Qingdao High-Tech Mold Plastic Technology Co., Ltd. (SZSE:301022) The stock had a very successful month, rising 58% after a volatile period earlier. Looking back a little further, it’s encouraging to see that the share price is up 47% in the last year.

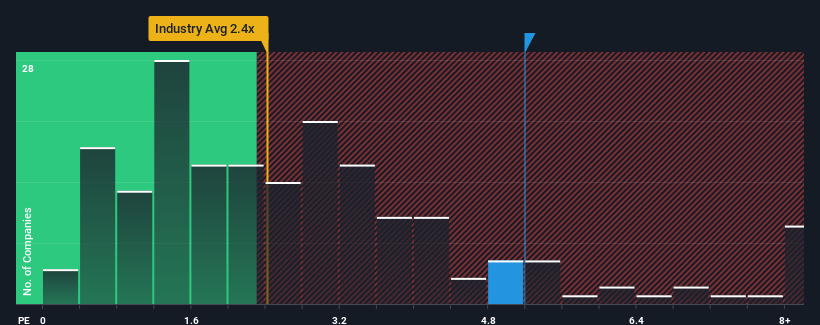

With a solid price rebound, it might be reasonable to think that Qingdao High Technology Mold Plastic Technology is a stock to mostly avoid, with a price-to-sales (P/S) ratio of 5.2x. Half of the companies in China’s auto parts industry have a P/S multiple of less than 2.4x. However, there may be a reason why the P/S is so high, and further research is needed to determine if it’s justified.

Check out the latest analysis on Qingdao High-Tech Mold and Plastic Technology.

How is Qingdao High-Tech Mold and Plastic Technology’s recent performance?

Qingdao High Technology Mold Plastic Technology has been doing well recently, with revenue increasing at a steady pace. Perhaps the market expects this decent earnings performance to outperform the industry in the short term, supporting earnings. However, if this is not the case, investors may find out that they are paying too much for the stock.

Want a complete picture of a company’s earnings, revenue and cash flow? Then check out our free The report on Qingdao High-Tech Mold and Plastic Technology helps shed light on its historical performance.

What do earnings growth metrics indicate about high P/S?

Qingdao Hi-Tech Molds & Plastics Technology’s profit margins are typical of a company that is expected to experience very strong growth and, importantly, outperform its industry.

First, looking back at the past, we can see that the company grew its revenue by a strong 7.8% in the last year. Its strong recent performance means it has been able to grow its revenue by a total of 21% over the past three years. So you can start by checking that the company has actually done a good job of growing its earnings over that period.

Comparing the recent medium-term earnings trend to the industry’s one-year growth forecast of 22%, we find it to be significantly less attractive.

This information raises concerns that Qingdao High-Tech Mold Plastic Technology is trading at a higher rate of return than the industry. Apparently, many of the company’s investors are much more bullish than recent expectations and are unwilling to exit the stock at any price. If the P/S declines to a level commensurate with recent growth, there’s a good chance existing shareholders are setting themselves up for future disappointment.

Conclusion on profit and loss of Qingdao High School Mold Plastic Technology

Qingdao High-Tech Mold Plastic Technology’s stock price has increased significantly recently, which has greatly contributed to boosting the company’s profit margin. Price-to-sales ratios shouldn’t be a deciding factor in whether or not to buy a stock, but it is a very useful barometer of earnings expectations.

A review of Qingdao High-Tech Mold and Plastic Technology reveals that the company’s poor three-year earnings trend will not hurt its bottom line as much as expected, given the outlook is worse than current industry expectations. Became. If we observe slower earnings growth and a higher P/S ratio than the industry, we believe there is a significant risk of share price decline, resulting in a lower P/S ratio. If recent medium-term earnings trends continue, shareholders’ investments will be at significant risk and potential investors will be at risk of paying an excessive premium.

That being said, please be careful Qingdao high-tech mold plastic technology shows 4 warning signs Two of them are a bit concerning in our investment analysis.

If you’re interested in strong companies that are profitable, then you might want to check this out. free A list of interesting companies that trade at low P/E ratios (but have proven they can grow earnings).

Valuation is complex, but we help make it simple.

Please check it out Qingdao High-Tech Mold and Plastic Technology Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.