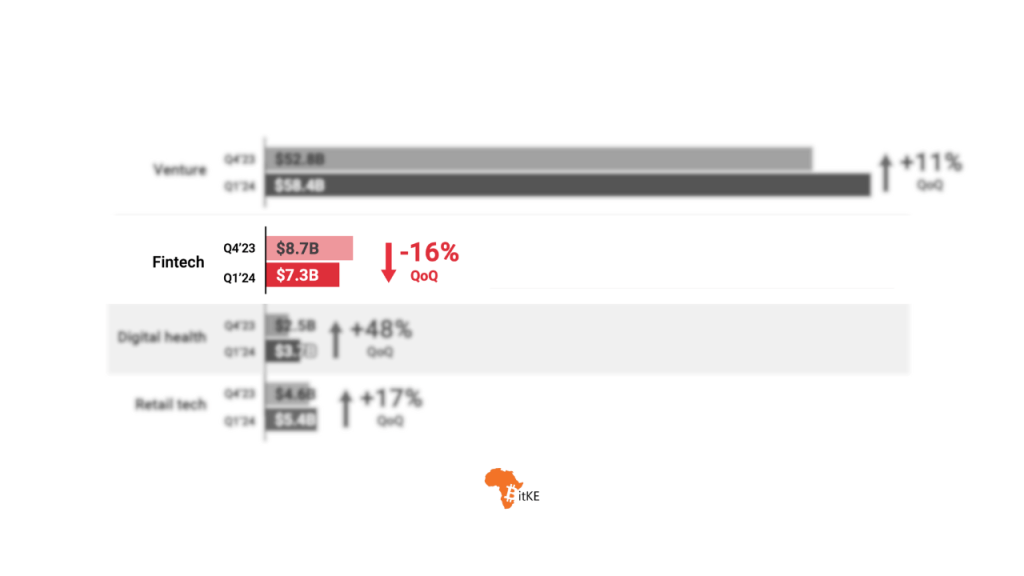

Funding for fintech startups fell 16% compared to the previous quarter, even though overall venture funding to startups increased 11% quarter-over-quarter to $58.4 billion, according to a new report.

According to CB Insights’ Q1 2024 State of Ventures report, startups in the sector raised just $7.3 billion in funding over the three-month period, the lowest level since early 2017.

Still, stock trading activity increased by 15%, indicating continued investor interest in fintech solutions, particularly in payments technology. Nevertheless, average deal size decreased in Q1 2024 due to larger investments towards companies focusing on broader AI solutions.

In three months, fintech startups received a total of 904 investments. His Monzo in the UK raised his $430 million funding round, which stood out as the quarter’s largest raise. Meanwhile, in Bilt Rewards Series C he secured his third place with $200 million.

Among the recipients, US-based companies raised the most money, raising $3.3 billion across 393 deals. Meanwhile, Europe followed suit, with European startups raising $2.2 billion in 203 deals during the same period.Fewer deals in Europe suggests that funding rounds are larger on average in the region compared to the US

In contrast, $16 billion was invested in 1,271 fintech startups in the first quarter of 2023. This year’s total funding represents a significant decrease of 54.3% compared to the same period last year. [2023].

In the first quarter of 2022, $32.9 billion was poured into 2,026 fintech startups. Both total funding and number of deals were down compared to Q4 2023, when 786 fintech startups raised $8.7 billion.

According to another report, African startups secured $466 million in funding in the first quarter of 2024, a 47% decrease compared to the same period in 2023.

While African fintech is typically the most vibrant technology sector on the continent and is predicted to drive global growth in the coming years, the transport and logistics sector will account for the largest share of total funding in Q1 2024. It took the top spot with a share of 32%. twenty three%.

[TECH] Report | Payments are predicted to continue to dominate the fintech market until 2030: Africa’s fintech market is predicted to grow significantly, with total revenue .. https://t.co/L79fpq8VWU @Bitcoin KE

— Top Kenyan Blogs (@Blogs_Kenya) February 8, 2024

At the same time, in March 2024 alone, startups in the Middle East and North Africa (MENA) region secured $254 million across 54 deals, a significant 186% month-on-month increase from $88.7 million in February. This is a significant increase.

🇪🇬🇩🇿🇹🇳🇲🇦🇱🇾🇲🇷🇸🇩🇪🇭🇩🇯🇪🇷🇹🇩🇸🇴North Africa | In March 2024, Egypt became one of MENA’s leading investment destinations

In March 2024, startups in the Middle East and North Africa (MENA) region secured $254 million across 54 deals, marking a significant 186% month-on-month increase. pic.twitter.com/TWgZ9BTHQc

— BitKE (@BitcoinKE) April 3, 2024

See also

MENA fintech startups raised a total of $39.9 million during the month.

_______________________________________________

related