First Copper Technology Co., Ltd. (TWSE:2009) shareholders’ patience has paid off, with the share price up 28% in the last month. Looking back even further, his 18% rise over the past 12 months isn’t that bad despite the strong past 30 days.

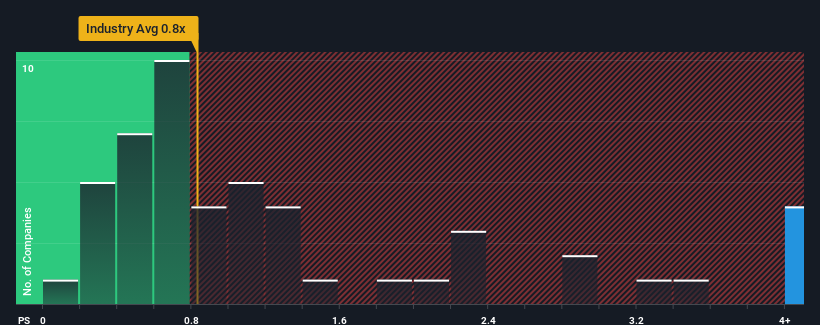

After such a large price increase, First Copper Technology has a price-to-sales (P/S) ratio of 5.4x, and considering that it’s almost half of the companies listed, it’s hard to believe it’s a stock to avoid. There isn’t. Taiwan’s metals and mining P/S multiple is less than 0.8x. However, there may be a reason why the P/S is so high, and further research is needed to determine if it’s justified.

Check out our latest analysis for First Copper Technology.

What does First Copper Technology’s P/S mean for shareholders?

For example, consider that First Copper Technology’s recent financial results have been poor because its revenue has been declining. One possibility is that the P/S is high because investors believe the company is good enough to outperform the industry in the near future. If not, existing shareholders could become very nervous about the viability of the stock price.

There are no analyst forecasts available for First Copper Technology, but take a look at this. free Data-rich visualizations show how a company’s revenue, revenue, and cash flow stack up.

Are revenue projections consistent with high returns?

To justify its P/S ratio, First Copper Technology would need to achieve outstanding growth that far outpaces the industry.

When we reviewed last year’s financials, we were disappointed to see that our revenue declined by 8.6%. The company’s three-year sales growth rate remains impressive at a combined 17%, putting a damper on what had been a strong long-term performance. So we can start by confirming that the company has generally done a good job of growing its earnings over that period, despite some hiccups along the way.

Interestingly, the rest of the industry is similarly expected to grow at 5.4% next year, which is roughly on par with the company’s recent medium-term annual growth rate.

With this in mind, it’s interesting to see that First Copper Technology’s P&L is outperforming most other companies. Most investors seem to be ignoring recent fairly average growth rates and are willing to pay for exposure to the stock. However, further gains will be difficult to achieve, as a continuation of recent earnings trends will ultimately put pressure on the stock price.

The last word

First Copper Technology’s earnings grew steadily last month thanks to a strong share price increase. Price-to-sales ratios shouldn’t be a deciding factor in whether or not to buy a stock, but it is a very useful barometer of earnings expectations.

Our research on First Copper Technology reveals that the company’s three-year earnings trend hasn’t driven its high P/S as much as we expected, given similar current industry expectations . At this point, we’re uncomfortable with the high P/S as this earnings performance is unlikely to support such positive sentiment long-term. Unless recent medium-term conditions improve, it is difficult to accept these prices as reasonable.

There can be many potential risks within a company’s balance sheet.take a look at ours free A balance sheet analysis of First Copper Technology, including 6 quick checks on some of these important factors.

If you’re interested in strong companies that are profitable, then you might want to check this out. free A list of interesting companies that trade at low P/E ratios (but have proven they can grow earnings).

Valuation is complex, but we help make it simple.

Please check it out First copper technology Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.