Consumer Price Index data this week offered encouraging signs that U.S. inflation is moving ever closer to the Federal Reserve’s oft-debated 2% target.

This has increased speculation about a rate cut.

Annual inflation in June 2024 fell more than expected, to its lowest level since March 2021. Notably, monthly inflation recorded its first contraction since May 2020, at 0.1%.

Investors and economists have become increasingly confident that the Fed is ready to cut interest rates in September, with the market suggesting the probability of a cut surpassing 90%.

A producer inflation data report released on Friday came in better than expected but did little to significantly change those expectations as the University of Michigan’s latest consumer confidence report confirmed declining morale and lower inflation expectations.

Sectors that have been hit by high interest rates and have not yet priced in a potential reduction in borrowing costs outperformed the technology sector, which has already largely anticipated such a cut.

The S&P 500 index is Invesco S&P 500 Equal Weight ETF (NYSE:RSP) outperformed the market-cap-weighted S&P 500. SPDR S&P 500 ETF Trust (NYSE:SPY), value stocks outperformed growth stocks.

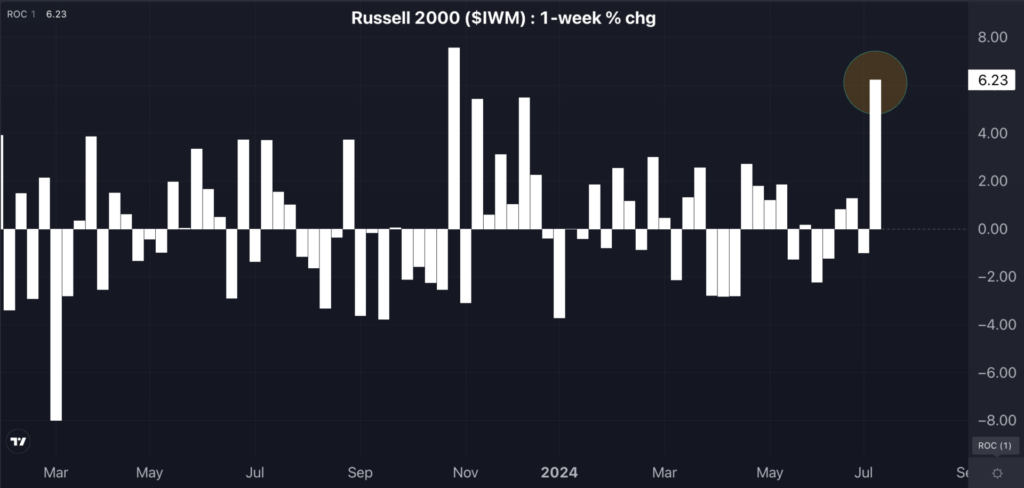

The real estate sector is real estate Select Sector SPDR Fund (NYSE:XLRE) and the Russell 2000 Small Cap Index. iShares Russell 2000 ETF (NYSE:IWM) – Just had its strongest week of the year.

Charts of the week: Russell 2000 posts strongest week since October 2023

You may have missed it…

Unusual market trendsOn Thursday, the Russell 2000 rose 3.63%, while the large-cap Russell 1000 fell 0.66%. This is the fifth time in history that the difference in performance between the two indexes has exceeded 4%, something that has happened before during major market downturns, this time nearing the S&P 500’s all-time high.

Weight loss drugs: Pfizer Japan Inc (NYSE:PFE) announced that its once-daily weight-loss drug danugliplon has demonstrated a favorable pharmacokinetic and safety profile, and the pharmaceutical giant plans to conduct a dose optimization study in the second half of 2024.

High-tech stock research: apple Co., Ltd. (NASDAQ:AAPL), Microsoft Co., Ltd. (NYSE:MSFT), Meta Platforms, Inc. (NASDAQ:META) and alphabet(NASDAQ:GOOGL) all hit new 52-week highs, as a Benzinga poll revealed investor preferences.

- Microsoft tops the list with 32%

- Apple 29%

- Google: 23%

- Meta is 16%.

Investors cited artificial intelligence’s growth potential and valuation as the main factors influencing their choices.

Read now:

- IPO-ready Shein enjoys more traffic than fast-fashion rivals, data shows: Are Temu and Poshmark outdated?

Image: Shutterstock