(Bloomberg) — Wall Street banks are vying for deals from Australian pension funds as the world’s fastest-growing retirement savings pool looks to hedge its large overseas investments.

Most Read Articles on Bloomberg

Bank of America last month hired industry veteran Scott Breakwell from Deutsche Bank to head its foreign exchange futures trading desk in Sydney as business from pension funds grows. Global financial institutions such as Goldman Sachs Group Inc. and Citigroup Inc. are bidding to meet growing demand from these asset managers Down Under. The largest funds collectively manage more than $650 billion in assets outside Australia.

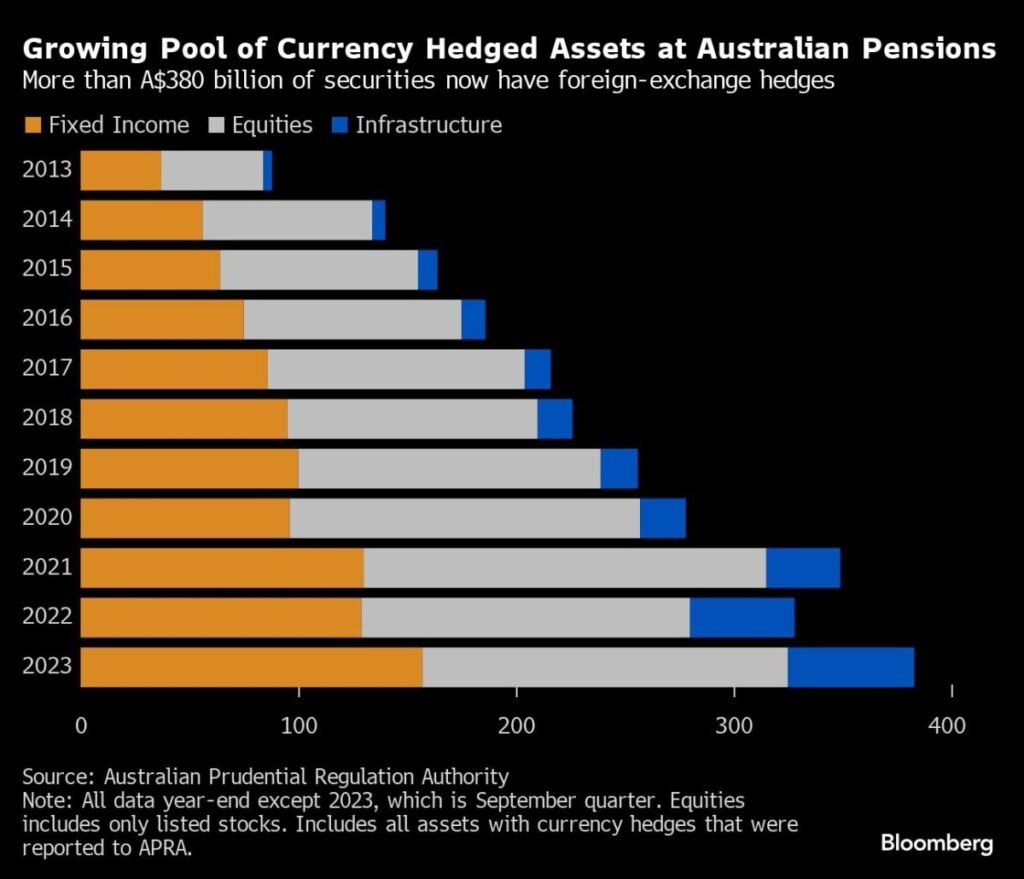

Due to the relatively small size of Australia’s private and public markets, pension funds have increased their overseas investments in recent years, accounting for almost 50% of their holdings. This is a boon for banks that can handle the swaps and other derivatives needs of managing capital on behalf of funds in Europe, the United States and parts of Asia.

“Australia’s size is finite,” said Nick Sims, co-head of Australia and New Zealand investment banking at Goldman Sachs in Melbourne. “As these funds increase international exposure in their portfolios, they will need to do so in response to inflows and will necessarily need to consider currency exposure.”

Take AustralianSuper and Australian Retirement Trust, the two biggest pension players, which together oversee around $390 billion. Last financial year, AustralianSuper increased the notional value of swaps (preferred hedging instruments) across its portfolio by 53% to A$55 billion ($36 billion), according to fund data. Meanwhile, ART announced that the notional principal exposure of derivatives used for currency hedging has doubled over the past five years to A$70 billion.

Aaron Ng, Citigroup’s head of short-term rates trading for Asia North and Australia, South Asia and Japan, said pension benefits in Australia were “very competitive”. He said super funds were a key target for the bank given expected asset growth. “This is definitely important and definitely attracts the attention of our global business.”

The two giants of Australia’s A$3.6 trillion pensions industry (the world’s fourth largest) represent the country’s rapid expansion, far outpacing its peer markets. The country’s pension assets are expected to more than triple to A$13.6 trillion by 2048, according to a Mercer report last month.

The increased use of derivatives is also part of the bank’s strategy to grow revenue from its global trading operations, while building closer links with Australian funds that have greater influence in global finance.

Mark Elworthy, Sydney-based head of fixed income, currencies and commodities trading at Bank of America in Australia, said: “Bank of America is increasingly focused on serving its superannuation customers. ” “We’re making a huge investment in this,” he said, adding: “We want to do everything we can to fully accommodate all of their needs.”

Options markets have shown that hedging costs have fallen in recent months. Still, uncertainty remains over the timing of the central bank’s policy adjustments this year, in part because the Australian dollar has weakened against the US dollar during the Federal Reserve’s interest rate hike cycle. Carol Kong, an economist and currency strategist at the Commonwealth Bank of Australia in Sydney, said the Australian dollar could rise to US$77 by the end of 2025 from its current level of around US$66.

“A rate cut could further brighten the outlook for the global economy, which would be positive for commodity prices,” he said.

In addition to hedging currency risk, pensions also use derivatives to manage liquidity and tilt portfolios to reflect expected short-term market movements. It can also be used to control for idiosyncratic factors, such as increased portfolio concentration in large-cap U.S. technology stocks.

These funds make offshore investments in public and private markets, from stocks and bonds to direct loans, private equity, infrastructure and even more esoteric holdings such as agricultural land that needs to be hedged against Australian dollar debt. is building.

Aware Super, another of the country’s five largest funds, has a roster of 11 banks that meet its derivatives requirements, said Michael Clavin, the firm’s head of income and markets. The company says it regularly evaluates lenders by adding or removing them. He declined to name the lender.

Andrew Fisher, head of investment strategy at ART, said: “The increased focus on offshore investing has led to an increasing proportion of funds being hedged. This shift is happening across the industry and is even more widespread among the largest pensions, he said.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP