key insights

-

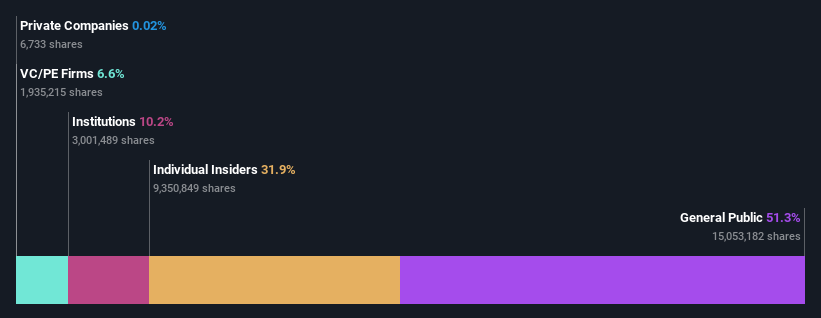

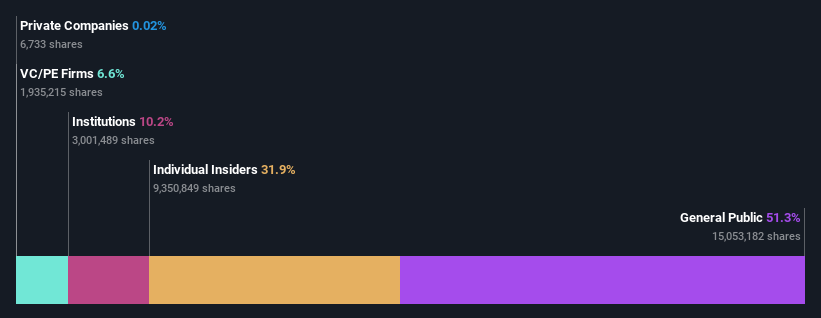

The significant ownership in Candel Therapeutics by retail investors indicates that they collectively have a greater say in its management and business strategy

-

A total of 25 investors hold a majority stake in the company, with an ownership of 48%.

-

Insider ownership in Candel Therapeutics is 32%.

To find out who really controls Candel Therapeutics, Inc. (NASDAQ:CADL), it’s important to understand the business’ ownership structure. We can see that retail investors own the largest stake in the company, accounting for his 51% ownership. In other words, the group will receive the maximum benefit (or maximum loss) from its investment in the company.

Retail investors were the biggest beneficiaries of last week’s 320% share price increase, but insiders also took a 32% cut.

The chart below zooms in on the different ownership groups for Candel Therapeutics.

Check out our latest analysis for Candel Therapeutics.

What does facility ownership tell us about Candel Therapeutics?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they usually consider buying larger companies that are included in the relevant benchmark index.

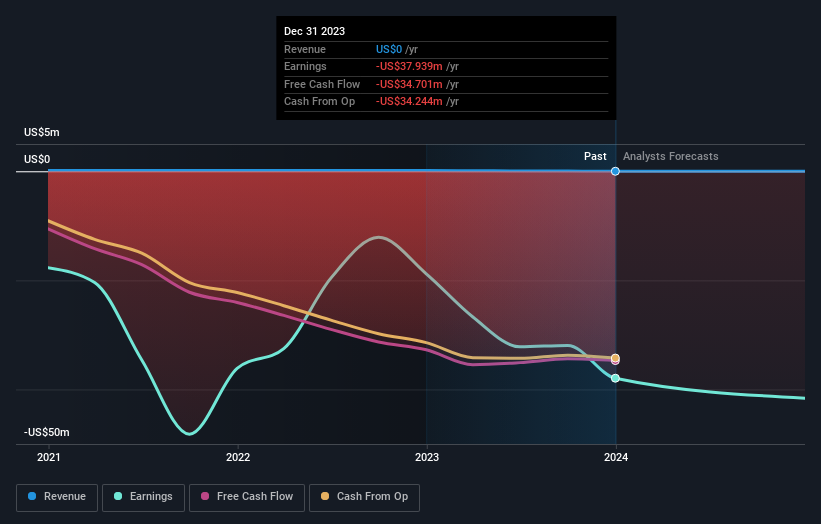

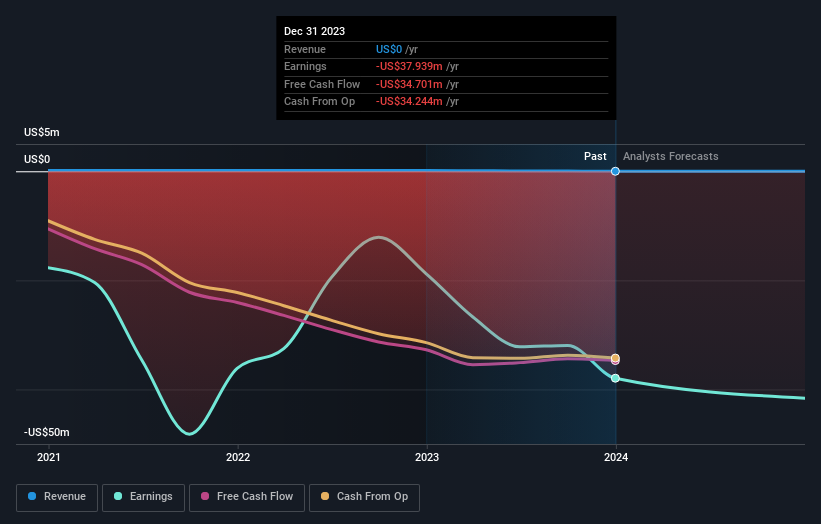

We can see that Candel Therapeutics has institutional investors. And they own a significant portion of the company’s stock. This suggests some credibility among professional investors. But we can’t rely on that fact alone because institutions make bad investments sometimes, just like everyone does. If multiple financial institutions change their view on a stock at the same time, you could see the stock price drop fast. It is therefore worth checking Candel Therapeutics’s earnings history, below. Of course, what really matters is the future.

Candel Therapeutics is not owned by hedge funds. From our data, we estimate that the largest shareholder is Estualdo Aguilar Cordova (also holds the title Top Key Executive), with 11% of shares outstanding. It is usually considered a good sign when insiders own a significant number of shares in a company, but in this case we see company insiders playing the role of key stakeholders. I’m glad. Laura Aguilar and Paul Manning are the second and third largest shareholders with 10% and 7.9% of the shares outstanding, respectively. Interestingly, the third largest shareholder, Paul Manning, also serves as Chairman of the Board, indicating strong insider ownership among the company’s top shareholders.

Our research shows that the top 25 shareholders collectively control less than half of the company’s shares. This means that the company’s shares are widely distributed and there is no dominant shareholder.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely reported. Therefore, it may receive more attention in the future.

Insider ownership in Candel Therapeutics

The definition of an insider may vary slightly from country to country, but members of the board of directors are always considered. A company’s management runs the business, but the CEO answers to the board, even if he or she is a member of the board.

Insider ownership is positive when it signals leaders are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative depending on the situation.

Our information suggests that insiders maintain a significant stake in Candel Therapeutics, Inc. Insiders own US$60m worth of shares in the US$188m company. It’s great to see insiders are so invested in this business. It might be worth checking if those insiders have been buying recently.

Open to the public

The general public, including retail investors, owns 51% of Candel Therapeutics. This level of ownership gives retail investors a degree of power to influence important policy decisions such as board composition, executive compensation, and dividend payout ratios.

private equity ownership

Private equity firms hold a 6.6% stake and are positioned to play a role in shaping corporate strategy, with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally private equity has short investment horizons and, as the name suggests, doesn’t invest much in public companies. After a while, they may consider selling their capital and redeploying it elsewhere.

Next steps:

It’s always worth thinking about the different groups who own shares in a company. However, to understand Candel Therapeutics better, you need to consider many other factors. For example, risk.Every company has them and we discovered that 5 warning signs for Candel Therapeutics (4 of which you shouldn’t ignore!) you need to know about.

If you’re like me, you might want to consider whether this company will grow or shrink. Luckily you can check this free report showing analyst forecasts for its future.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.