Palm Beach County has reaped record revenue from its $5 billion investment portfolio, but a surge in real estate foreclosures is raising concerns about future revenue, according to the county’s chief financial officer.

The investment portfolio also includes the controversial purchase of $700 million in Israeli bonds to support the war in Gaza.

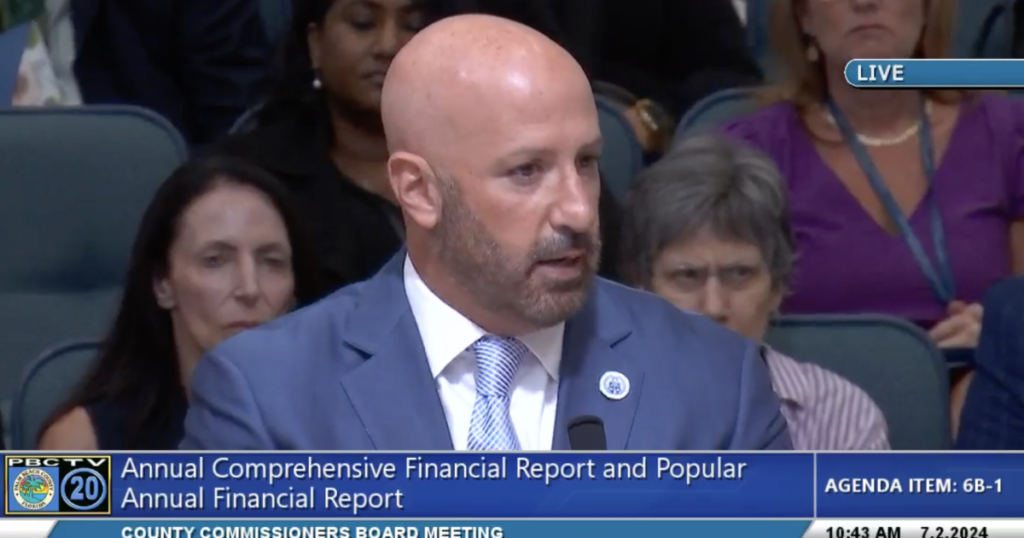

Circuit Court Clerk and Comptroller Joseph Abruzzo, who oversees the county’s investments, told commissioners this week that the county saw a record $172 million return in fiscal year 2023 from its roughly $5 billion portfolio.

He said the county expects to bring in a record $215 million into county coffers by the end of the year.

Mr. Abruzzo defended his decision last year to invest 15% of the county’s funds in Israel bonds after county commissioners raised the limit from 10% to 15%, making the county the world’s largest buyer of those bonds.

“Nobody takes more criticism than me, and I’m happy to take that criticism all day, every day,” Abruzzo said. “I’m proud of what they’re giving back, and I’m proud that at the end of the day, we’re making about $83 million off 15% of the portfolio, which is really awesome, frankly.”

In May, amid the ongoing war and humanitarian crisis in Gaza, dozens of residents protested outside the Palm Beach courthouse, calling on the state of Abruzzo to halt the sale of Israeli bonds. That same month, three Palestinian residents filed a lawsuit against the Palm Beach County government.

The county bought the bonds last year after Hamas fighters invaded southern Israel on Oct. 7, 2023, killing about 1,200 people, mostly civilians, and abducting about 250. Israel’s nine-month war against Hamas has reportedly left more than 37,900 people dead in Gaza.

Abruzzo said Israel bonds offer higher yields than U.S. Treasuries and are renewable for periods of two to three years. He noted that the bonds make up 15 percent of the county’s investment portfolio and generate $35 million in investment income annually, and that the county had previously earned $27 million annually from the entire portfolio.

“It’s all about safe investments,” Abruzzo said.

A sharp rise in foreclosures

While briefing the county on its finances, Mayor Abruzzo also told commissioners that there were more than 2,400 property foreclosures last year, nearly double the total for 2022. He said he expects the number of foreclosures to rise, due in part to variable mortgage rates and higher interest rates.

“The interest rate market is just changing, and the entire workforce is changing right before our eyes,” Abruzzo said.

“They are [property owners] “You went from paying 2-3 percent interest to suddenly paying 7-8 percent interest,” he said, pointing to rising interest rates.

Abruzzo provided a comprehensive annual financial report with a detailed layout. Ask the committee how your tax money is being spent.

read more: Amid housing affordability crisis, Palm Beach County launches affordable housing dashboard

Commissioner Marcy Woodward said she was “a little concerned” by the rise in foreclosures, noting that many properties were vacant during the 2008-2009 Great Recession, when home prices plummeted as the global economic crisis hit.

“We have arguably the most booming real estate market in the country,” Abruzzo added. “At this point, that could change. There are always investors looking to buy properties, so I don’t think we’ll have vacant properties sitting around for long.”

He said other concerns included the risk of job losses due to advances in artificial intelligence and the long-term pain of a ballooning $34 trillion national debt, including reduced purchasing power, faster inflation and higher interest rates.

Mortgage applications fall

Home prices have been soaring in recent years. The average sales price for a single-family home in Palm Beach County is $650,000, according to data from the Palm Beach County New Home Trends Dashboard. Nationwide, home prices rose 46% between March 2020 and March 2024, according to the closely watched Case-Shiller 20-City Composite Home Price Index.

Another worrying statistic, Abruzzo said, is the low number of mortgage deeds. The number of mortgages and deeds recorded in the clerk’s office has dropped sharply, he said.

Abruzzo said a “huge increase in people buying homes with cash” may partly explain why there are so few mortgages recorded.

This means less revenue for Palm Beach County and the clerk’s office, because part of that revenue comes from fees and recording documents.

Abruzzo plans to return to the committee to explain how taxpayers will benefit from the county’s investment, where exactly that additional revenue will be spent and what commissioners have at their disposal when the county determines its tax rate and future budget.

The new fiscal year begins on October 1st.