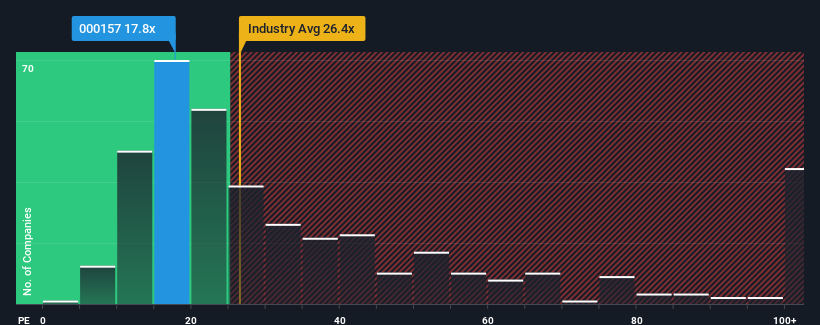

Nearly half of Chinese companies trade at a price-to-earnings ratio (or “P/E”) of 28 or more. Zoomlion Heavy Industry Science and Technology Co., Ltd. (SZSE:000157) is an attractive investment with a P/E ratio of 17.8x, however it would be unwise to take the P/E at face value as this could explain why the P/E is limited.

Zoomlion Heavy Industry Technology has certainly been doing well lately, with earnings growing faster than most other companies. One possibility is that the price-to-earnings multiple is low because investors believe this strong performance will be less pronounced going forward. If you’re interested in the company, you’d hope that’s not the case, so you can buy shares while they’re still out of favor.

Read our latest analysis for Zoomlion Heavy Industry Science and Technology

Want a complete look at what analysts are forecasting for the company? free The report on Zoomlion Heavy Industry Science and Technology will help you understand what is coming next.

Is the growth worth the low P/E?

Zoomlion Heavy Industry Technology’s price-to-earnings ratio (P/E) is typical for a company that is expected to have limited growth and, importantly, underperform the market.

Looking back, the company’s bottom line grew an exceptional 69% last year. Despite this recent strong growth, the company is still struggling to catch up after a frustrating three-year EPS decline of 63% overall. Shareholders would therefore be pessimistic about earnings growth in the medium term.

Looking ahead, EPS is expected to grow 19% annually over the next three years according to the 12 analysts tracking the company. With the market expected to grow 24% annually, the company’s earnings are expected to stagnate.

This information explains why Zoomlion Heavy Industries Technology’s P/E is lower than the market – most investors likely expect limited future growth and are therefore willing to pay less for the stock.

What can we learn from Zoomlion Heavy Industries Technology’s P/E ratio?

While it would be unwise to use the price-to-earnings ratio alone to decide whether or not you should sell a stock, it can be a useful indicator of a company’s future prospects.

As expected, a survey of analyst forecasts for Zoomlion Heavy Industry Technology reveals that the company’s poor earnings outlook is driving its low P/E ratio. At this stage, investors feel that the potential for earnings improvement is not great enough to justify a higher P/E ratio. Under these circumstances, it is difficult to see a significant rise in the stock price in the near future.

That being said, be careful Zoomlion Heavy Industry Technology is Showing Three Warning Signs In our investment analysis, you need to know:

Interested in the P/E ratio?you might want to take a look at this free A collection of other companies with high earnings growth and low P/E ratios.

Valuation is complicated, but we can help make it simple.

investigate Zoomlion Heavy Industries Science and Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Valuation is complicated, but we can help make it simple.

investigate Zoomlion Heavy Industries Science and Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com