Warren Buffett is currently the 10th richest person in the world, according to the Bloomberg Billionaires Index. In June 2024, Buffett not only estimated his net worth at more than $127 billion, but also candidly stated that 99% of that total is invested in a single stock. Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B).

Buffett bought Berkshire nearly 60 years ago and his investment prowess has helped the company grow into an $875 billion diversified conglomerate. Under his leadership, Berkshire’s stock price has grown at a compound annual rate of 19.8% from 1965 to 2023, nearly doubling its annual return in 2015. S&P 500 (SNPINDEX: ^GSPC) During the same period.

Buffett is arguably one of the most brilliant minds in American business, making his belief in Berkshire all the more remarkable. Here’s what investors need to know about this incredible stock.

Berkshire has two key advantages

Berkshire Hathaway is a holding company that owns dozens of subsidiaries organized into three segments: (1) insurance, (2) railroads, utilities, and energy, and (3) manufacturing, services, and retail. This business structure is advantageous for two reasons.

First, Berkshire Hathaway is one of the largest property and casualty insurance companies in the world. As a result, the company continually generates investable cash in the form of insurance premiums. Warren Buffett explained this aspect of the business in his 2009 shareholder letter:

“Insurance companies receive premiums up front and pay claims later. In extreme cases, such as certain workplace accidents, the payments can extend for decades. This collect now, pay later model means that we hold a large amount of money, which we call ‘float,’ that will eventually be in someone else’s hands. In the meantime, we can invest this float for Berkshire’s benefit.”

Buffett has invested his liquidity effectively over the years: Berkshire’s book value per share, a good gauge of the company’s changing intrinsic value, has risen 11.1% annually over the past decade.

A second advantage of Berkshire’s business structure is that many of its subsidiaries offer recession-proof products and services, particularly insurance underwriting (GEICO), freight rail transportation (Burlington Northern Santa Fe), and utility services (PILOT and Berkshire Hathaway Energy Company).

As a result, Berkshire Hathaway has historically outperformed the S&P 500 during bear markets, as shown in the chart below.

|

Bear market start date |

S&P 500 biggest drop |

Berkshire Hathaway’s biggest drop |

|---|---|---|

|

March 2000 |

(49%) |

(twenty four%) |

|

October 2007 |

(57%) |

(54%) |

|

February 2020 |

(34%) |

(30%) |

|

January 2022 |

(twenty five%) |

(27%) |

|

average |

(41%) |

(34%) |

Data source: Yardeni Research, Ycharts.

Berkshire reported strong first quarter results

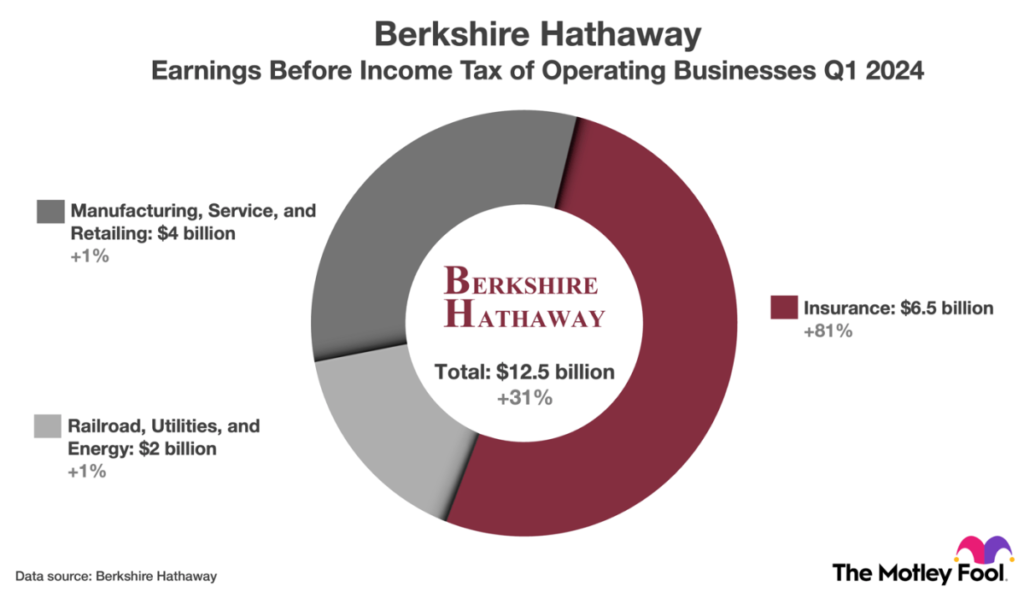

Berkshire had a strong first quarter, with revenues rising 5% to $89.9 billion on strong sales growth at its insurance and utilities subsidiaries, offset by slightly lower sales at its other divisions, while pretax operating income rose 31% to $12.5 billion.

The chart below shows pre-tax operating income for Berkshire’s three main business segments. It’s important to note that these income does not include investment gains or losses, realized or unrealized, but does include investment income such as stock dividends and interest on U.S. Treasury bills.

Berkshire shares are trading at an acceptable valuation

CFRA analyst Catherine Seifert sees Berkshire’s operating earnings per share growing 12% annually over the next three years, which may be a conservative estimate given that Berkshire’s earnings per share have grown 23% annually over the past three years. But even with that slowdown in mind, the current price of 21.7 times operating earnings is within acceptable limits.

We can also look at valuation from another perspective: Berkshire shares are currently trading at 1.5 times book value, which is slightly higher than its three-year average of 1.4 times book value, but not unreasonable.

Investors shouldn’t assume that Berkshire is undervalued, but its stock has kept pace with the S&P 500 over the past five years, and I believe it can do so over the next five, with the added benefit of outperforming in market downturns.

Should I invest $1,000 in Berkshire Hathaway right now?

Before you buy Berkshire Hathaway shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… and Berkshire Hathaway wasn’t among them. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $786,046.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 2, 2024

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool owns shares in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Billionaire Warren Buffett has 99% of his fortune invested in one great stock. This article was originally published by The Motley Fool.