Just because a company isn’t making a profit doesn’t mean its stock price will fall. For example, Amazon.com lost money for many years after it went public, but if you bought and held its shares since 1999, you would have made a lot of money. That said, companies that aren’t making profits are risky because they could burn through all their cash and run into financial difficulties.

So the natural question is Richmond Vanadium Technology (ASX:RVT) shareholders’ biggest concern is whether they should be worried about its cash burn rate. For the purpose of this article, we define cash burn as the amount of cash a company is spending each year to fund growth (also known as negative free cash flow). Let’s start by examining a company’s cash compared to its cash burn.

View our latest analysis for Richmond Vanadium Technology

When will Richmond Vanadium Technology run out of cash?

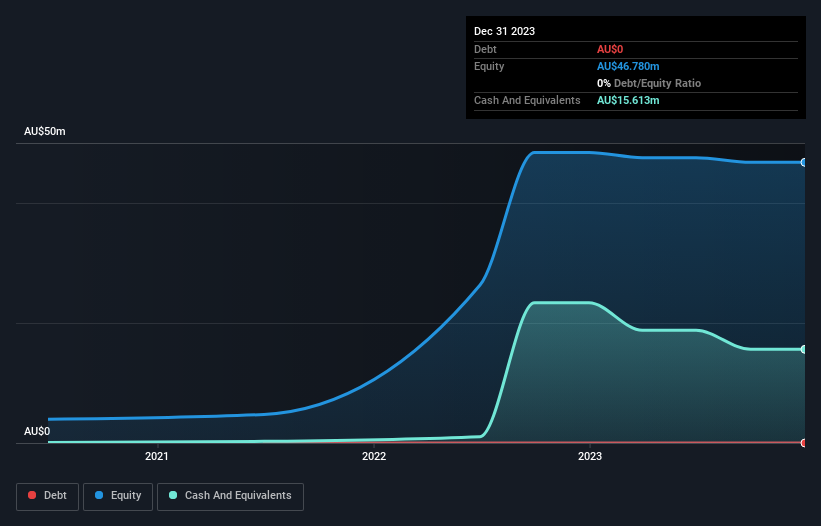

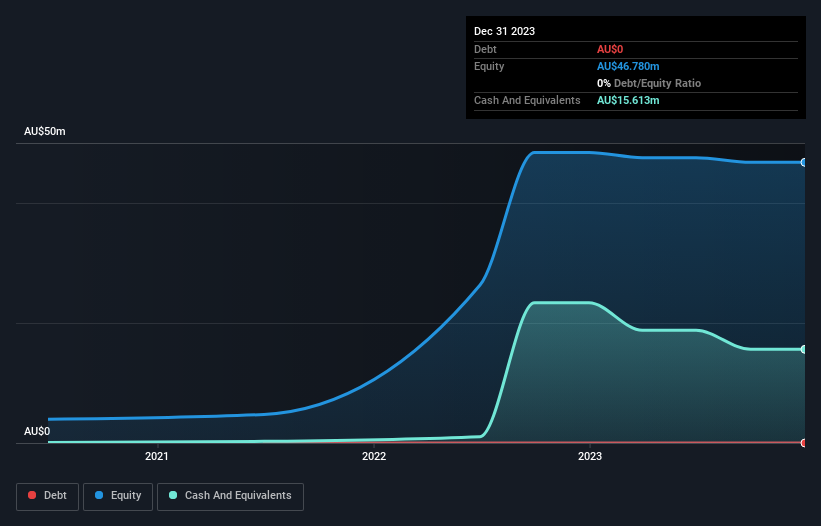

A cash runway is defined as the length of time it would take a company to run out of funds if it kept spending at its current cash burn rate. As of December 2023, Richmond Vanadium Technology had cash of AU$16m and no debt. Looking back at last year, the company burned through AU$4.7m, which means its cash runway was about 3.3 years as of December 2023. With a runway this long, a company can get the time and space it needs to expand its operations. Importantly, if we extrapolate the recent cash burn trend, the cash runway would be significantly longer. You can see how its cash balance has changed over time in the image below.

How has Richmond Vanadium Technology’s cash burn changed over time?

Richmond Vanadium Technology recorded Statutory Last year, revenue was A$604,000. operationTo us, that means it’s a company that hasn’t yet generated revenue, so we’ll look at its cash burn trajectory to assess its cash burn situation. A steep 145% increase in cash burn year over year certainly tests our nerves. Generally speaking, that rate of spending growth can’t last long before it starts to weaken the balance sheet. Richmond Vanadium Technology’s lack of substantial operating revenue makes us a bit nervous. We like most of the stocks on this list of stocks analysts expect to grow.

How easily can Richmond Vanadium Technology raise capital?

Richmond Vanadium Technology certainly has a stable cash runway, but the trajectory of its cash burn may have some shareholders anticipating when the company will need to raise more capital. The most common ways for public companies to fund their operations are by issuing new shares or borrowing. One of the main advantages that public companies have is that they can sell shares to investors to raise cash to fund growth. Looking at a company’s cash burn relative to its market capitalization can give us an idea of how much dilution shareholders would face if the company needed to raise enough cash to cover its cash burn over the next year.

Richmond Vanadium Technology’s cash burn was A$4.7m, which is roughly 7.0% of its market capitalization of A$68m. This is a fairly small percentage, so it would be very easy for the company to fund its growth over the next year by issuing new shares to investors or taking out a loan.

Are you concerned about Richmond Vanadium Technology’s cash burn?

You may already know that we are relatively comfortable with Richmond Vanadium Technology’s cash burn situation. In particular, we think the company’s cash runway stands out as evidence that the company has good control over its expenses. While the company’s increasing cash burn is a bit worrying, the other factors mentioned in this article give us a lot of comfort with regards to its cash burn. Given all the factors discussed in this article, we are not too worried about the company’s cash burn, but we think shareholders should keep a close eye on how it plays out. Apart from that, we have looked into various risks affecting the company and found the following: 4 warning signs for Richmond Vanadium Technology (Three of them are unpleasant for us!) It’s something you should know about.

If you want to check out another company with a better foundation, don’t miss this one free A list of interesting companies with high return on equity and low debt, or a list of stocks that are expected to grow.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com