Designer 491

introduction

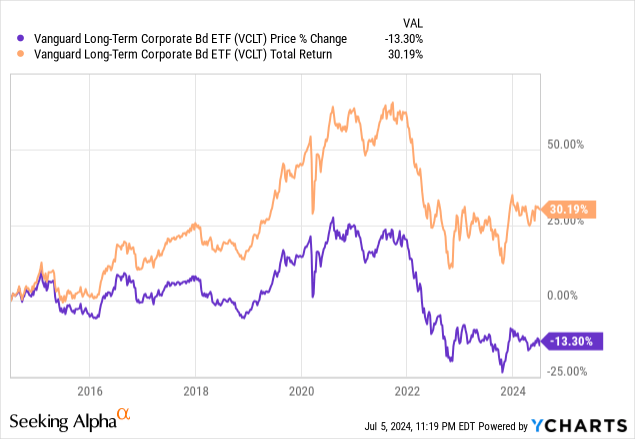

I am using the Vanguard Long Term Corporate Bond ETF (Nasdaq:VCLT) was announced in October 2023. At the time, I highlighted VCLT’s attractive yield and that inflation would moderate over time, albeit slowly. The current macroeconomic environment is very It’s not the same as last year, and it’s time for another update.

ETF Overview

VCLT holds a portfolio of long-term investment-grade U.S. corporate bonds. Inflation has improved dramatically from its mid-2022 peak but is still far from the Federal Reserve’s long-term target. This requires the Fed to keep interest rates high for a long period of time, increasing the risk of a recession. Meanwhile, credit spreads between corporate bonds and U.S. Treasuries have shrunk to just 1%, making corporate bonds less attractive. This suggests that it may not be the best time to invest in a corporate bond fund. As VCLT. This is certainly true for short-term income investors. But long-term income investors should definitely hold onto this fund as it is likely to continue to outperform Treasuries over the long term.

Y Chart

Fund Analysis

VCLT has seen robust earnings growth since October 2023

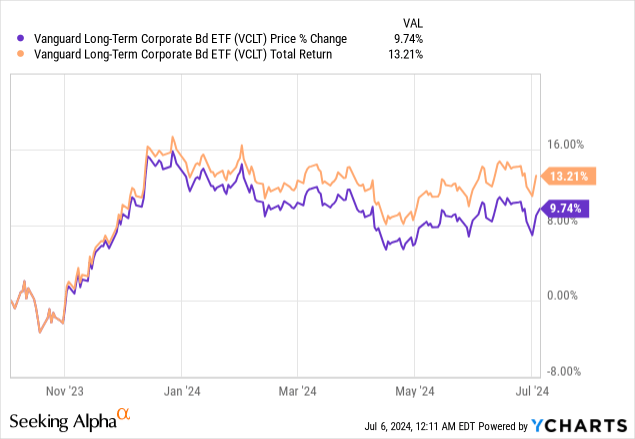

VCLT has performed well since October 2023. This is mainly due to the fund price surging towards the end of 2023. As you can see from the chart below, the fund surged by 16% in the last two months of 2023. Meanwhile, the fund’s attractive 30-day SEC yield of 5.8% helped it maintain this robust return in the first half of 2024. Combined, VCLT’s total return has been around 13.2% since October of last year.

Y Chart

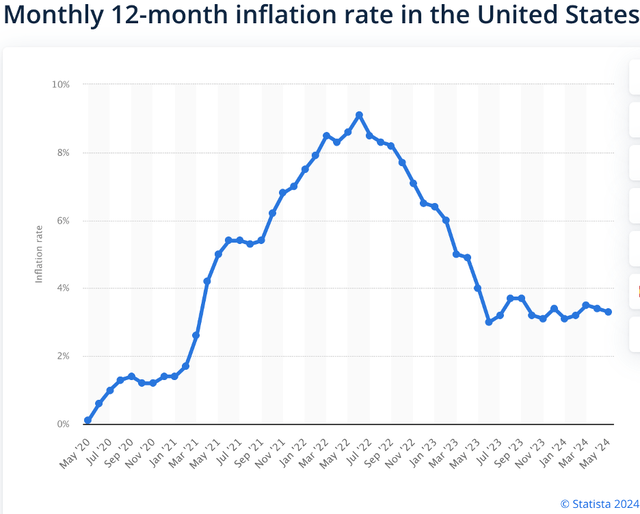

Inflation is falling, but not enough

Looking at the macroeconomic environment, inflation is clearly above the peak it reached in mid-2022. However, inflation has remained in the 3-3.5% range for over a year. It is still far from the Federal Reserve’s long-term target of 2%, which is why the Federal Reserve has chosen to keep interest rates high over the past year.

Statista

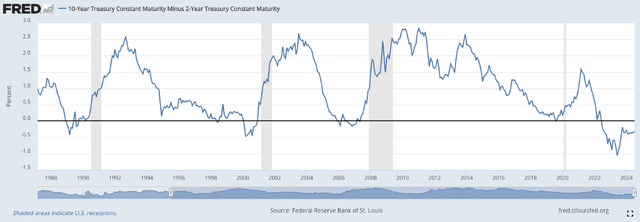

A soft landing may not happen

The problem with this scenario is that the longer the Fed keeps interest rates high, the greater the risk that the economy will slip into a recession. We are currently in an environment where the yield curve is inverted. In other words, long-term Treasury rates are lower than short-term Treasury rates. In fact, the 10-year Treasury rate minus the 2-year Treasury rate is currently -0.32%. As you can see in the chart below, this yield curve inversion usually precedes a recession (shaded area). This trend has been confirmed in the last four recessions: the 1991, 2001, 2008/2009, and 2020 recessions. Therefore, it appears that the yield curve inversion is a very accurate future economic indicator. If this future indicator is accurate, a recession may not be far away from now.

Federal Reserve Bank of St. Louis

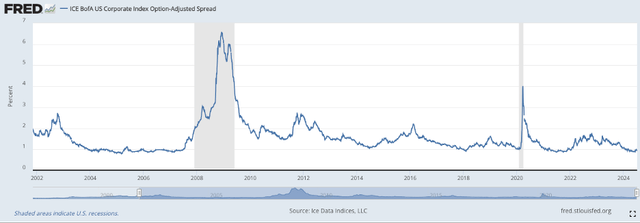

Credit spreads are at rock bottom and could soon reverse

Another trend we have observed is that credit spreads between corporate bonds and Treasury bonds have now narrowed to 1 percentage point. As you can see from the chart below, when credit spreads narrow below 1%, a recession typically occurs. Therefore, we may be at a point where a recession could soon occur.

Federal Reserve Bank of St. Louis

In this environment, would it be better to buy a Treasury fund rather than a corporate bond fund?

In this situation, is it better to buy a corporate bond fund such as VCLT or is it better to hold a US Treasury fund? First, let’s compare the yields of VCLT and Vanguard Long-Term Treasury Bond ETF (VGLT). As mentioned earlier, VCLT has a 30-day SEC yield of about 5.8%. In contrast, VGLT has a 30-day SEC yield of 4.7%. Thus, there is a difference of 1.1% between the two. Investing in VCLT will definitely give you a higher yield than VGLT. However, we also know that VGLT has no credit risk because US Treasuries are considered risk-free assets in the market. In contrast, VCLT has a high credit risk even though it only contains investment-grade corporate bonds. About 44.5% of the portfolio belongs to BBB bonds, which are the lowest rated investment-grade bonds. If the entire economy is in turmoil, some of these BBB bonds may be downgraded. Therefore, credit risk certainly exists.

Vanguard

However, if your goal is to hold the fund for the long term, VCLT may be the better option.

Given the narrow credit spread between corporate bonds and Treasury bonds, some may think that choosing a corporate bond fund such as VCLT at this time is a waste. This is certainly true if you are just parking your money for the short term. It may be wise to wait until a recession before choosing VCLT. A better choice for short-term investors would be to choose a Treasury fund instead.

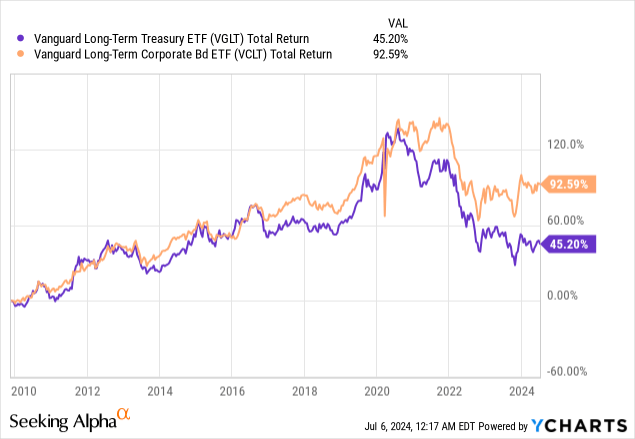

However, if your goal is to hold the fund for the long term and earn interest on the bonds, that’s a different story. As you can see from the chart below, VCLT has delivered a total return of 92.6% since the beginning of 2010. In contrast, VGLT’s total return over the same period was just 45.2%, less than half of VCLT’s total return.

Y Chart

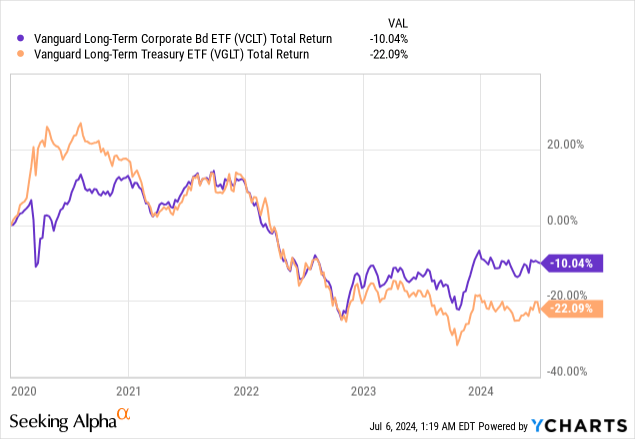

Even if you purchased the fund when credit spreads were only around 1%, such as at the start of 2020, VCLT’s total returns will be much better than VGLT’s, as shown in the chart below.

Y Chart

Investor View

For income investors looking to simply park their money for the short term, VCLT may not be the best option given the macroeconomic uncertainties. However, as we have suggested in this article, over the long term, VCLT will likely be a better option than Treasuries. Therefore, long-term income investors should continue to hold this fund.

Additional Disclosures: This is not financial advice and all financial investments involve risk. Investors are urged to seek professional financial advice before making any investment.