Advances in AI and falling component costs are helping to bring humanoid robots from theory to reality, attracting interest from corporate investors.

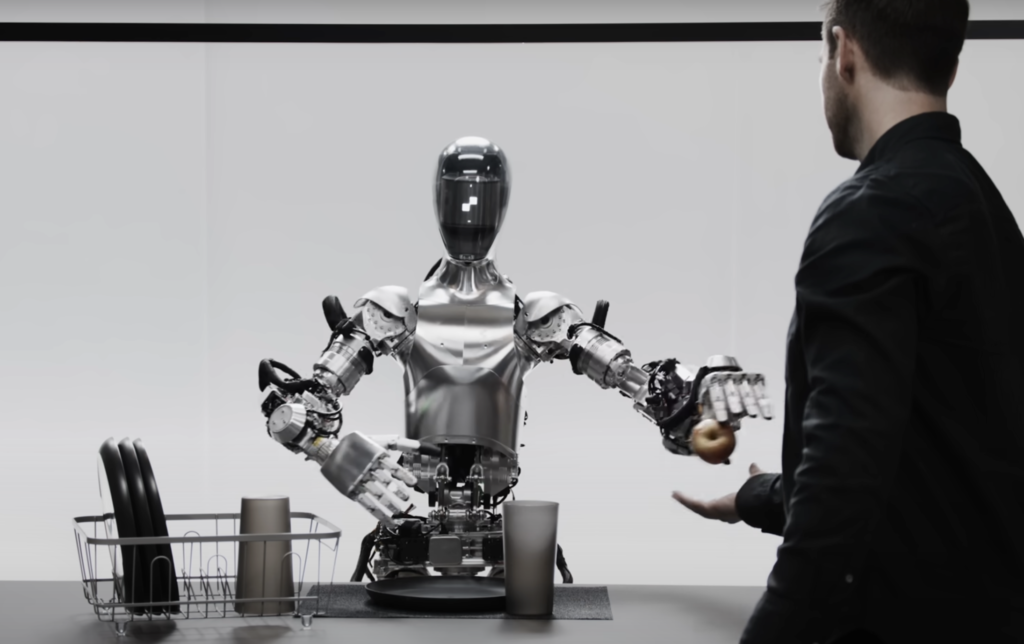

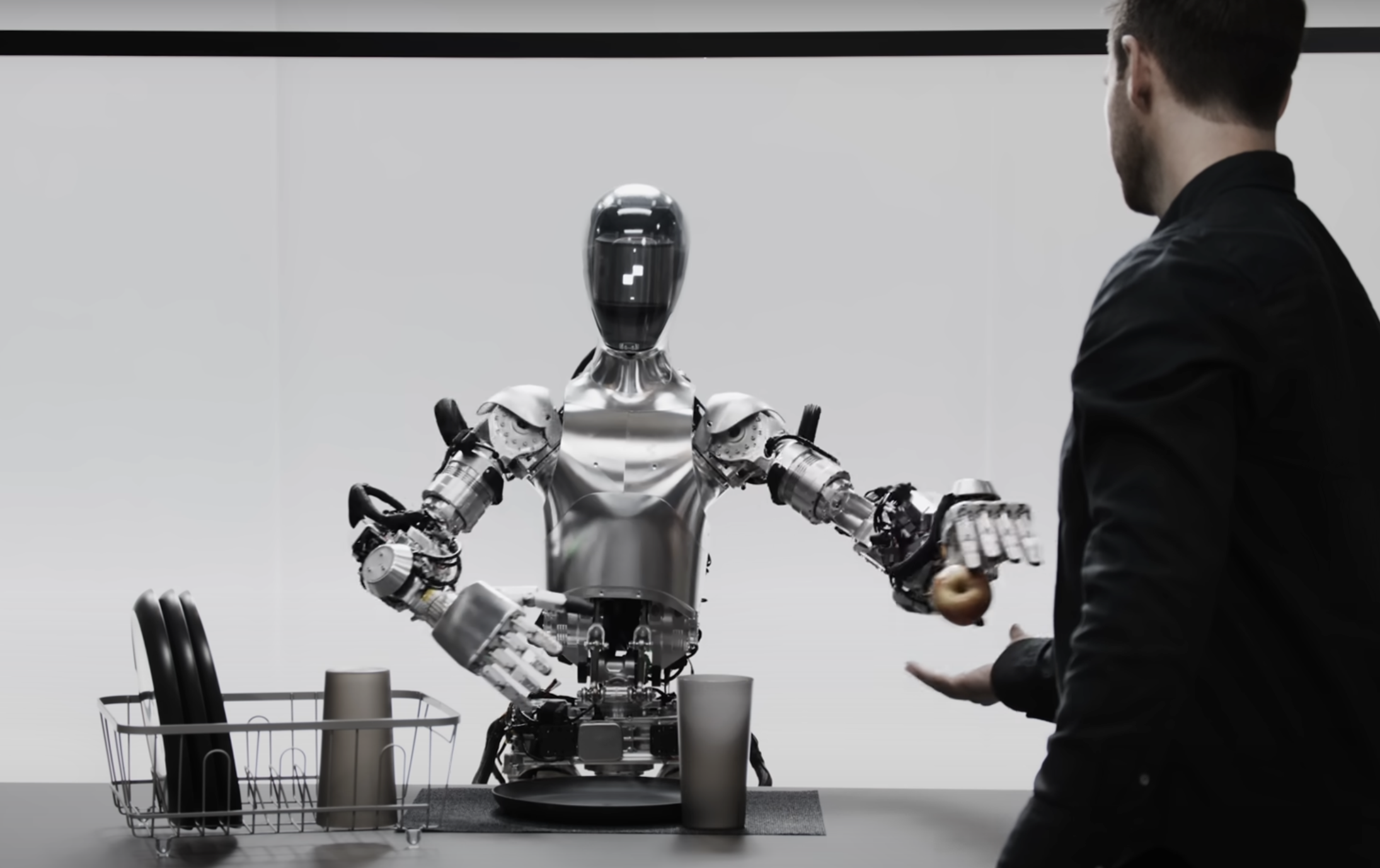

In an unforgettable moment for AI technology, OpenAI’s ChatGPT stepped out of the virtual world and into the form of a humanoid robot built by Figure AI. A video that went viral a few months ago captured the impressive debut of a human-like AI: ChatGPT fed the human the only edible food in front of it, picked up trash, neatly arranged dishes on a drying rack in one fluid motion, and carried on a coherent conversation with its tester.

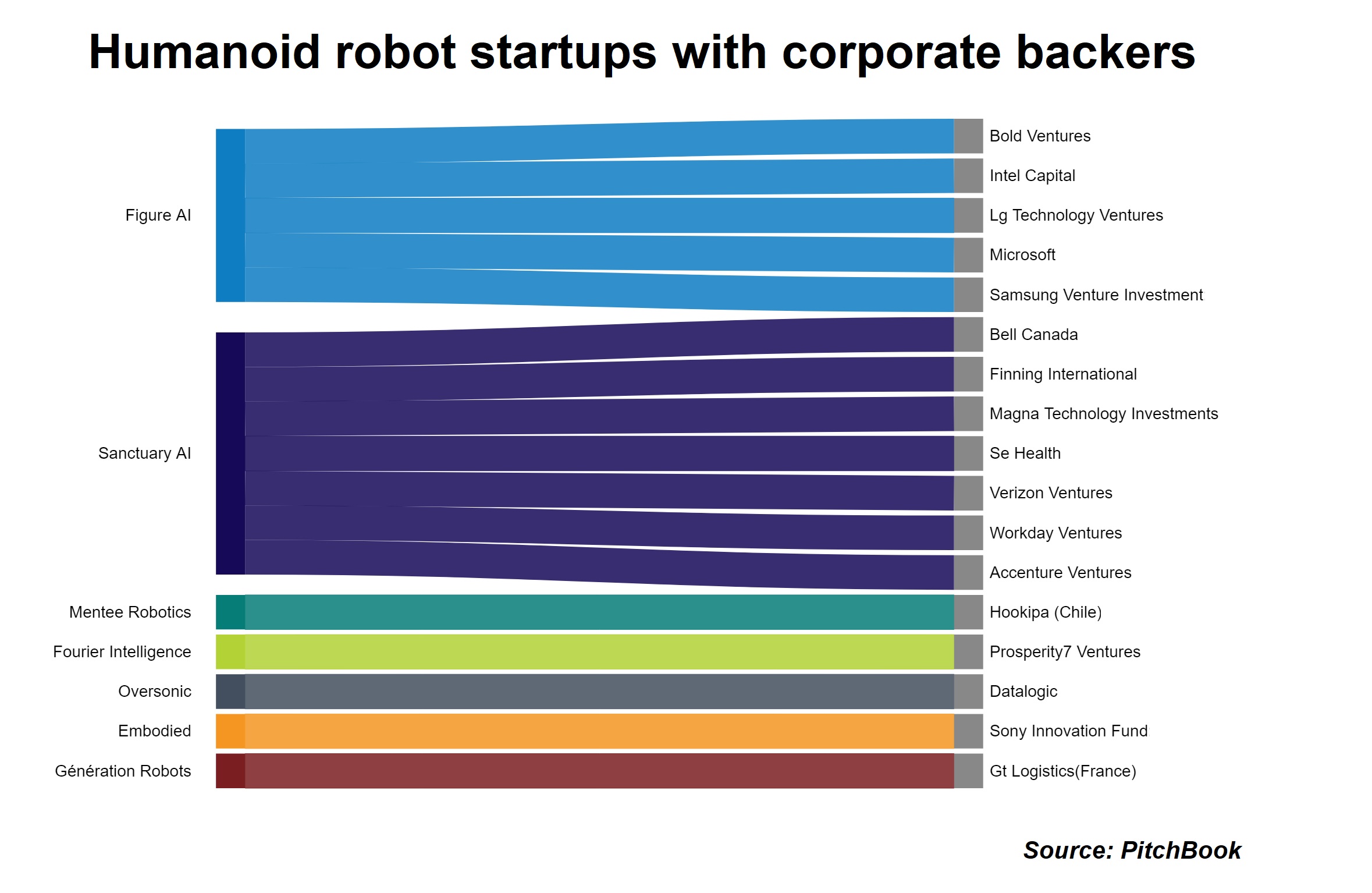

After decades of theoretical existence, humanoid robots are finally here and appear to be catching the attention of corporate investors. Much of the corporate investment in this space is focused on two companies: Figure AI and Sanctuary AI.

California-based Figure AI secured $675 million in a Series B round in February this year, with participation from tech giants LG, Samsung, Microsoft and Nvidia, giving the company a reported pre-money valuation of $2 billion. Other investors in the startup include semiconductor maker Intel (via Intel Capital) and OpenAI. LG and Samsung participated through their LG Technology Ventures and Samsung NEXT Ventures units. The significant capital injection is expected to accelerate the development of Figure AI’s advanced humanoid robots.

Vancouver-based Sanctuary AI is developing general-purpose humanoid robots that provide a cost-effective solution for autonomous labor, addressing growing challenges such as labor shortages and workplace safety concerns.

Sanctuary AI recently raised an undisclosed amount from Accenture Ventures. Other corporate investors on the company’s capital table include auto parts maker Magna, telecommunications companies Verizon and Bell Canada, software developer Workday, long-term care service SE Health and industrial equipment maker Finning International.

Several other humanoid robot development companies have received corporate investments, but usually from a single company: Saudi Aramco’s Prosperity7 Ventures, for example, is funding Shanghai-based Fourier Intelligence, which is developing a general-purpose robot called GR-1 focused on healthcare and rehabilitation services, and health and wellness humanoid robot developer Embodied has received funding from the Sony Innovation Fund.

Why humanoid robots now?

As with any technology, cost and scalability are always top of mind for investors. In the case of humanoid robots, a number of factors are converging to drive their rise.

Recent advances in AI have made it possible to train humanoid robots to learn tasks rather than programming every behavior individually.

Falling component costs are also helping: “Cost is always an issue, but prices are coming down. For example, the cost of a camera module is now very cheap,” said Kim Dong-soo, head of LG Technology Ventures at LG Innotek Fund, which invested in FigureAI.

Even in the post-pandemic era, there will still be a labor shortage and there will be a market need for robotic replacements.

Josh Berg, head of corporate ventures at Manga and an investor in Sanctuary AI, believes humanoid robots could be effective in filling undesirable jobs: “The workforce has been significantly impacted by the COVID-19 pandemic, resulting in labor shortages in certain industries. In this context, humanoid robots can be seen as a potential solution to fill jobs where it may be difficult to find willing human workers. Ultimately, our aim is to use humanoid robots to tackle undesirable or hard-to-fill jobs.”

Humanoid robots are emerging to fill a very specific market niche. There are already plenty of robots in everything from home appliances to manufacturing assembly lines that don’t mimic the human form. But LG Technology Venture’s Kim says there are some tasks where a humanoid shape would be useful.

Most workspaces are designed for humans, and it would be useful for robots to have a similar shape, he said. “I don’t see humanoid robots replacing existing robots in manufacturing. They’re more likely to replace humans in some industrial settings, such as warehouses, where spaces are designed specifically for humans,” he said.

Beyond dangerous industrial tasks, Kim sees great potential for general-purpose humanoid robots in the medical field. “Another area with great potential is elderly care, as people tend to feel more comfortable with things that resemble humans,” he said, noting that such robots have already been used for some time in Asian countries such as South Korea and Japan.

What corporate investors want

Corporate investors backing humanoid robotics startups all look for the same basic criteria: a great team and a solid investor base. But there’s one thing in particular they look for:

Humanoid robot startups are heavily funded, so there’s a temptation to do everything on their own. “Founders need to be willing to cooperate and partner with others who have the know-how, including companies like LG. Some companies can be overprotective at times and difficult to work with. I’ve seen this to varying degrees,” says LG Technology Venture’s Kim.

While some companies, like Tesla, have had success manufacturing (almost) all of their components in-house, it’s generally more efficient to partner with an entire ecosystem.

“Just because you’ve raised enough capital to do something in-house doesn’t necessarily mean you should,” Magna’s Berg said. Sanctuary AI is a good example, he said. “They’re taking an approach similar to OEMs, and they’re seeing the benefits of outsourcing certain components and services.”

“They understand that even if they have the capability to produce humanoid robots themselves, it may be more cost-effective to work with a supplier that can also produce them in large quantities. This mindset requires not only organizational and technical understanding, but also the humility to know that sometimes they have to rely on the expertise of experts around them,” he says.