Here are the most important news items investors need to start their trading day:

1. Sour Start

The market started off rough in the second quarter. Markets are falling as bond yields rise and traders lower expectations that the U.S. Federal Reserve will cut interest rates in June. The 30-stock Dow Jones Industrial Average fell nearly 400 points on Tuesday, marking its second straight decline. The S&P 500 fell 0.7% and the Nasdaq Composite Index fell nearly 1%. Investors are keeping an eye on the ADP private jobs report on Wednesday ahead of Friday’s March jobs report. Follow live market updates.

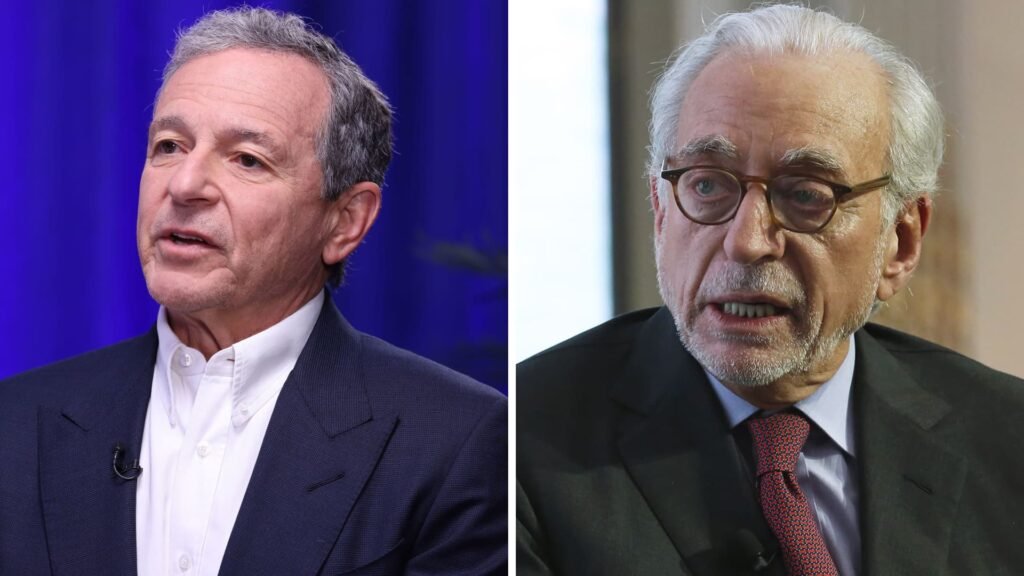

2. Today is Disney Day

Bob Iger and Nelson Peltz.

CNBC

The big battle with activist investor Nelson Peltz disney The issue will come up as shareholders vote on the company’s board of directors on Wednesday. Voters are deciding whether the board deserves to remain in place for another year or whether certain directors should be replaced by candidates nominated by activist investors, including Mr. Peltz of Trian Partners. Among other issues, Tryon said Disney has failed to generate significant profits and that Disney’s board and CEO Bob Iger are struggling with succession planning. . Disney is reportedly leading in the polls, but both sides have received support from major shareholders ahead of Wednesday’s general meeting, which is scheduled to begin at 1 p.m. ET, Reuters and Bloomberg report. It is being

3. Tesla falls

A Tesla car sits on the floor of a showroom in Miami, Florida, on April 2, 2024.

Joe Radle | Getty Images

tesla Deliveries decreased year-on-year for the first time since 2020, when operations were suspended due to the pandemic. The electric vehicle company on Tuesday reported first-quarter deliveries of 386,810 vehicles, down 8.5% from a year earlier. Analysts had expected deliveries to be about 457,000 vehicles in the same period, according to an average of 11 estimates compiled by FactSet. The company faced a number of challenges in the first quarter, including disruptions at its German factory outside Berlin. Tesla stock fell nearly 5% in Tuesday trading.

4. Feel the pinch

The Humana office building in Louisville, Kentucky, February 3, 2019.

Bloomberg | Bloomberg | Getty Images

Shares of major U.S. health insurance companies fell sharply on Tuesday after the Biden administration announced payments to private Medicare plans that disappointed the insurance industry and investors. The company had been hoping for a significant increase in these payments, but the decision puts additional pressure on companies grappling with high medical costs. humanais more reliant on its Medicare Advantage plans than its competitors, and its stock fell 13% on Tuesday. CVS Health stock fell more than 7% on Tuesday, and UnitedHealth Group stock fell nearly 7%.

5. Crude oil

On March 5, 2019, a flare stack bursts into flames behind an oil storage tank at the Taneko oil refining and petrochemical complex operated by Tatneft PJSC in Nizhnekamsk, Republic of Tatarstan, Russia.

Bloomberg | Bloomberg | Getty Images

Oil prices hit their highest since October on Tuesday, on the back of heightened geopolitical risks and solid economic data. US crude oil, West Texas Intermediate (delivered in May) rose $1.44 (1.72%) to settle at $85.15 per barrel. The global benchmark Brent contract for June delivery rose $1.53, or 1.75%, to $88.94 a barrel. Investors are eyeing escalating conflict in the Middle East and Ukrainian drone attacks on major Russian refineries that could threaten supplies.

— CNBC’s Sarah Min, Alex Sherman, Rohan Goswami, Laura Kolodny, Annika Kim Constantino and Sam Meredith contributed to this report.

— Follow broader market movements like a pro CNBC Pro.