If there’s one thing you should know AGNC Investments (Nasdaq: AGNC)AGNC Investment’s biggest strength is that this mortgage real estate investment trust (REIT) has a very high dividend yield of 15%. This can be both a blessing and a curse for investors, but it really depends on the type of investor you are. Here’s why most investors don’t want to buy AGNC Investment and why some investors might be very interested in this high-yield stock.

Who Shouldn’t Buy AGNC Investments?

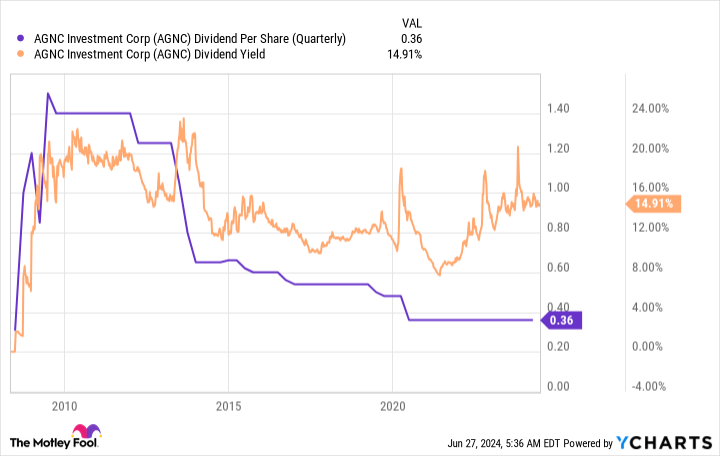

A 15% dividend yield is eye-catching for most dividend investors. Think about it for a second. The average return on stocks is generally considered to be 10%. The dividends from AGNC Investment alone exceed that figure. While that sounds too good to be true, for those who need to use their dividends to pay for everyday expenses, teeth That’s incredible, and when you take a look at the chart below, it’s easy to see why.

The quarterly dividend (purple line) is key for dividend-focused investors. Dividends increased rapidly after AGNC Investment went public, but have been declining for over a decade. Most investors would prefer a growing dividend rather than a decreasing one. Next, look at the orange line. This is the dividend yield. It has remained high throughout the REIT’s history, often exceeding 10%. High-yield stocks that regularly cut their dividends are the epitome of a dividend trap.

FYI, dividend yield calculations dictate that in order for the dividend yield to remain high, the stock price would have to fall along with the dividend (more on stock prices later). So not only did investors lose income, they also lost capital. You can see why most investors, especially those looking for passive income, would want to avoid this super high yield REIT.

AGNC investment may be attractive to some investors

But just because it’s a bad choice for most investors doesn’t mean it’s not suitable for some, and that’s certainly the case with AGNC Investment. Looking at another chart, we can see why. As you’d expect from the way yields are calculated, AGNC Investment’s stock price has fallen since its dividend was cut. As the purple line below shows, the stock has lost roughly half of its value since inception.

But look at the orange line. That’s the total return. An increase of over 385%. The key here is that you need to reinvest the dividends to get the total return. Essentially, a large yield encourages investors to keep buying the stock, allowing the compounding effect to more than make up for the share price decline. But you need to reinvest the dividends to get this result. In other words, AGNC Investment shouldn’t really be viewed as an income stock, but as a total return vehicle.

AGNC Investments is an attractive way to gain exposure to the mortgage market. In fact, since its IPO, AGNC Investments’ total return has been: S&P 500 Indexing. This is of interest to investors who use asset allocation models. This is not an approach that most smaller investors take, but it is a common approach for larger investors such as pension funds, family offices and insurance companies.

Bad for some, good for others

AGNC Investment is not a bad company, and it’s not a bad stock. Its purpose is to provide exposure to the mortgage market, and it serves that purpose fairly well. But that purpose won’t meet the needs of every investor. If you need access to income from your portfolio, past experience tells you you don’t want to own AGNC Investment. But if you care about total return, want exposure to mortgage securities, and want to complement your asset allocation model, AGNC Investment might just be the stock for you.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before buying AGNC Investment Corp. shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks The stocks investors should buy now are… AGNC Investment Corp. was not among them. The 10 selected stocks have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $759,759.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 24, 2024

Ruben Greg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is AGNC Investments Stock a Buy? was originally published by The Motley Fool