LockieCurrie/E+ via Getty Images

Co-authored with Tread Softley

Living in Florida, what I miss most is the change of seasons. We experience more seasons here in North Florida than those living in South Florida, such as Miami.but it doesn’t reach me Look at the beautiful fall foliage that people in the northern United States see. If you are too close to a tree surrounded by fallen leaves, it may be difficult to fully appreciate the beauty of autumn leaves. To truly enjoy the colors and contrasts of the season, you need to take a step back and admire multiple trees from a distance. That’s when you can actually see the yellows, oranges, and reds of the leaves come alive against the sky.

I like to take a step back sometimes. Evaluate my portfolio from an overall perspective. When dealing with investment portfolios, it’s easy to get caught up in the nuances of what’s going on. While the majority of your portfolio is doing well, you will become highly concentrated in a few drama stocks that are gaining traction. Think of it like a classroom full of students. Her one clown in the class gets so much attention that the work of all the other students goes unnoticed and unappreciated.

So instead of getting hung up on individual holdings, we want to take a step back and consider a more holistic approach. For our community of income investors, I provide allocation recommendations for individual holdings. This is 2-3% of the portfolio size for investors who follow the Rule of 42. It also defines sectors allocation as well as broader portfolio sections such as maintaining balance. Personal holdings, diversified funds, fixed income securities such as baby bonds, preferred stocks, etc. A three-tiered approach allows you to analyze security levels, sector levels, and key sections of your portfolio. This provides a comprehensive overview of your portfolio, allowing you to identify concentration risks and take appropriate corrective actions based on macro factors affecting the market.

There’s a classic saying, “You can’t miss the forest for the trees,” and this rings true for many investors. We can get so focused on individual holdings that we lose sight of the portfolio as a whole. So today I’d like to talk about where I invest 50% of my overall portfolio, explain why I chose that area, and talk about some other specifics.

Let’s dive in!

Bonds – fixed and introduced

For income investors, owning a large sample of bonds is very important. A classic 60/40 portfolio tells us that he should invest 40% of his total portfolio in some kind of fixed income investment, such as bonds. I think this is no different for investors who seek short-term profits. It is important to have approximately 40% of your assets in bonds. I refer to decentralized funds (such as ETFs and CEFs) whose assets are allocated to bonds, preferred securities, baby bonds, or other credit instruments such as fixed-term loans and whose capital structure is senior to common stocks (such as ETFs or CEFs) as bonds. Include. While I enjoy using his ETFs and CEFs to gain broad exposure to a variety of fixed income securities, I also believe in finding high quality individual securities for high income opportunities.

Before the Fed raised interest rates, I advised and wrote publicly about my views on investing from fixed to floating rates, or starting to buy floating rate investments. This is why I was able to enjoy rising interest rates as my investments paid me more and more and I started accumulating large amounts of capital gains on those investments.

At this point, there is no room for interest rates to rise. We are currently at or near the peak of this interest rate cycle, making rate cuts more likely in the near future. Since my expectation is that interest rates will fall, my recommendation is the opposite. I am currently looking for fixed rate preferred securities and baby bonds to ensure predictable income for the next few years. Therefore, I intend to invest in various bonds to ensure high yields in order to enjoy these high dividends for many years to come.

REIT – UnintelliREIT Don’t Become an Investor

In recent years, many people have realized that owning real estate can be very profitable. This is primarily because high inflation has driven up home prices, and multi-home owners are likely accumulating large unrealized gains on their investments.

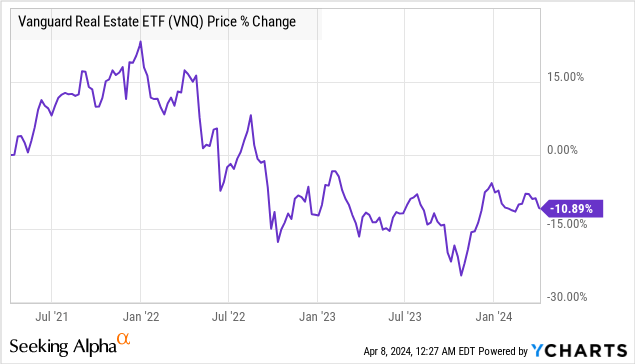

Whether the asset can be sold is another matter entirely. Selling a home is limited by high interest rates and deters buyers, as they hold a large amount of equity value that could be used as collateral. As a result, many people are stuck with very valuable homes and are unable to meaningfully realize capital gains. At the other end of the spectrum, public REITs have been hit hard by rising interest rates.

This is due to the simple fact that many of these REITs are viewed as fixed income replacements. As interest rates rose, they were sold like bonds. Since I expect interest rates to fall in the future, I believe many of these REITs cover their dividends well and offer high yields even at heavily discounted valuations. I would happily buy more stock and take a new position in a quality company.

There’s a classic adage that says you should own the land because it won’t be created anymore. By owning various investments in this sector, one can not only enjoy a deep income stream due to the regulatory obligation to distribute 90% of his taxable income, but also expand his land ownership.

This lucrative sector offers a variety of opportunities between owning cell phone towers, retail stores, hospitals, entertainment facilities, and data centers, but not all opportunities should be valued equally. Just because a REIT owns land doesn’t automatically mean it’s a good investment. You’ll hear real estate agents say “location, location, location” all the time. If you own a REIT, it’s important to understand what niche you’re investing in, where your portfolio is, and how diversified your tenant base is. However, the sector serves as a good source of income and is well-positioned to deliver significant profits as interest rates begin to fall.

A REIT’s business model is backed by reliable cash flow from tangible assets, providing shareholders with an excellent source of income while waiting for capital appreciation. This makes it ideal for income investors. Time is your friend. You get paid to wait.

conclusion

Today we took a step back and reviewed where we invested half of our retirement portfolio. It should come as no surprise that my portfolio is not only fine-tuned to generate high income, but also provide significant capital gains in the future. My portfolio provides me with a very predictable and rich source of income, so I regularly grow my portfolio by becoming a buyer in the market and starting new positions or adding to existing ones. You can continue. A portion of every dollar I receive is allocated to be immediately put back into my portfolio to keep it functioning. I have long learned that the laziest thing in the world is sleeping money. Money is a great tool and a terrible master, but it can be used to great advantage to keep making more money. Nothing else is as complex as this. So currently half of my portfolio is invested in bonds and REITs.

If you want to become an income investor in retirement, it’s important to understand how all the capital that flows through the economy flows through the markets. By studying your cash flow and investing carefully in the market, you can direct some of this capital into your portfolio. Thousands of retirees are living on dividends from their portfolios because they have been able to take advantage of the profitability of American companies and the profits of financial markets. With our unique income method, you can do just that. My investment portfolio is designed to leverage the market and generate income, like a spigot collecting sap from a maple tree in the spring.

That’s the beauty of my income method. That’s the beauty of income investing.