Artificial intelligence (AI) is currently the biggest tailwind in the technology field. Generative AI has countless applications, and giant companies are leading innovation efforts across industries.

One of the subtle growth opportunities in AI is data centers. In fact, Statista estimates that network infrastructure, storage, and server solutions will be a $439 billion opportunity by 2028.

surely, Nvidia and Advanced Micro Devices has benefited greatly from data center network services. But smart investors know there are opportunities on the periphery beyond the obvious winners.

One of the AI data center stocks I keep an eye on is oracle (NYSE:ORCL). As the data center boom continues, let’s take a closer look at why Oracle could be a lucrative opportunity for long-term investors.

AI data centers are on the rise and…

Besides Nvidia and AMD, many other technology companies are gaining traction in the data center space.

Vertive This is a unique opportunity for significant growth due to the increasing demand for data center services. Additionally, the company’s close ties to Nvidia certainly don’t hurt.

moreover, Amazon recently announced an $11 billion investment to build additional data center infrastructure. This is not at all surprising given that Amazon is a leader in cloud computing platforms and the company develops its own semiconductor training and inference chips.

…Oracle is quietly emerging as a major force

Back in March, Oracle announced its financial results for the third quarter of fiscal 2024 (ending February 29). On the surface, the company’s 7% year-over-year revenue growth may seem mundane.

However, Oracle reported a number of key performance indicators beyond traditional financial statements. Perhaps the most important of these metrics was the remaining performance obligation (RPO). This is an important operational metric because it measures a company’s backlog and gives investors a glimpse into future growth.

As of the end of Oracle’s fiscal third quarter, RPO was $80 billion, up 29% year over year, a record for the company.

What’s one reason for such a high backlog? Data centers. Oracle Chairman Larry Ellison said during an earnings call that the company is “building out data centers at record levels.”

He’s not exaggerating. Just this week, Bloomberg reported on rumors that one of Elon Musk’s startups, xAI, was negotiating a $10 billion deal with Oracle to rent cloud servers.

Is Oracle stock a buy?

A deal could be reached between Oracle and xAI, but this stock is not a buy. This deal could fall apart, and there is no guarantee that xAI will use Oracle for its cloud solutions.

That said, I am cautiously optimistic that this deal will come to fruition. Oracle is already working with xAI related to other AI services.Additionally, the good relationship between Larry Ellison and Elon Musk is well known, with Ellison previously teslaBoard of Directors.

The bigger idea here is that enterprises aren’t just relying on traditional hyperscalers. alphabet, microsoft, Amazon, and Nvidia for your AI cloud needs. Regardless of whether Oracle signs a deal with xAI, I see this negotiation as a major source of proof that there are more winners than big tech companies in the AI data center space. ing.

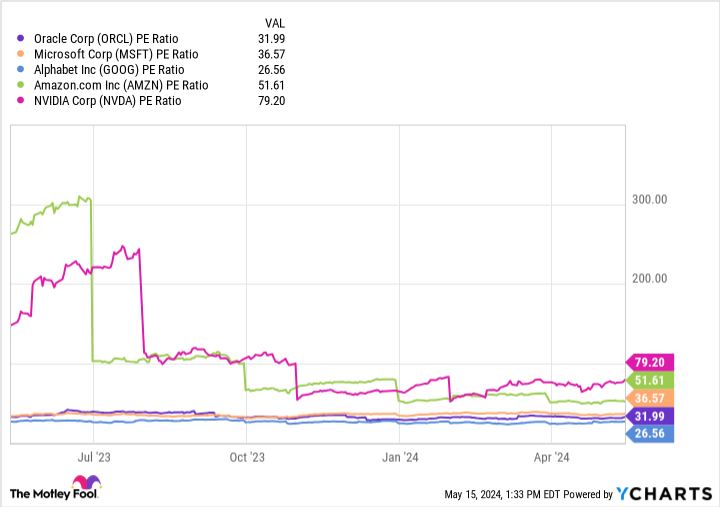

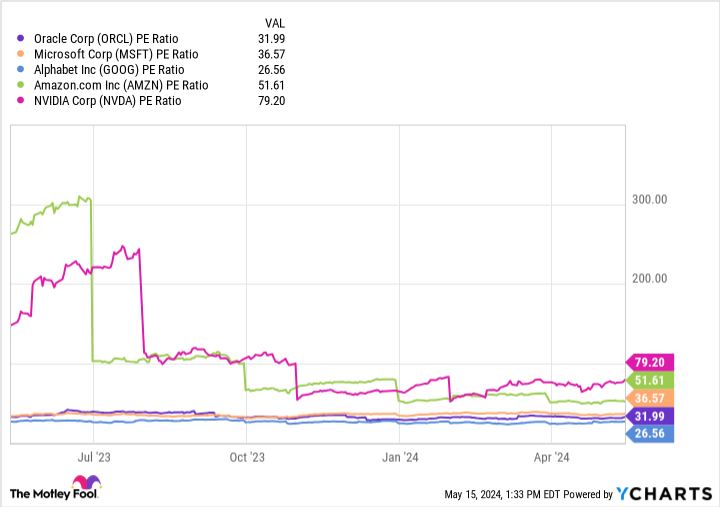

Oracle’s price-to-earnings (P/E) ratio of 31.9, while not cheap, is well below many of its peers.

I think now is a great time to start building a position in Oracle stock. As demand for AI cloud storage solutions continues to grow, Oracle should see an influx of business from both new and existing customers.

The secular trends accelerating AI represent a new growth story for Oracle, and I think now is a great time to buy the stock. It looks like Oracle’s best days are ahead, and I’m bullish on even more returns for long-term shareholders.

Should you invest $1,000 in Oracle right now?

Before purchasing Oracle stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Oracle wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $566,624!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of May 13, 2024

Suzanne Frey, an Alphabet executive, is a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Adam Spatacco has held positions at Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: His January 2026 $395 long call on Microsoft and his January 2026 $405 short call on Microsoft. The Motley Fool has a disclosure policy.

“Once-in-a-generation investment opportunity: 1 data center stock that could go parabolic” (hint: not Nvidia) was originally published by The Motley Fool.