Last week, I wrote about biotech stocks, sector rotation, lithium and electric vehicles (EVs), as well as raw materials demand due to electricity use.

Biotech (more on that later) has disappointed investors.

Sector rotation did occur, but only to a point.

Lithium fell and Tesla was the winner in EVs, but that wasn’t actually the case.

We saw some support in terms of raw materials demand, but nothing spectacular in terms of commodities.

Let me state that gold is stabilizing, copper is starting to rebound, sugar has broken through resistance, crude oil is above $81 a barrel, and platinum may be poised to surge.

We plan to explore this in more detail in the coming weeks.

With PCE weakening slightly, GDP essentially unchanged, and the first round of debate over, it is time to reexamine our economic modern family.

Families help us understand what trends are continuing, emerging, or ending, and why.

First, the Retail Sector ETF (XRT) has captured the interest of families and economists alike.

Following poor performance from Nike and Levi Strauss, XRT is once again sitting at the bottom of its weekly channel line, just as it was two weeks ago.

So, once again, we’ll need to keep an eye on the market for signs of further consumer fatigue, and then see how the story changes from there.

Currently, the sector has little hope for sustained deflation or a Fed bailout.

The Russell 2000 ETF (IWM) saw inflows but barely managed to hold above the key 202 level.

This will be a key indicator to watch this week as it could signal strength for the U.S. economy and provide some relief to retailers.

The Biotechnology Sector ETF (IBB) failed to break out of the upper limit of its weekly channel line and closed below its 200-week moving average.

IBB is back in range again.

yawn.

As for the rest of the ETF family, Regional Bank (KRE) performed the best.

Absolutely, that’s why we called it the Prodigal Son.

Now, we are watching to see if it will break through the upper limit of the weekly channel line.

The message here is that commercial banks have not been hit too hard and do not pose a threat to the U.S. economy at this time.

After FedEx posted solid earnings guidance through 2025, the Transportation Sector ETF (IYT) became a valuable member of the family.

However, headwinds remain.

IYT needs to break out of the lower limit of the weekly channel line or the 67 level.

Transportation is a key driver of growth because it connects goods and services to markets.

These areas reveal potential patterns.

Banks can help small businesses. Small businesses can help retail.

And if all this helps transportation stocks rise, it would raise hopes that interest rate cuts are on the table, or that a soft landing may be achievable, and that the U.S. economy will at least improve in the second half of 2024.

And finally:

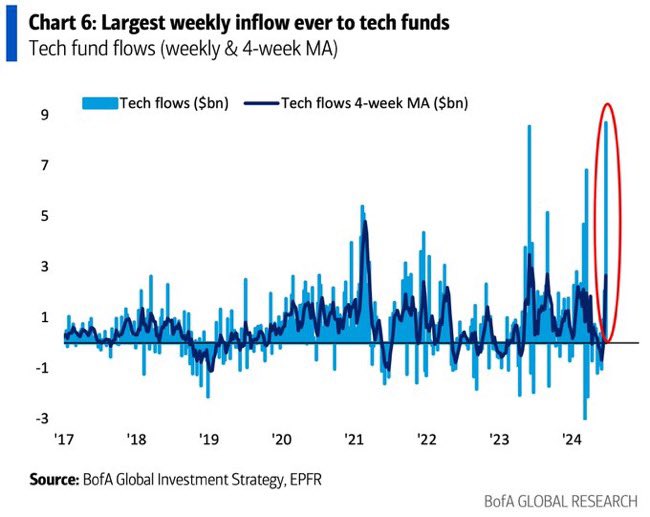

The Semiconductor Sector ETF (SMH) and technology funds recorded their largest weekly inflows on record.

Of course this happened, but the chart shows SMH with a potential depleted top.

Last week, SMH closed below its two-week low.

This is a technically confirmed ceiling pattern and could see the sector price drop closer to 230.

That’s not guaranteed, but the larger lesson is that the public doesn’t believe the best is in sight for stocks and continues to buy at what could become record highs (at least for a while).

Overall, sector rotation to the “inside sectors” is at least starting to rear its head.

I want to see more.

twitter: @MarketMinute

The author may hold positions in the securities mentioned at the time of publication. The opinions expressed in this article are solely those of the author and do not necessarily represent the views or opinions of any other person or entity..