Key Insights

- Insiders appear to have a vested interest in the growth of Shanghai Weihong Electronics Technology, as can be seen from their large ownership interest.

- Together, the two investors hold the majority stake in the company, with 55% ownership.

- A company’s past performance and ownership data can help give you a strong idea of the business’s prospects.

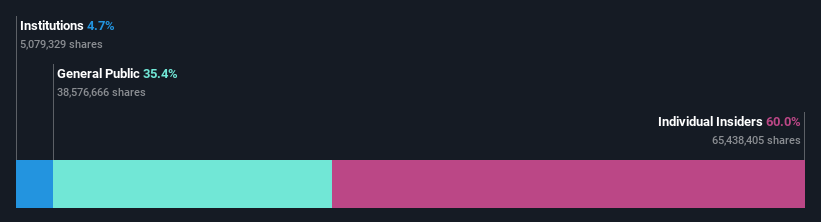

To understand who really controls Shanghai Weihong Electronics Technology Co., Ltd. ( SZSE:300508 ), it is important to understand the company’s ownership structure. With a 60% stake, individual insiders have the largest stake in the company, which means that if the share price rises, the group stands to gain the most (and lose the most if the share price falls).

And with the share price falling 11% last week, it was insiders who suffered the biggest losses.

Let’s take a closer look to see what the different types of shareholders can tell us about Shanghai Weihong Electronics Technology.

Check out our latest analysis for Shanghai Weihong Electronics Technology

What do institutional ownership tell us about Shanghai Weihong Electronic Technology?

Institutions typically compare their own performance against a benchmark when reporting to their own investors, so when a stock is included in a major index, they often increase their interest in that stock. You can expect most companies to have some institutional investors on the register, especially if they are growing.

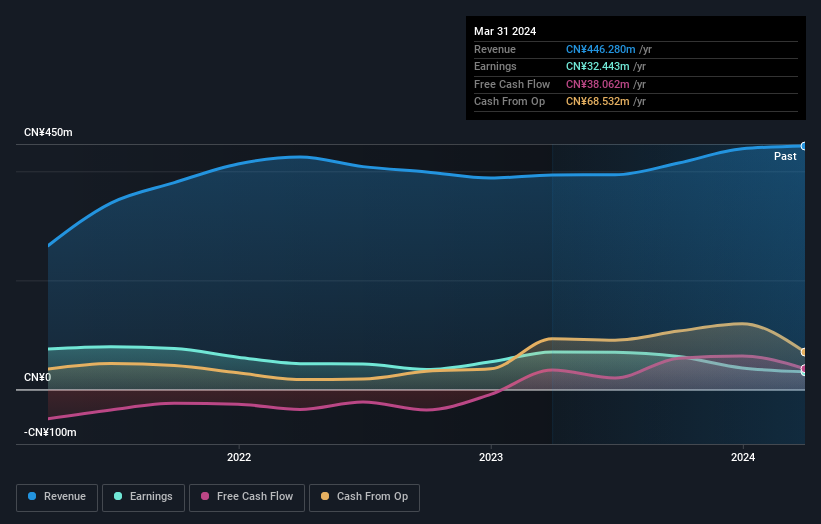

Institutional investors hold only a small percentage of Shanghai Weihong Electronics Technology’s shares. This indicates that the company is attracting interest from some funds, but it is not particularly popular among professional investors at the moment. If the company’s business strengthens in the future, we may see more institutional investors willing to buy. If several large institutional investors want to buy a particular stock at the same time, the stock price may rise. The earnings and revenue history shown below may help you consider whether more institutional investors will want the stock. Of course, there are many other factors to consider.

Hedge funds don’t hold much stock in Shanghai Weihong Electronics Technology. The company’s largest shareholder is Dong Kuitang, who owns 32%. By comparison, the second and third largest shareholders own about 23% and 3.7% of the stock, respectively. The second largest shareholder, Zheng Zhikai, also happens to hold the title of CEO.

What makes our research even more interesting is that we discovered that the top two shareholders hold majority ownership in the company, giving them enough power to influence the company’s decisions.

While studying institutional ownership for a company can add value to your research, it is also a good idea to research analyst recommendations to get a deeper understand of a stock’s expected performance. As far as we can tell, there is no analyst coverage of the company, so it’s probably not under the radar.

Insider Ownership of Shanghai Weihong Electronics Technology

While the precise definition of an insider can be subjective, almost everyone considers directors to be insiders. Management are ultimately responsible to the board of directors, however it is not uncommon for managers to be members of the executive board, especially if they are founders or CEOs.

Insider ownership can be a positive if it signals management are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company, which can be a negative in some circumstances.

It appears that insiders own more than half of Shanghai Weihong Electronics Technology Co., Ltd.’s shares. This gives them a lot of power. With a market capitalization of RMB2b, that means insiders own RMB1.2b worth of shares. Most would argue that this is a good thing, indicating strong alignment with shareholders. To see if insiders have been buying or selling, click here.

General public property

Thirty-five percent of Shanghai Weihong Electronics Technology’s shares are held by the general public, usually individual investors. While this ownership is significant, it may not be enough to change the company’s direction if it is not aligned with the decisions of other large shareholders.

Next steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important, such as: Two Warning Signs for Shanghai Weihong Electronics Technology Something you should know.

If you want to check out another company that may be financially superior, don’t miss this one. free A list of interesting companies backed by strong financial data.

Note: The figures in this article are calculated using data from the last 12 months, which refers to the 12-month period ending on the last day of the month in which the financial statements are dated, which may not match the figures in the annual report.

Valuation is complicated, but we can help make it simple.

investigate Shanghai Weihong Electronics Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Valuation is complicated, but we can help make it simple.

investigate Shanghai Weihong Electronics Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com