In 2020, I wrote a quick overview of the U.S. real estate market with charts to show how the pandemic was affecting the housing market.

Now that a few years have passed, it’s time to update these charts.

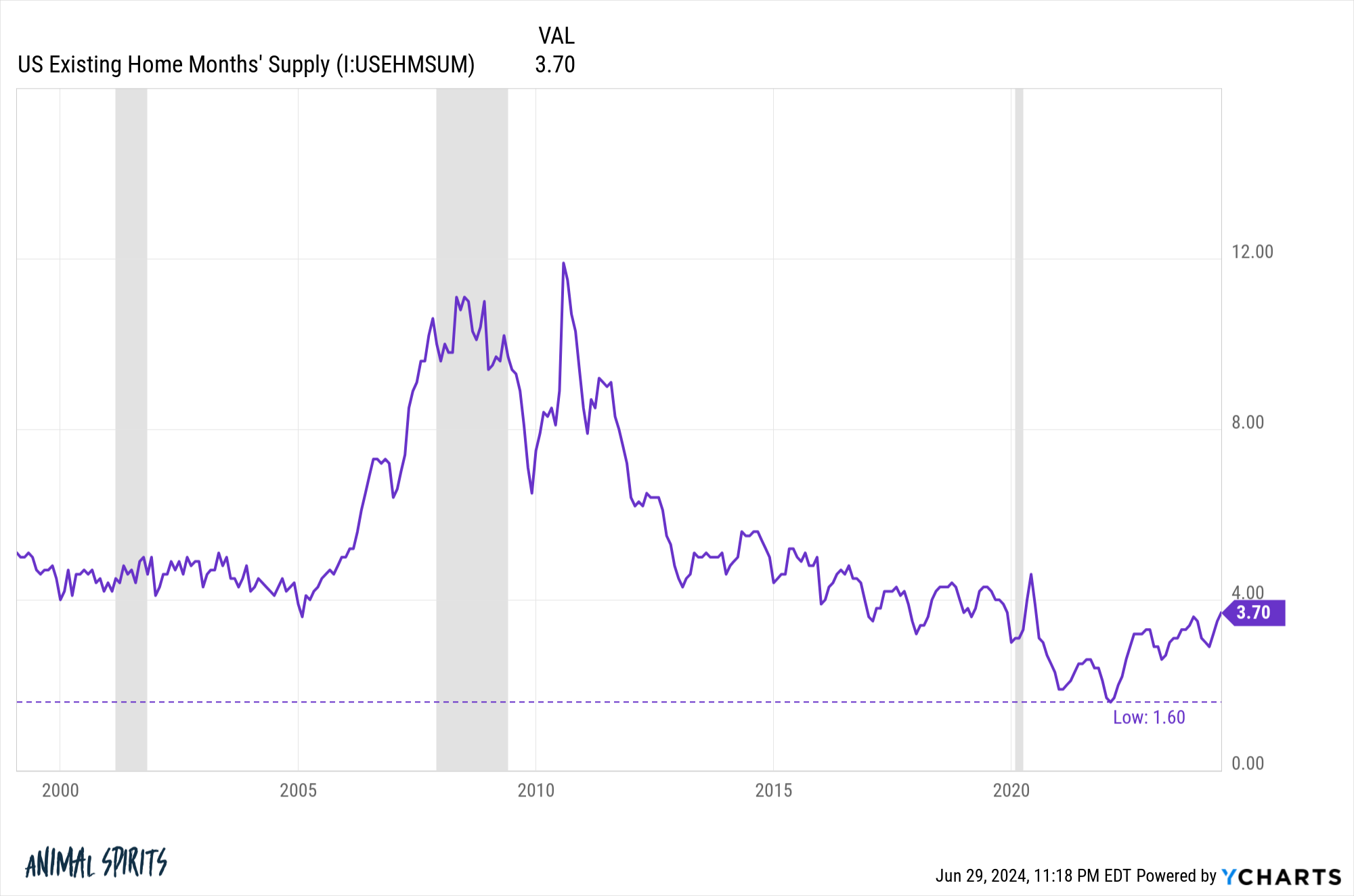

The monthly supply of existing homes measures the number of months it would take to sell all the homes on the market at the current sales pace.

They are trending significantly higher from the lows of late 2021/early 2022. This is good news for a healthy housing market.

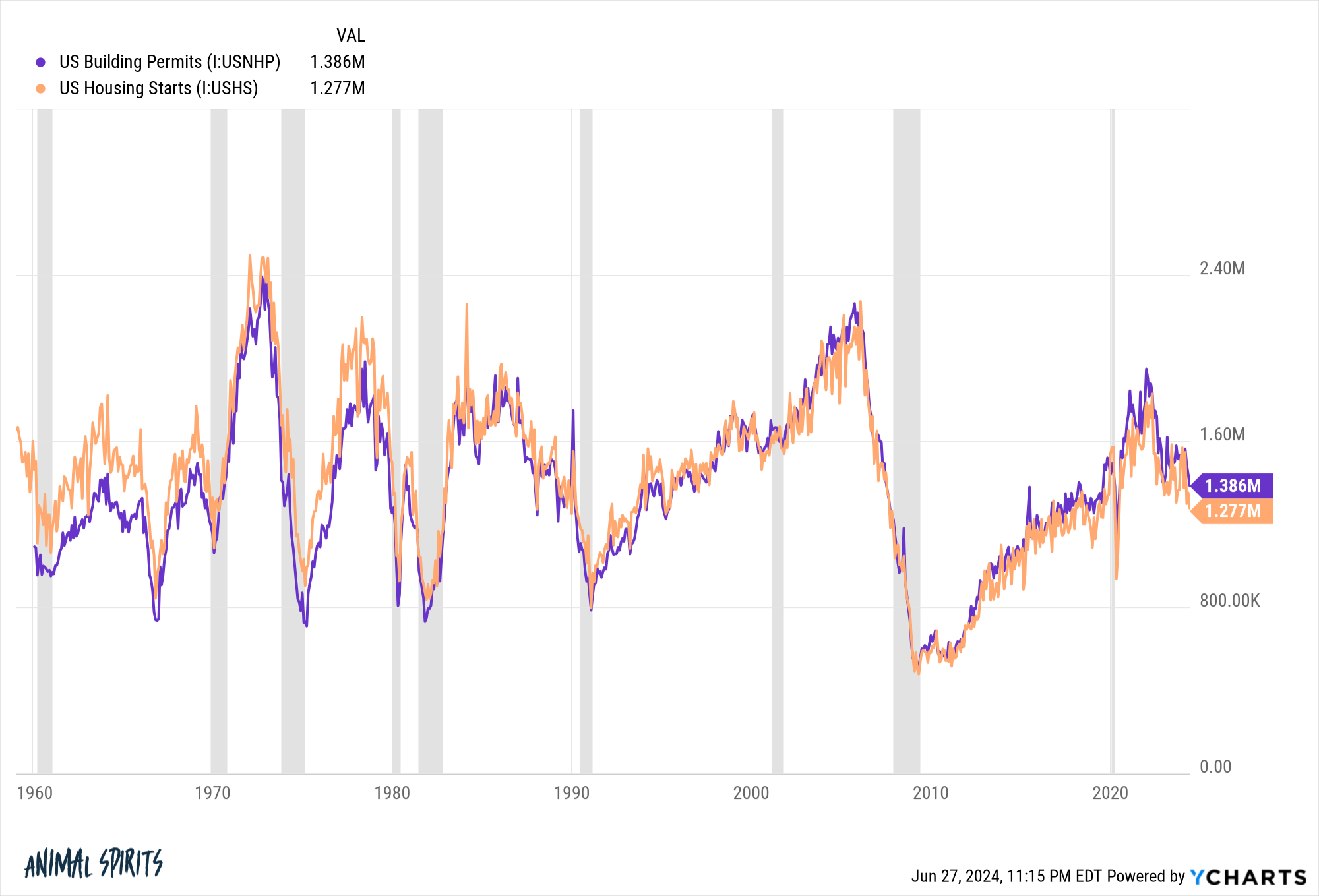

The pandemic has created a surge in demand for housing, leading to a mini-boom in new home construction.

The good times continued, but rising mortgage rates quickly put an end to the trend. As you can see, building permits and housing starts are falling just as fast as they increased.

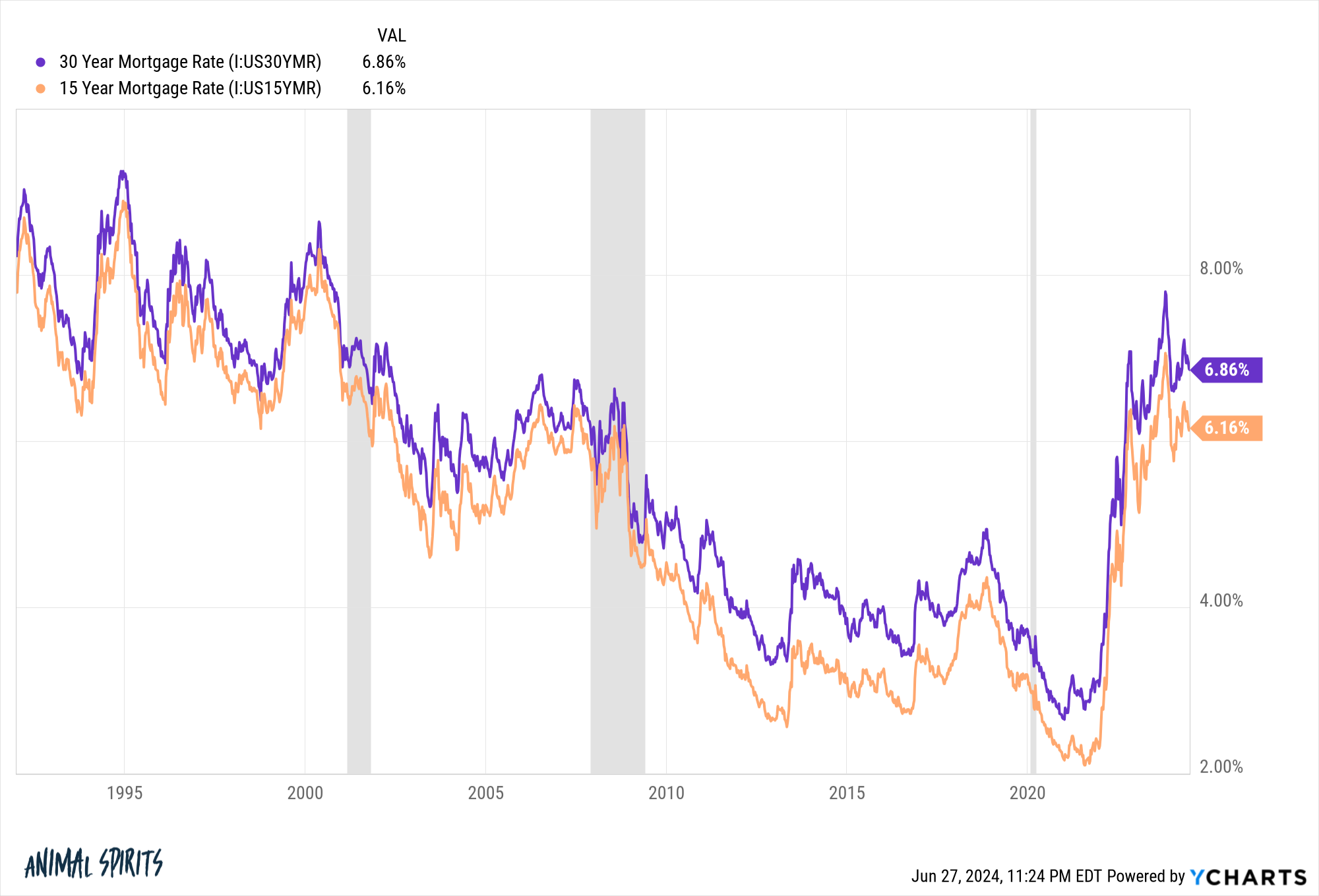

The rise in mortgage interest rates is clear when you look at the graph.

It’s hard to believe that there was a housing bubble in the first decade of this century with mortgage rates exceeding 6%. The big difference is that interest rates were falling from high levels back then, whereas today mortgage rates are at historic lows that are fresh in anyone’s memory.

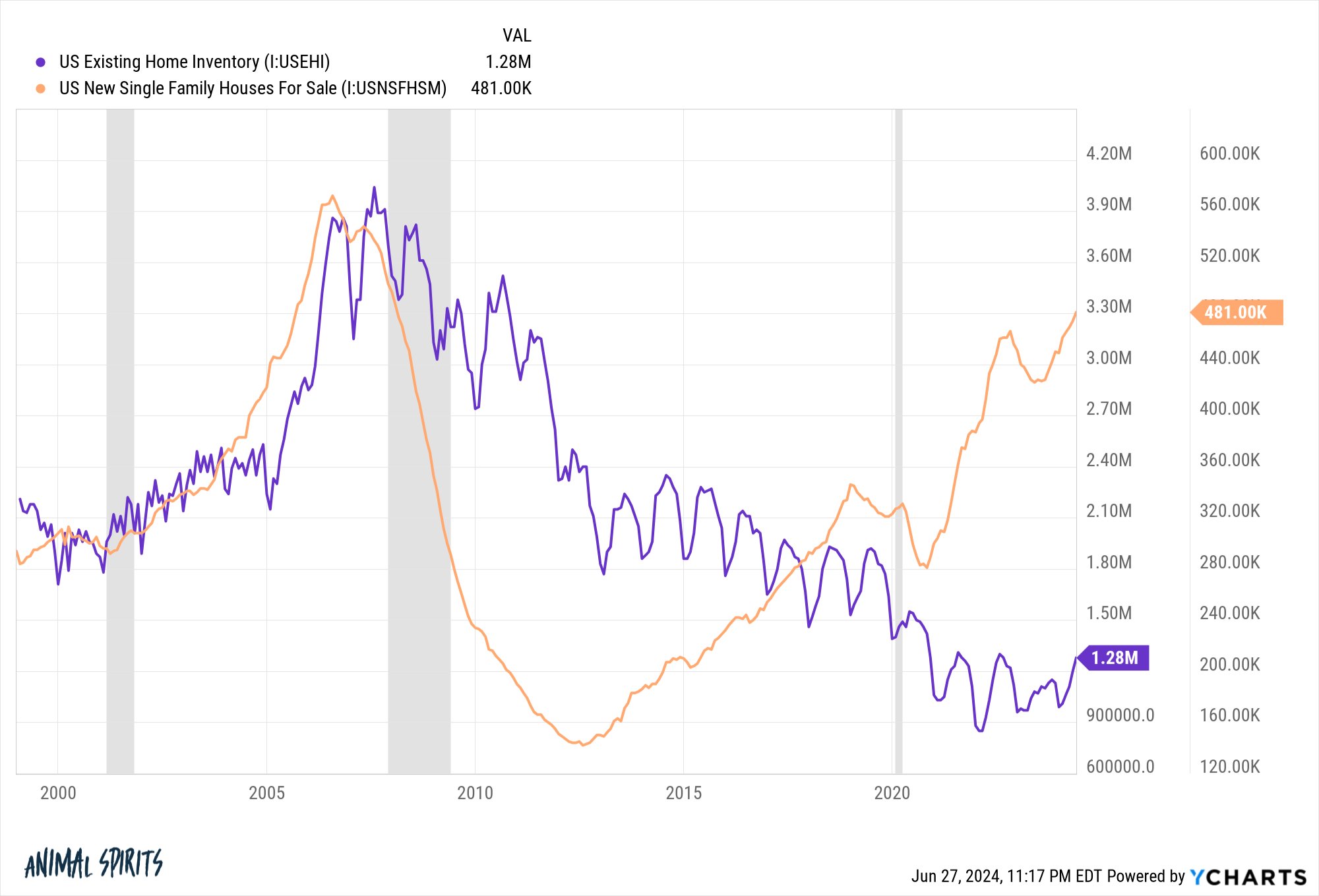

A small boom in new home construction, combined with price cuts by homebuilders, is helping to make up for the decline in existing home inventory.

Unfortunately, this situation won’t last long as housing starts data is rolling over, so the existing housing market will have to make up the shortfall.

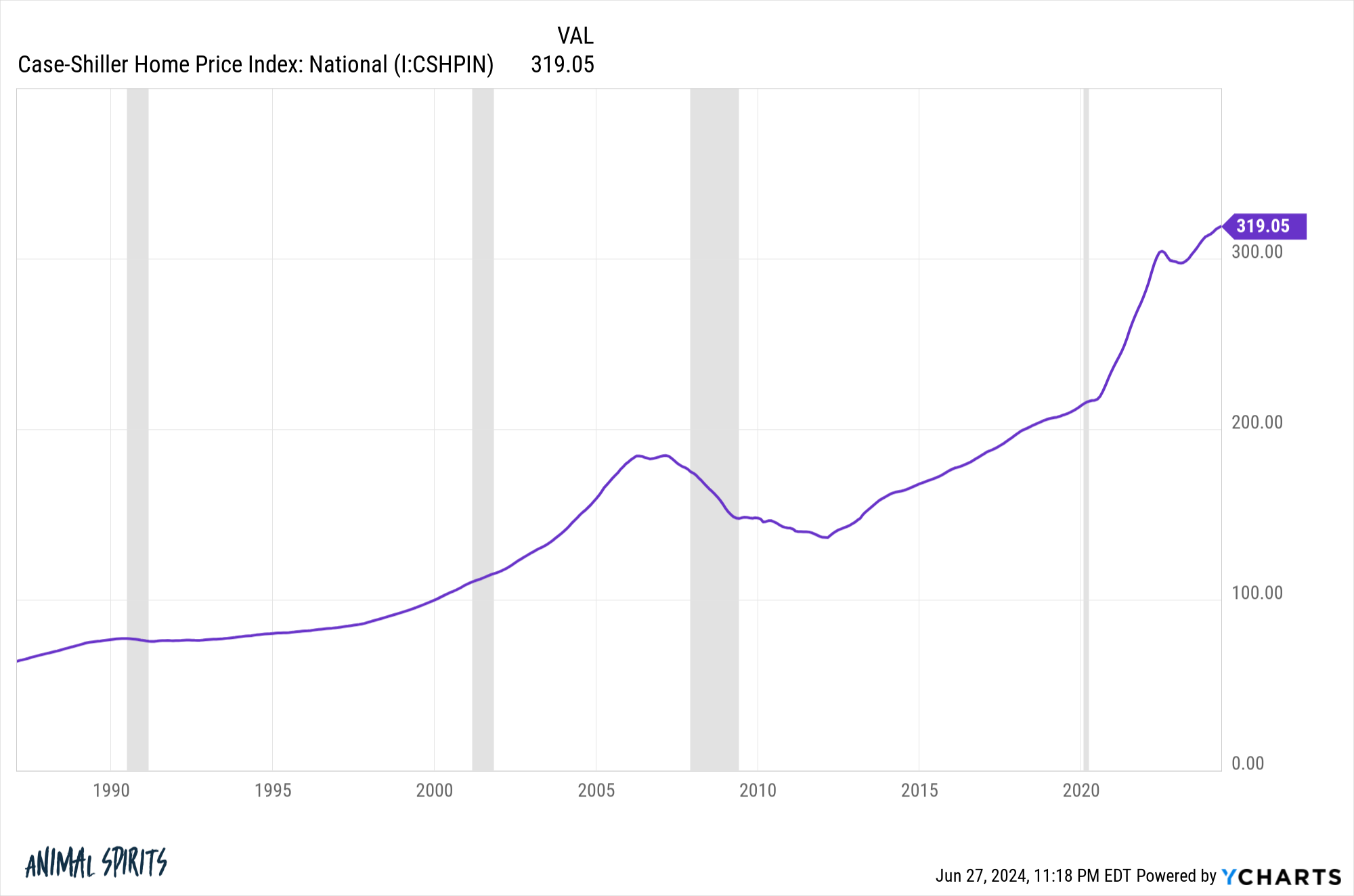

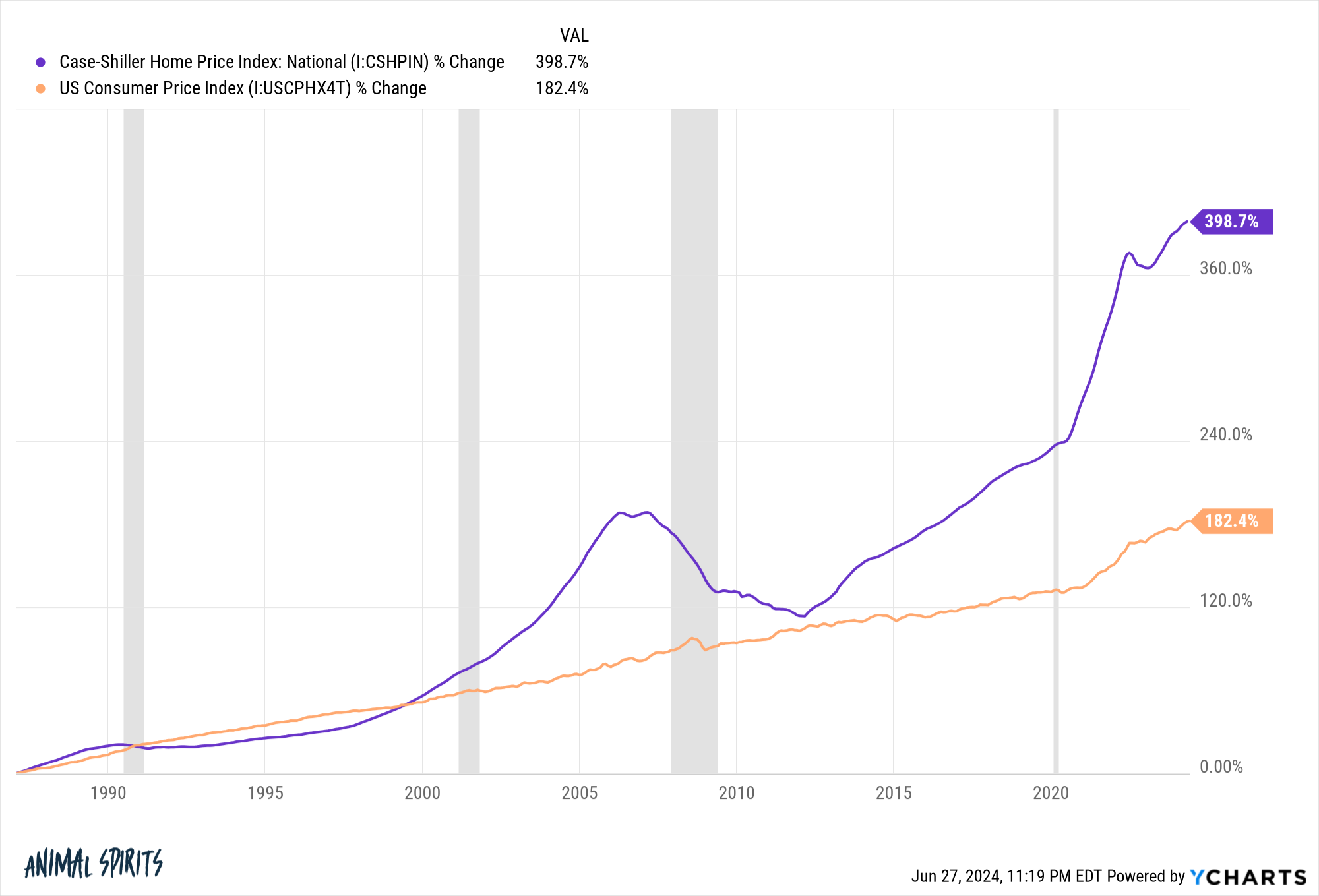

Home prices continue to reach new highs.

After all, homeownership was probably the best hedge against inflation this cycle.

It’s unclear what the future holds for the housing industry.

If mortgage rates remain high, inventory will continue to rise and price appreciation will slow.

If mortgage rates fall enough, you could see a surge in demand from buyers and sellers who have previously held off on purchasing, but that may depend on why rates are falling.

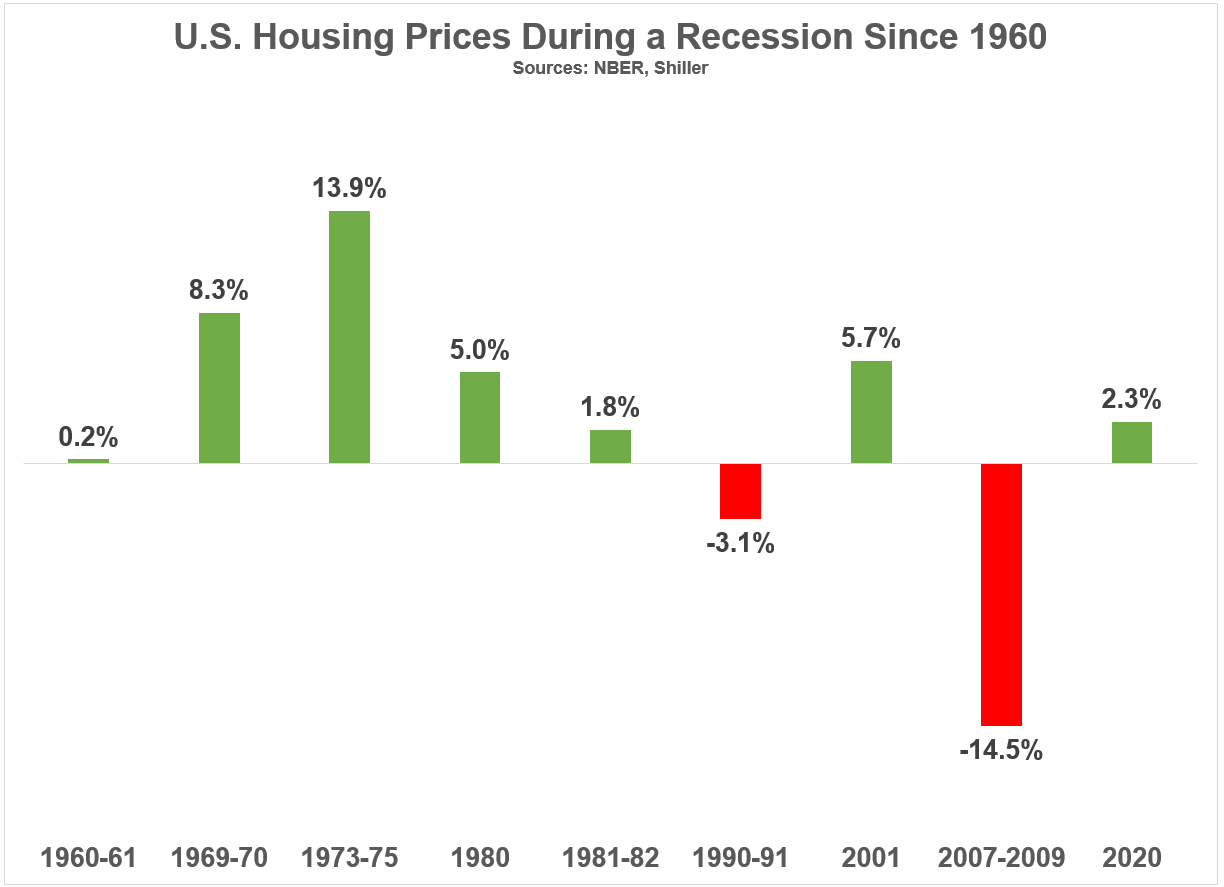

A recession doesn’t necessarily devastate the housing market as expected.

It is not a given that prices will plummet during the next economic contraction.

Higher mortgage rates have helped cushion the housing market from the pandemic’s turmoil, but they could cause more problems in the future as homebuilders slow down new construction.

Lower mortgage rates give borrowers peace of mind and encourage more homebuilding, but they could also lead to increased demand in an already supply-constrained market.

This situation won’t last forever, as something unexpected will inevitably happen at some point, but for now, the housing market is in a “try and fail” state.

References:

Who is buying a home in this market?

This content, including any security-related opinions or information, is for informational purposes only and should not be relied upon in any way as professional advice or a recommendation of any practice, product or service. There is no guarantee or assurance that the views expressed herein will apply to any particular facts or circumstances and they should not be relied upon in any way. Please consult your own advisors regarding legal, business, tax and other related matters regarding investments.

Comments in this “Post” (including any associated blogs, podcasts, videos and social media) reflect the personal opinions, viewpoints and analysis of the Ritholtz Wealth Management employees providing the comments and should not be considered as the views of Ritholtz Wealth Management LLC or any of its affiliates, nor as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to securities or digital assets or performance data are for illustrative purposes only and do not constitute an investment recommendation or the provision of investment advisory services. Charts and graphs provided are for informational purposes only and should not be relied upon when making an investment decision. Past performance is not indicative of future results. Content speaks only as of the date indicated. Projections, estimates, forecasts, goals, prospects and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to opinions expressed by others.

Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payments from various entities for advertising in affiliated podcasts, blogs and emails. The inclusion of such advertisements does not constitute or imply an endorsement, sponsorship, recommendation or affiliation of those advertisements by the content creator or Ritholtz Wealth Management or its employees. Investing in securities involves risk of loss. For additional advertising disclaimers, please see: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosure here.