(Bloomberg) – Asian stock markets were mostly higher as U.S. stocks recovered and bonds rose ahead of key inflation data that will shape the outlook for the Federal Reserve’s next steps. .

Most Read Articles on Bloomberg

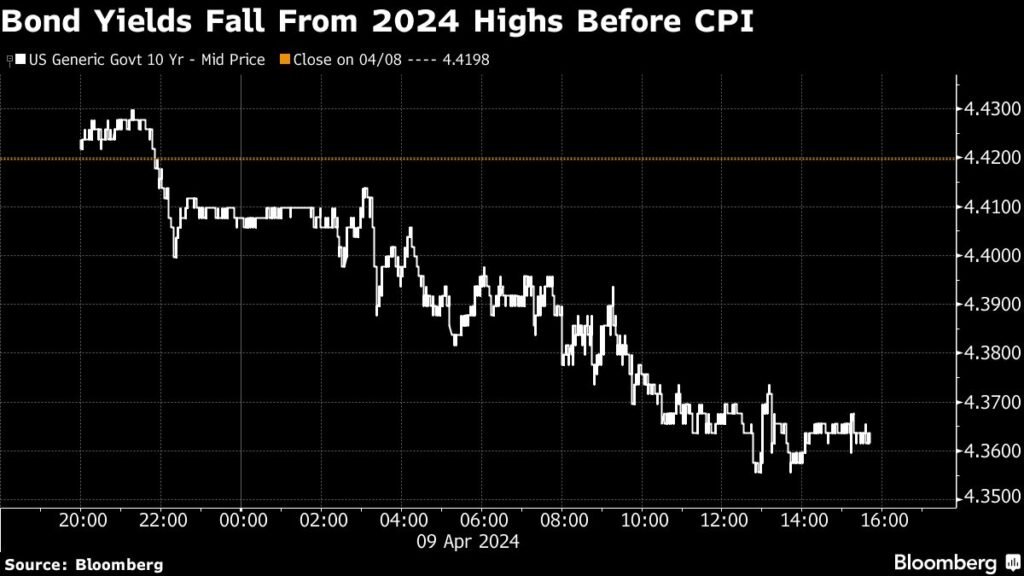

Hong Kong and Australian futures rose, while Japan’s futures showed a modest decline, with Singapore’s holiday likely to slow trading in the region. The S&P 500 fell 0.8% before ending the day 0.1% higher. U.S. Treasuries rose, with the 10-year Treasury yield falling from this year’s highest level.

U.S. traders took positions in anticipation of Wednesday’s consumer price index, as related economic data was not on schedule. Officials have opposed the need for easing, and continued strong economic data has dampened market expectations for the Fed to cut rates.

“Given the resilience of the economy, investors are increasingly questioning the turnaround in June,” said Marta Norton, chief investment officer for the Americas at Morningstar Wealth. “The postponement is within the expected outcome, especially if March’s inflation numbers show an unexpected upside,” she said.

After struggling through much of the trading session, the S&P 500 rose above the 5,200 level with Tesla Inc. leading the mega-cap rally. Nvidia fell after Intel announced a new version of its artificial intelligence chip. The yield on the US 10-year Treasury note fell 6 basis points to 4.36%. Oil fell as traders assessed diplomatic efforts in the Middle East. Gold rose to a new record.

In Asia, the central banks of New Zealand and Thailand are expected to keep interest rates on hold at their meetings on Wednesday.

“CPI is the important number this week,” said Andrew Brenner of NatAlliance Securities. “The concern is that CPI continues to be a thorn in the Fed’s side. But the positioning is very bearish, echoing the words of some old traders we’ve worked with in the past. To quote him, “What hurts traders the most is what happens when they are in a strong position.”

U.S. inflation trends in March and April will play a crucial role in determining whether the Fed cuts interest rates in June, according to Evercore’s Krishna Guha.

“We don’t think the hurdles are too tough and we’re likely to have enough data to move forward,” Guha said.

Swaps markets are pricing in about 65 basis points of Fed rate cuts by the end of this year, lower than the central bank expected last month.

Atlanta Fed President Rafael Bostic reiterated that he expects one rate cut this year, but is prepared to change his view to subsequent or additional rate cuts if economic conditions change. He added that there is.

Mohamed El-Erian argues that the Fed’s long-term inflation expectations should be revised upward as macro conditions such as supply chains and productivity evolve.

“Inflation is here to stay,” the president of Queen’s College, Cambridge University, and a columnist for Bloomberg Opinion, told Bloomberg TV. “But that doesn’t mean the Fed should stop, because a 2% inflation target is too harsh for a global economy undergoing a massive rewiring.”

Bond yields are likely to remain volatile in the near term due to market shifts in the Fed’s policy, but UBS’s chief investment officer believes the risk-reward of high-quality fixed income, including government bonds and investment-grade corporate bonds, is likely to remain volatile in the short term. We continue to view the outlook as attractive.

“We continue to emphasize high-quality fixed income in our global portfolios and encourage investors to secure attractive bond yields at this time,” said Solita Marcelli of UBS Global Wealth Management. said. She says: “We prefer bonds with maturities in the one to 10 year range and see value in sustainable bonds.”

Company highlights:

-

Boeing Co. fell after the New York Times reported that the Federal Aviation Administration is investigating complaints by engineers about safety issues with the company’s 787 Dreamliner planes.

-

Pfizer’s RSV vaccine triggered an immune response not only in older adults but also in younger adults at high risk of severe disease, spurring the company’s plans to apply for broader approval in the United States.

-

Cisco Systems was reinstated with an overweight rating by Morgan Stanley, which said the computer networking equipment maker’s valuation discount was “too severe.”

-

Google announced a number of updates to its artificial intelligence products for cloud computing customers, emphasizing that the technology is safe and ready for use in the enterprise realm, despite recent stumbles with consumer tools. did.

-

Best Buy uses artificial intelligence to speed up home visits and reduce the number of visits. This is part of the company’s efforts to use technology to streamline its operations.

-

A hydroelectric power plant owned by Enel Spa’s renewable arm Enel Green Power in northern Italy has suffered a deadly explosion.

This week’s main events:

-

Japanese PPI, Wednesday

-

Canadian interest rate decision Wednesday

-

US CPI, Fed Minutes, Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

China PPI, CPI, Thursday

-

Eurozone ECB interest rate decision Thursday

-

U.S. new unemployment insurance claims, PPI, Thursday

-

New York Fed President John Williams speaks Thursday

-

Boston Fed President Susan Collins speaks Thursday

-

china trade friday

-

University of Michigan Consumer Sentiment, Friday

-

Citigroup, JPMorgan and Wells Fargo are scheduled to report earnings on Friday.

-

San Francisco Fed President Mary Daley speaks on Friday

The main movements in the market are:

stock

-

Hang Seng futures were up 0.5% as of 7:04 a.m. Tokyo time.

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 0.3%

-

S&P500 rose 0.1%

-

Nasdaq 100 rose 0.4%

currency

cryptocurrency

-

Bitcoin remains almost unchanged at $69,128.81

-

Ether fell 0.3% to $3,502.48.

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP