On June 24, 2024, Sharp Ingle, Director of Ingles Markets Inc (NASDAQ:IMKTA), sold 4,799 shares of the company’s stock at $70.38 per share. The transaction was listed in a recent SEC filing. Following this sale, the insider now owns 5,901 shares of the company’s stock.

Ingles Markets Inc operates a chain of supermarkets in the southeastern United States. The company carries a variety of grocery items, including fresh produce, non-perishable foods, and other general merchandise. Ingles Markets Inc is known for its focus on providing a local product mix and strong customer service.

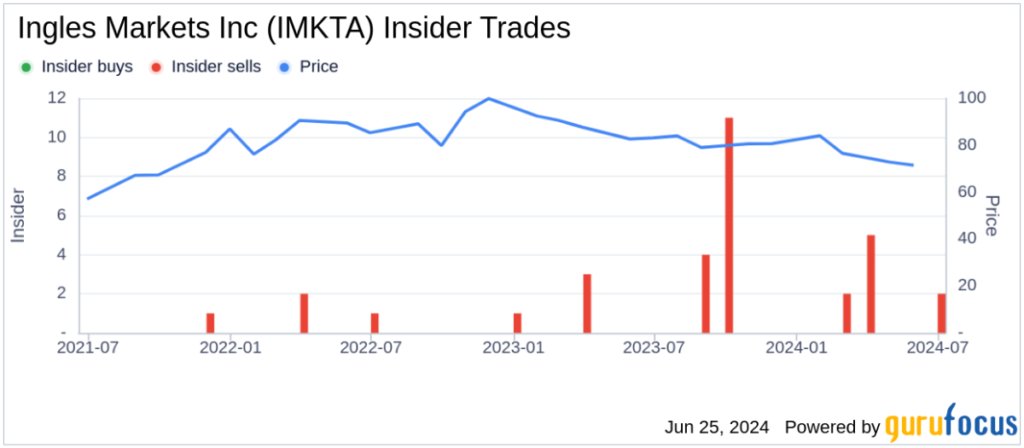

Over the past year, Sharp Ingle has sold a total of 75,799 shares but has not made any purchases of the company’s stock. Ingles Markets Inc’s insider trading history shows a total of 25 insider sales and no insider purchases in the same period.

On the day of trading, Ingress Markets Inc.’s stock price was traded at $70.38, giving the company a market capitalization of $1.32 billion. The company’s price-to-earnings ratio of 7.50 is lower than the industry average of 16.62 and the company’s historical average.

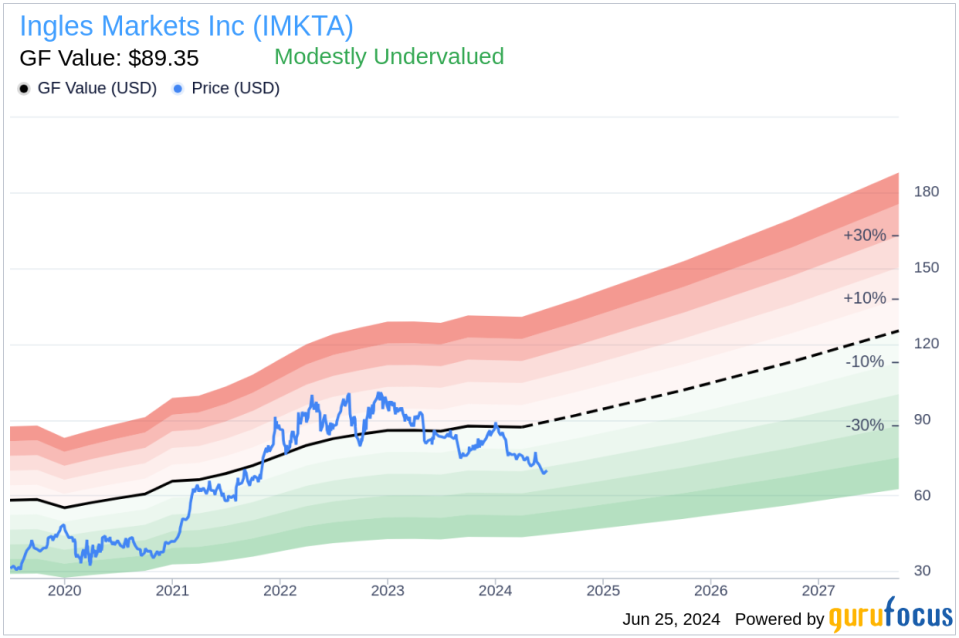

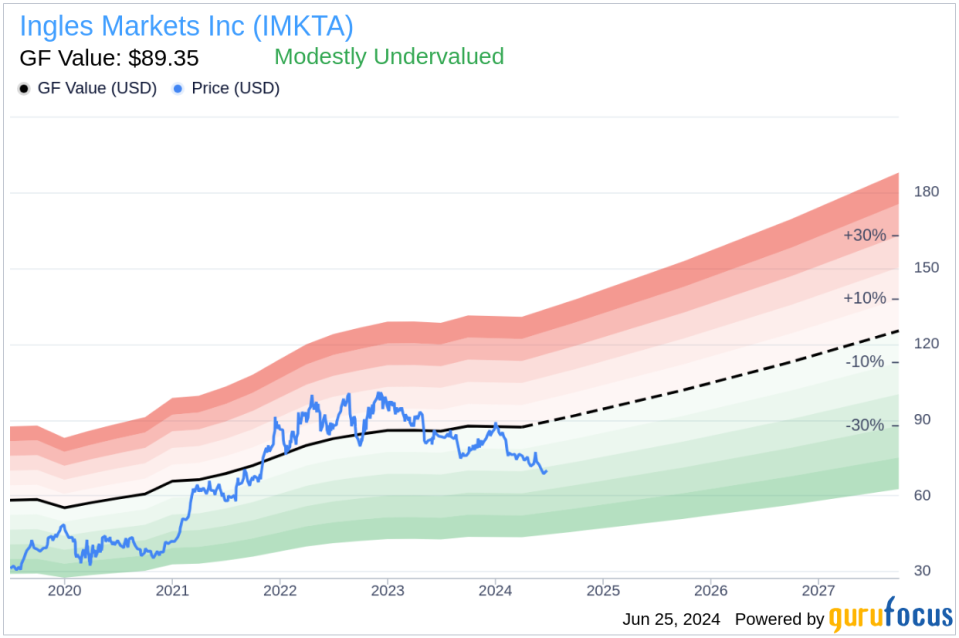

According to GF Value, a GuruFocus estimate of the intrinsic value, Ingles Markets Inc is currently moderately undervalued with a Price to GF Value ratio of 0.79, and a GF Value of $89.35 suggests that the stock is likely undervalued.

This valuation is supported by historical multiples such as price-to-earnings, price-to-sales, price-to-book and price-to-free cash flow ratios, as well as GuruFocus adjustment factors based on historical earnings and growth, and Morningstar analyst forecasts of future earnings performance.

This article written by GuruFocus is intended to provide general insights and is not tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment guidance. It is not a recommendation to buy or sell stocks, nor does it take into account individual investment objectives or financial situation. Our objective is to provide long-term, fundamental data-driven analysis. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus has no position in the stocks mentioned herein.

This article was originally published on GuruFocus.