alberta investment management company announced on Monday The balanced fund achieved a return of 8% in 2023, which was lower than the fund’s benchmark return of 9.3%, it said. The 8% rate of return equates to $8.9 billion in net investment income, giving the fund total assets of $160.6 billion at the end of 2023.

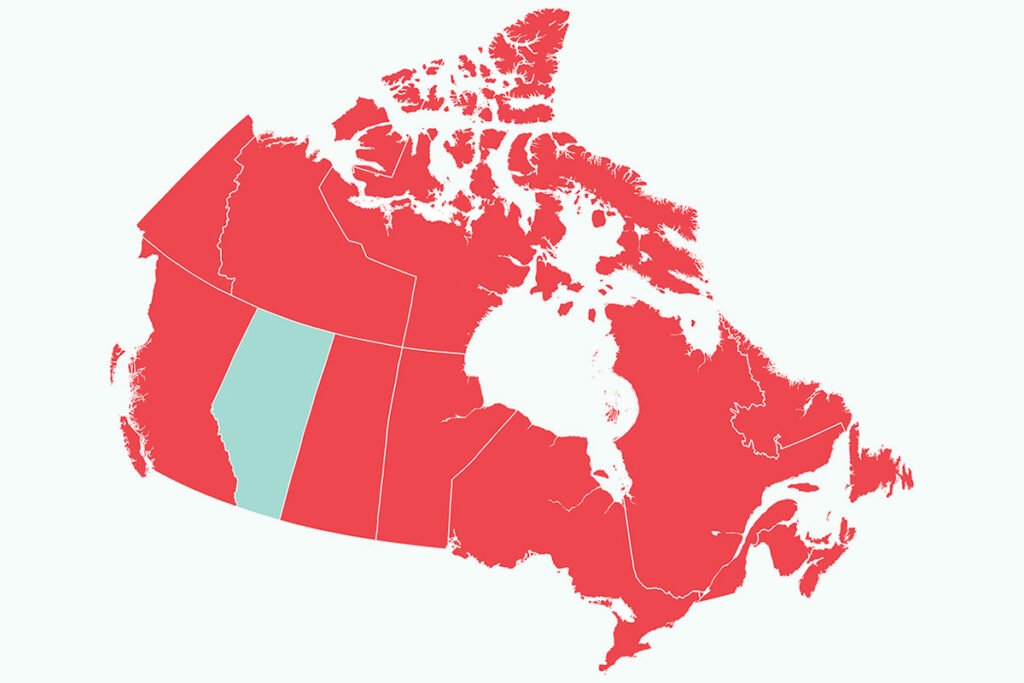

AIMCo invests on behalf of pensions, endowments, foundations and insurance companies in Alberta, Canada. AIMCo’s Balanced Fund returns represent client mix across asset classes. The fund announced that the fund’s total return was 6.9%, below the benchmark’s 8.7%.

“A combination of persistently high inflation and interest rates and difficult geopolitical factors impacted global markets in 2023,” Evan Siddal said., CEO of AIMCo, in a press release. “Our investment team continued to seize opportunities and effectively mitigate emerging risks to deliver solid returns for our clients and the Albertans they serve.”

The balanced fund’s annualized returns over the past 1, 4, and 10 years were 8.0%, 5.3%, and 7.3%, respectively. Over the same period, the fund’s overall returns were 6.9%, 5.0%, and 6.7%.

AIMCo plans to announce detailed investment returns in its annual report, scheduled for publication in June 2024.

Asset class returns

AIMCo’s best-performing asset class was equities, with a return of 15.8% in 2023. Private debt and loans returned 9.6%, while money market and fixed income assets returned 7.7%. Private equity returned 6.7%. The fund’s only negative return was in real estate, which returned -8.4% in 2023. Infrastructure and renewable resources returned 3.8% and 1.6%, respectively.

“Our continued focus on long-term results will enable us to navigate through challenging markets throughout 2023, while implementing new investment strategies and leveraging them into asset classes,” Marlene Puffer, AIMCo’s chief investment officer, said in the release. “We’ve made great progress by moving to a unique strategy.” “With our sights set on 2024, we remain focused on increasing the value of our existing direct investments and managing our private asset class allocation in an environment of capital constraints and rising interest rates.”

Related article:

Alberta threatens to withdraw from Canada Pension Plan

Alberta Investment Management names Marlene Puffer as CIO

Can Canada’s model be improved?

Tags: AIMCo, Alberta, Canada, Evan Siddal, Marlene Puffer, Tags: Alberta Investment Management Company