At what point does investing in cryptocurrency become too big and irresponsible? This is the billion-dollar question you should be asking yourself before considering buying Microstrategy (Nasdaq:MSTR) shares. Bitcoin (BTC-USD), I still recommend caution and am currently neutral on MSTR stock.

Founded and chaired by prominent investor Michael Saylor, MicroStrategy develops software as a service (SaaS) products. At least, that’s what the company did primarily before Saylor changed MicroStrategy’s business model. But as we’ll see, the company has been doing things recently that have nothing to do with building enterprise SaaS products.

Calling MicroStrategy’s strategy irresponsible may be a stretch, but when a stock’s performance is so closely tied to a single digital currency, investors should think carefully before making any rash decisions.

Yes, MicroStrategy sells software

Though the financial media doesn’t give it much coverage, MicroStrategy actually makes money selling software. The company claims to be a “pioneer in AI-powered business intelligence,” though I think that title would be better awarded to Palantir Technologies.NYSE:PLTR).

And yet, MicroStrategy recently released an updated software product with an artificial intelligence (AI) perspective. Specifically, the company announced the latest version of MicroStrategy ONE, which “layers contextual, bite-sized AI insights onto any application in a no-code environment.”

That’s a big claim in terms of interoperability. Does MicroStrategy ONE really work with “any application”? I’m excited to test this out with a variety of applications.

If so, MicroStrategy may actually be, as the company claims, a “pioneer” in AI. MicroStrategy ONE gives everyone from sales reps and healthcare professionals to call center agents “faster access to critical information while helping customers, enabling data-driven decisions across the organization.”

For some reason, MicroStrategy ONE is Microsoft’sNasdaq:MSFT) Copilot and other software products. Moreover, if Microstrategy is truly inventing something new, perhaps a bigger fish in the pond (such as Microsoft) will soon release a similar or better product.

Still, it’s too early to make a definitive judgment on Microstrategy ONE. I would give Microstrategy the benefit of the doubt for now and recommend that investors closely monitor the company’s income statement for any improvements.

Microstrategy’s Strategy: Brave or Reckless?

There’s a fine line between courage and recklessness. Ask yourself: would I suggest that investors should put more than half of their portfolios in a single highly volatile asset? If the answer is no (and I hope it is), then it’s time to seriously question Microstrategy and Saylor’s highly aggressive crypto buying strategy.

Usually, it’s only when the price crashes that people remember how volatile and risky Bitcoin really is. I’m not saying you shouldn’t own small amounts of Bitcoin, but let the recent drop in Bitcoin serve as a reminder that it can fall just as fast as it rose.

Certainly, Bitcoin can be useful for portfolio diversification and as a hedge against dollar inflation/devaluation, but buying too much of any cryptocurrency can be dangerous, and it doesn’t take a catastrophe for the price of Bitcoin to fall.

Just recently, Bitcoin dropped from $70,000 to $58,000. There was no economic recession and many risk-on tech stocks continue to hover near all-time highs. Rather, it was primarily the Mt. Gox payoff and miner selloff that prompted the Bitcoin selloff.

None of this would have been such a problem if MicroStrategy had stuck to its business model of selling AI-embedded software, but under Saylor’s leadership, the company has behaved like an amateur investor who got too excited about buying bitcoin.

Par FlyMaxim analysts say (and Barons MicroStrategy was confirmed to have held 226,331 Bitcoin as of June 20. This Bitcoin holding was valued at approximately $13.4 billion and represented 55% of MicroStrategy’s stock price.

Needless to say (and I will still say it), 55% is too much, and even half that is too much exposure to Bitcoin given the risks and volatility involved.

Plus, I’m not a big fan of borrowing money to buy Bitcoin, which MicroStrategy reportedly did. Bernstein analysts wrote: CoinDesk) reported that MicroStrategy “raised $4 billion in convertible notes to buy Bitcoin.” Bloomberg The report confirmed that MicroStrategy recently “purchased approximately $786 million worth of Bitcoin with proceeds from the sale of convertible notes.”

Again, MicroStrategy is borrowing money to buy large amounts of Bitcoin, which the company must pay back at 2.25% annual interest through 2032. This is a very risky strategy, to say the least.

To make matters worse, there are concerns about share dilution. Remember, these are convertible MicroStrategy can convert the notes into common stock. As the company acknowledges, “The notes are convertible, at MicroStrategy’s option, into cash, shares of MicroStrategy Class A common stock, or a combination of cash and shares of MicroStrategy Class A common stock.” This means that MicroStrategy can apparently pull the trigger at any time and flood the market with a huge amount of common stock.

Is MicroStrategy Stock a Buy According to Analysts?

TipRanks rates MSTR a Strong Buy, after seven unanimous Buy ratings from analysts in the past three months. Microstrategy’s average price target of $2,142.29 suggests there is room for upside of 64.5%.

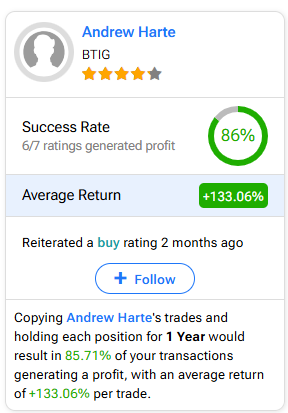

If you want to buy or sell MSTR stock and are wondering which analysts to follow, the most profitable analyst covering this stock (over a 1-year period) is Andrew Harte of BTIG, with an average return per rating of 133.06% and a success rate of 86%. Click on the image below to find out more.

Conclusion: Should you consider Microstrategy stock?

It’s fine to own Bitcoin, so it’s fine to own MicroStrategy shares, as long as you own them in moderation, but understand that Bitcoin tends to be volatile in price, and MicroStrategy has been very aggressive in buying Bitcoin.

MicroStrategy’s strategy of borrowing money to buy Bitcoin is reckless and even irresponsible. This is a harsh opinion, but I’m not dismissing the possibility that MicroStrategy could be a pioneer in AI software development. But ultimately, I’m neutral on MicroStrategy shares and I’m not considering buying them now.

Disclosure