In recent years, CEE startups have begun to capitalize on the momentum of the space tech industry, which has historically been government-dominated due to high barriers to entry and the need for deep expertise. According to Dealroom data, the region ranks second in market share across the upstream space tech segment (already home to three unicorns in the space tech sector: OneWeb, Lilium and TomTom), followed by China, Canada and the rest of the world.

If we look at the CEE level, the region already has future unicorns in the sector with Polish roots. Ice Eye Founded by Rafal Modrzewski (Polish) and Pekka Laurila Finish has raised a total of $395 million in funding. The startup ICEYE owns the world’s largest fleet of synthetic aperture radars. The company enables objective, data-driven decision making for clients in insurance, natural disaster response and recovery, security, maritime surveillance, finance, and more. ICEYE’s data can be collected day or night, even under cloud cover.

Moreover, looking at the number of startups, funding rounds and total funding, several promising startups have emerged from the region, particularly from the Czech Republic, Poland and Bulgaria.

Where is space technology heading in CEE?

The global space technology economy is expected to grow to $10 trillion by 2030. Space Technology AnalysisSpace technology includes the hardware, equipment and systems used in space exploration and development, as well as the technologies and processes that support their operation and maintenance.

What has most driven the growth of space technology?

in Previous Interviewwe spoke Dr. S. Pete WardenWe spoke with the former director of NASA Ames Research Center and current chairman of the Breakthrough Prize Foundation about the evolution of the industry and how he’s seen it change.

He believes technological advances that allow for more frequent space missions will spur the development of even more advanced technologies.

“The timeframe required to conceive, create, and execute a mission has drastically decreased. Today, missions can be accomplished in less than a year, allowing professionals, including students, to work on multiple endeavors throughout their careers. This change creates a sense of fulfillment and progression. Additionally, the accelerated pace of mission development creates valuable learning opportunities. When working on only one mission, lessons learned remain scarce. But with multiple missions, potentially 10 or 20, the approach becomes iterative, meaning lessons learned from one mission can be carried over to the next, allowing for growth and improvement.”

We reviewed space tech startups emerging from CEE in the last 12 months. Some are early stage startups that have made it to 2024, while others have raised significant amounts of funding. We compiled a list.10 CEE space tech startups to watch”

What technologies are being used by space tech startups in CEE?

Technologies used by space tech startups in CEE include:

- Artificial Intelligence (AI): It will be used for data analysis, satellite imagery and autonomous operations.

Startup: SatRev, ICEYE - Blockchain: Applications include secure data transactions, satellite communications, and logistics management.

Startup: Thorium, EnduroSat - Satellite Technology: It is the basis of communications, Earth observation, and navigation.

Startup: ICEYE, SatRev - Small satellite launch capabilities: It was developed to launch small satellites into orbit.

Startup: Satlev - Deep Tech Innovation: Application of advanced technologies in space missions and digital infrastructure.

Startup: EnduroSat, Orbital Matter

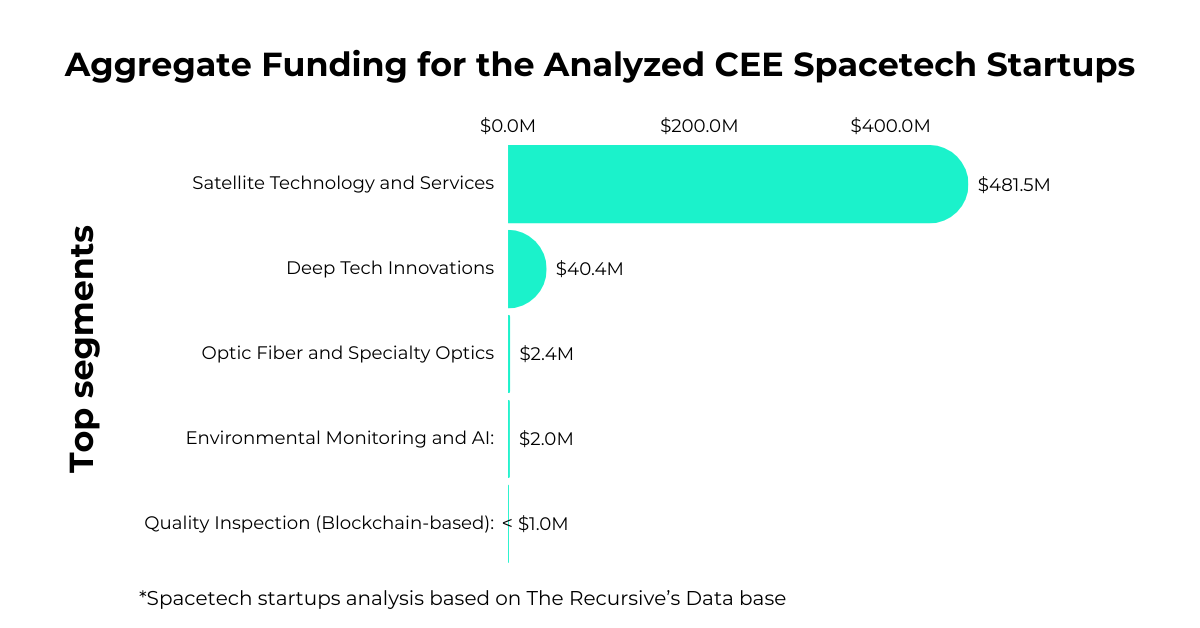

The most funded segments for analyzed CEE space tech startups:

Who is investing in space tech startups in CEE?

Besides important public supporters such as the European Innovation Council, national research centres, ESA (European Space Agency) and EUSPA (European Union Space Programme Agency), there are other larger organisations and venture capitalists who have added at least one space tech start-up to their portfolio, such as:

Imperio: A venture capital firm investing in information technology, products, services, ITC and e-commerce sectors.

Space tech startups they’ve invested in: $380,000 in SatRev;

Virgin Orbit – A vertically integrated space company providing dedicated small satellite launch capabilities to its customers.

Space tech startups that have invested: Virgin Orbit invested $5.2 million in SatRev together with Millennials Venture Capital ASI SA.

Nevec – GP of two institutionally backed VC funds.

Space tech startups it has invested in: Invested in EnduroSat alongside Imperia Online and Trading212 for an undisclosed amount.

Neo Ventures – A deep tech fund that will invest in builders of digital infrastructure for smart cities, outpatient healthcare and space missions.

Space tech startups they’ve invested in: $1 million to EnduroSat;

Sunfish Partners – An early stage VC investing in deeptech startups in Central and Eastern Europe (CEE).

Space tech startups they’ve invested in: Orbital Matter, $1 million.

Freya Capital – A venture capital fund that supports and funds innovative businesses that will impact the world of tomorrow.

Space tech startup portfolio companies: The company invested in Liftero alongside bValue and Sunfish Partners for an undisclosed amount.

b-value Fund – a specialist growth equity investment firm partnering with technology and technology-enabled companies in CEE.

Space tech startups invested in: Co-invested in Lifero.

Solidium – A limited liability company owned by the Finnish government whose mission is to strengthen and stabilise domestic ownership of the country’s leading companies and increase the economic value of their holdings in the long term.

Space tech startups invested in: $93 million in ICEYE alongside Blackwells Capital and Move Capital Fund.

Blackwells Capital – Alternative investment manager with a focus on global fundamental and special situation investing.

Space tech startups invested in: Co-invested in ICEYE.

Move capital (Fund I) – a pan-European growth equity fund that aims to develop European technology champions, focusing on highly strategic sectors around the data value chain.

Space tech startups invested in: Co-invested in ICEYE.

Freegeist Capital – A private investment fund that partners with visionary founders to build disruptive technology companies.

Space tech startups it has invested in: $9.1 million in EnduroSat with CEECAT Capital.

CEECAT Capital – A leading private equity and private credit investor focused on the high growth markets of emerging Europe and Central Asia.

Space tech startups invested in: Co-invested in EnduroSat.

SmartLink Partners – A venture capital fund combining the business expertise of leading Polish entrepreneurs with the professionalism of experienced investors.

Space tech startups they’ve invested in: Thorium, $960,000.

To ensure a comprehensive study, we are inviting all key players in CEE (founders, VCs, ecosystem builders) to respond to The Recursive’s survey “AI Landscape 2024”. Your input is very valuable to us. If you have any comments or additional information, please feel free to contact us. [email protected].