plan, they realized they wouldn’t be profitable for three years, so they abandoned the idea.

“We consider this a success because they didn’t put money down or take out loans and then realize later on that they weren’t going to see results in the time frame they wanted,” Nottingham said.

Now “retired” for 28 years, she’s an avid golfer who plays 18 holes every Sunday and works as a part-time model, and she has no plans to slow down.

In the 1980s, when business resources were limited, especially for women, she didn’t have the benefit of a mentor. “That’s why I felt I had to do it,” Nottingham says. “I like to help people, and I’m happy to share my mistakes.”