Did you know that there are several financial indicators that can provide clues to a potential multibagger? First, let’s take a look at the proven results. return One is growing capital employed (ROCE) and second is growing capital employed (ROCE). base of capital employed. This basically means that the company has a profitable endeavor that can be continuously reinvested, which is the nature of compound interest. Having said that, at first glance, Investment in West Shore Terminal (TSE:WTE) I’m not going to jump out of my chair on the return trend any time soon, but let’s take a deeper look.

About Return on Capital Employed (ROCE)

For those who don’t know, ROCE is a measure of a company’s annual pre-tax profit (return) on the capital employed in the business. Analysts use the following formula to calculate investment in Westshore Terminal.

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.13 = CAD 160 million ÷ (CAD 1.4 billion – CAD 146 million) (Based on the previous 12 months to December 2023).

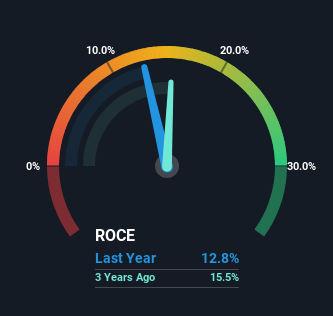

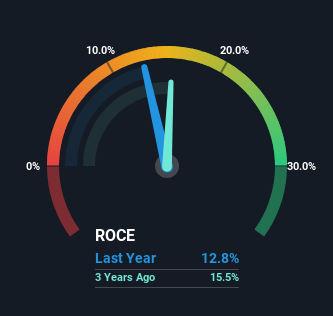

So, Westshore Terminals Investment’s ROCE is 13%. While this is a standard return in itself, it is much better than the 6.8% produced by the Infrastructure industry.

See our latest analysis for investing in Westshore Terminal.

In the chart above, we measured Westshore Terminals Investment’s previous ROCE against its previous performance, but the future is probably more important. To find out what analysts are predicting for the future, check out the free analyst report for Westshore Terminals Investment.

What does the ROCE trend show for Westshore Terminal Investment?

When it comes to Westshore Terminals Investment’s historical ROCE movement, it’s not great. Over the past five years, return on equity has fallen to 13% from 17% five years ago. However, given that both capital employed and revenue are increasing, it appears that the business is currently pursuing growth for short-term returns. If these investments are successful, they can bode very well for long-term stock performance.

conclusion

Westshore Terminals Investment’s earnings have fallen recently, but it’s encouraging to see that its sales are increasing and it’s reinvesting in the business. Additionally, the stock price is up 61% over the past five years, suggesting investors are optimistic about the future. So while investors seem to be recognizing these encouraging trends, we would like to research this stock further to see if its other metrics justify a positive view.

I realized that there are some risks with Westshore Terminals investment. two warning signs (and #1 is a little off-putting) but I think you should know.

Westshore Terminals Investment may not have the highest profit margin right now, but we’ve compiled a list of companies that are currently generating a return on equity of 25% or higher.check this out free I’ll list them here.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.