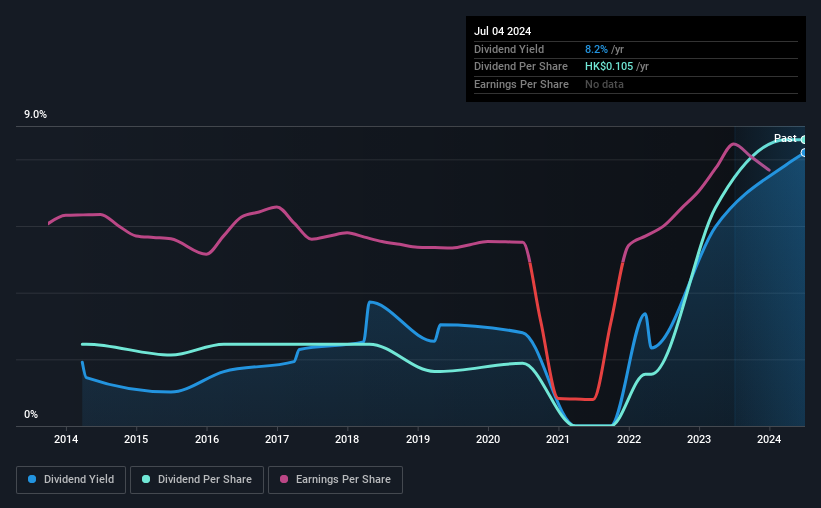

China Electronics Huada Technology Co., Ltd. (HKG:85) will increase its dividend on July 31 to HK$0.105 from last year’s equivalent, giving it an attractive dividend yield of 8.2%, significantly boosting shareholder returns.

Read our latest analysis for Chinese Electronics Huada Technology

China Electronics Huada Technology’s profits easily cover dividends

While a strong dividend yield is good, it’s worthless if the payments aren’t sustainable. However, prior to this announcement, China Electronics Huada Technology’s dividend was well covered by both cash flow and profits, which means that most of the company’s earnings are being used to fund growth.

If the trends of the past few years continue, EPS will grow by 43.4% over the next 12 months. Assuming dividends continue along recent trends, the dividend payout ratio could be 24% by next year, which is a fairly sustainable range.

Dividend fluctuations

The company has been paying dividends for many years, but performance has been poor due to past dividend cuts. Dividends have fallen from a total of HK$0.03 per year in 2014 to a total of HK$0.105 per year in the most recent period, a compound annual growth rate (CAGR) of approximately 13% per year over this period. Dividends have grown rapidly over this period, but the past dividend cuts make it unclear whether this stock will be a reliable source of income in the future.

Dividends are likely to increase

Given that the dividend has been cut in the past, we need to see if earnings are growing and whether that can lead to dividend increases in the future. It’s encouraging to see that China Electronics Huada Technology has grown its earnings per share at 43% per year over the past five years. A low dividend payout ratio gives the company great flexibility, and with growing earnings, it also makes it very easy to increase the dividend.

Chinese electronics company Huada Technology looks like a great dividend stock

In summary, it’s always good to see growing dividends and we’re especially pleased with their overall sustainability. Earnings are well covered by the dividend, and the company generates plenty of cash. Taking all that into account, this looks like a good dividend opportunity.

It’s important to note that a company with a consistent dividend policy will likely gain more investor confidence than one with an erratic one. Meanwhile, despite the importance of dividends, they’re not the only factor readers should know when assessing a company. For example, we’ve looked at companies like: One warning sign for China Electronics Huada Technology What investors should know before investing in this stock. Looking for more high-yielding dividend ideas? A collection of strong dividend paying companies.

Valuation is complicated, but we can help make it simple.

investigate China Electronics Huada Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Valuation is complicated, but we can help make it simple.

investigate China Electronics Huada Technology By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com