After days of losses, markets opened in the green after Fed Chairman Jerome Powell reiterated that the Fed is at the “peak” of its tightening cycle.

“If the economy broadly develops as we expect, most FOMC members believe it is likely appropriate to begin lowering policy rates at some point this year,” Powell said Wednesday. “There is,” he said. Bond yields fell early Thursday after Powell’s comments, raising concerns that a rate cut wouldn’t happen soon.

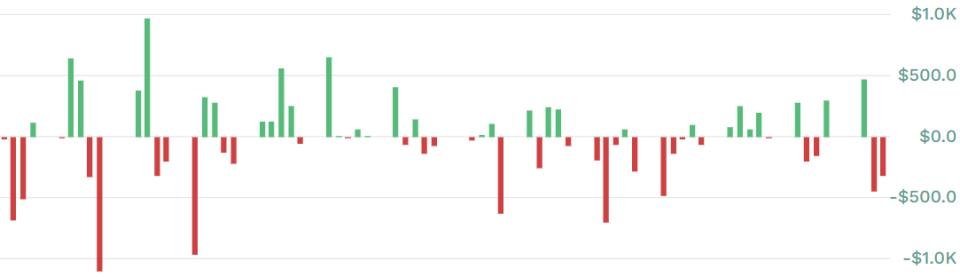

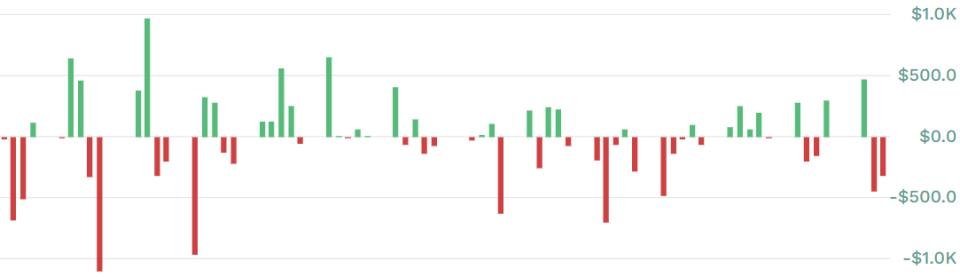

TLT, iShares 20+ Years Government Bond ETF Despite a sharp rise on Thursday, the stock still trades near this year’s lows at $92.50. Data available on etf.com shows that flows into TLT have been on a roller coaster since the beginning of the year as investors question the Fed’s future path to rate cuts.

TLT flow YTD:

Source: etf.com

Bond ETFs are known to be sensitive to movements in interest rates, and a “prolonged period of high” interest rates presents investors with a buying opportunity. Bond prices are inversely related to yields, so as interest rates rise, yields rise and prices stay low.

Investors will have to wait several more months to find out when the Fed will start cutting rates. According to the CME Fed Watch Tool, the probability of a June rate cut jumped to 61% after Powell’s remarks.

Elsewhere in the market, the Labor Department reported today that weekly unemployment claims (or people filing for unemployment for the first time) rose to 221,000 in the last week of March. This is higher than economists had originally expected. The numbers will be the last jobs data investors will receive before the Bureau of Labor Statistics releases nonfarm payrolls on Friday.

Investors are keeping an eye on the employment situation because the job market serves as a proxy for the Fed’s economic strength. Rising unemployment and a weakening labor market could create expectations that the Fed will cut interest rates sooner rather than later to stimulate the economy.

And the aftermath of the Taiwan earthquake continues to hit SOXS. Direxion Daily Semiconductor Bears Stocks Triple. Taiwan remains the world’s semiconductor manufacturing center, accounting for 60% of all chip production. According to data from etf.com, SOXS is currently the most active ETF of all time, with trading volume exceeding his 32 million.

The fund, which bets on declines in semiconductor industry stocks, is down more than 2.6% so far on the trading day.

Permalink | © Copyright 2024 etf.com.All rights reserved