The all-share index in Kenya’s capital Nairobi rose 49% in 2024, compared with a 43% decline the previous year.

Emily Fletcher, co-manager of the BlackRock Frontiers Investment Trust, said the turnaround in stock prices was a result of the country’s economic policies initiated under the Ruto government.

“This volatility created an opportunity.” she said in an email response. “Over the past two years, Kenya has seen significant changes in both fiscal and monetary policy.”

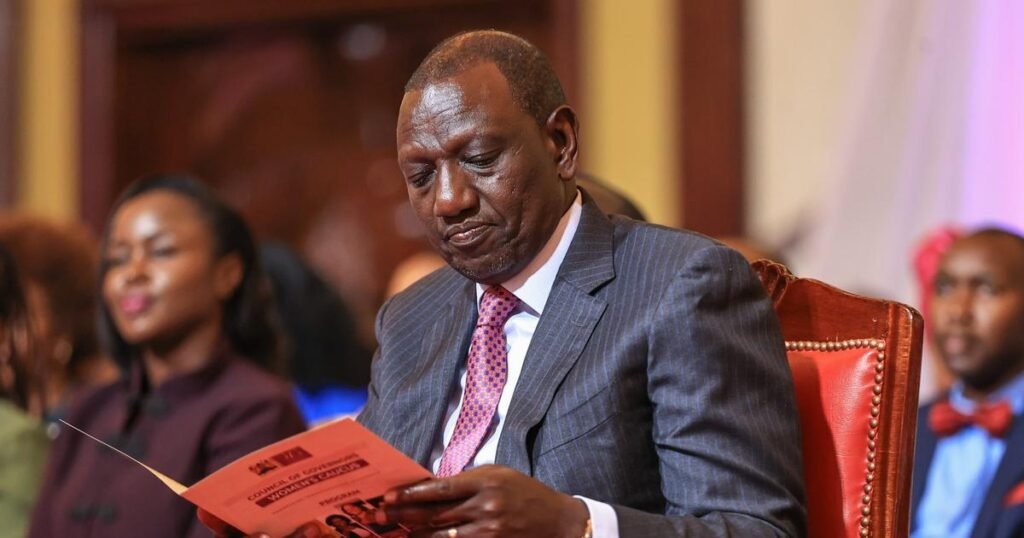

President William Ruto’s economic policies initially made him unpopular, but since the beginning of the year, the country’s currency has gone from being Africa’s worst-performing currency to being its best-performing currency. These policies began to bear fruit.

Fletcher said Kenya’s national debt also declined after the Ruto government raised the country’s benchmark interest rate to 13% and cut the budget deficit to about 4% of GDP in the previous two years, as seen in a Bloomberg report. It is said that it has become more attractive.

As one of Africa’s largest economies, Kenya is home to some of the continent’s major companies, including East Africa’s largest beer company, mobile phone service providers, and stock exchange-listed banks, and is a pillar of innovation. continues to play its role.

“The gains were led by financial companies. Equity Group Holdings, the country’s biggest lender by market capitalization, soared 73% in dollar terms, while rival KCB Group soared 66%.Kenya’s biggest mobile phone The company Safaricom rose 54%. Only one stock in the 63-member index has fallen this year.” The Bloomberg report says:

“The index has a price-to-earnings ratio of approximately 5.6 times, compared to 12 times for South African stocks and 15.9 times for Nigerian stocks. South Africa’s benchmark index fell 4.2% in dollar terms, compared to 12 times for South African stocks and 15.9 times for Nigerian stocks. The stock index fell 4.1%.” he adds.