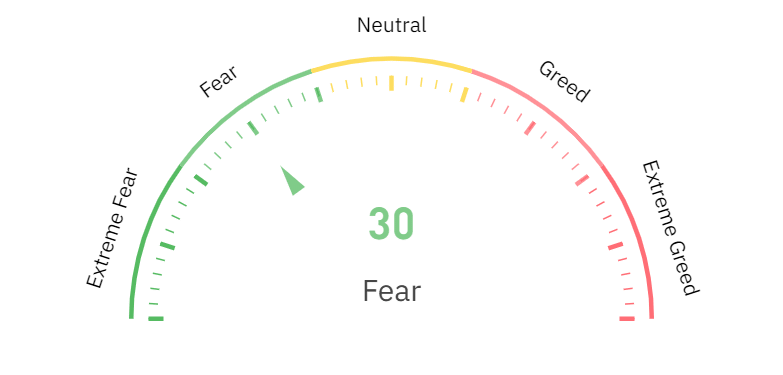

- Fear and greed over cryptocurrencies has shown that the market is in fear.

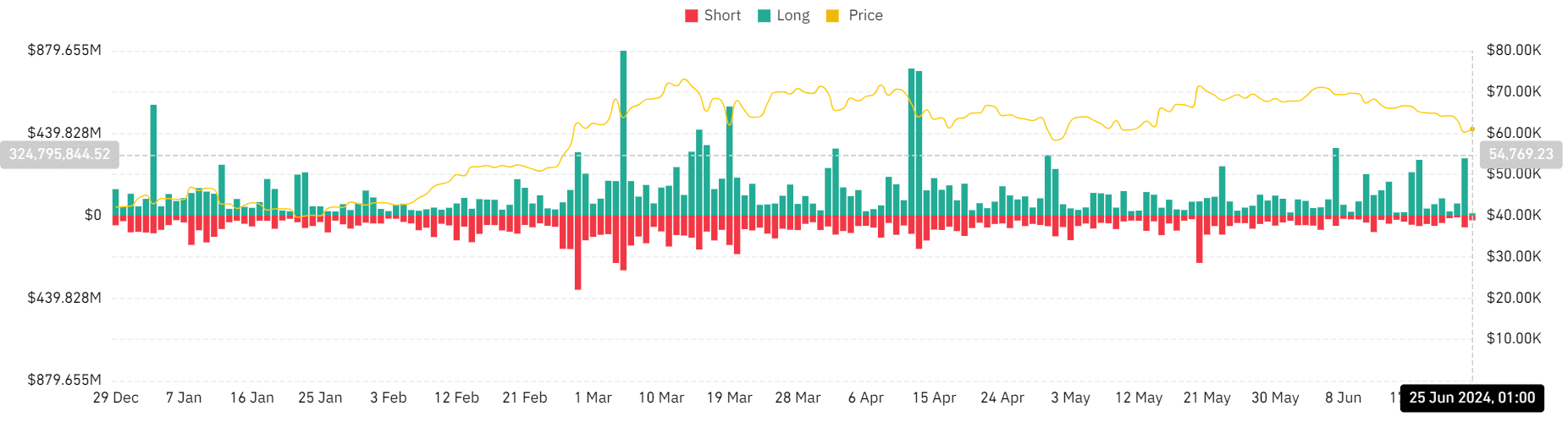

- Long liquidation volume also increased sharply.

The recent drop in Bitcoin [BTC] The price drop had a noticeable ripple effect across the cryptocurrency market. The drop had a significant impact on market sentiment, as evidenced by the change in the Fear and Greed Cryptocurrency Index.

The impact of the price drop was also seen on the liquidation map.

Fear dominates cryptocurrencies

Coinglass reported that the Fear and Greed Cryptocurrency Index was at 30 at the time of writing, a clear indication that fear was dominating market sentiment.

The index collects data from various sources, including market volatility, social media sentiment, trends, and other relevant factors to gauge the general sentiment of cryptocurrency investors.

Source: Coinglass

A score of 30 falls into the “fear” category and indicates investors are concerned about potential downside risk. This sentiment often arises in response to recent negative market events, such as a large price drop.

This may lead to a more cautious approach among investors.

In such a situation, trading volume may decline as investors refrain from purchasing for fear of further losses. Conversely, if investors expect a further decline, they may sell their holdings to avoid bigger losses.

This shift to fear reflects growing uncertainty and pessimism about the market’s near-term outlook.

Market liquidations on the rise

An analysis of the liquidation chart highlights that there was a significant increase in liquidations on June 24th, with the total amount exceeding $367 million.

The majority of the liquidations were from long positions, amounting to over $305 million, which was a key factor in driving the fear and greed crypto index towards fear.

Such a large liquidation of long positions indicates that many investors who had bet on the cryptocurrency’s price to rise were forced to exit their positions.

This can cause the market to be flooded with sell orders, causing prices to plummet.

Source: Coinglass

The small amount of short liquidation, just over $62 million, suggests that fewer traders were willing to go against the market and forcibly liquidate their positions.

This suggests that investors were expecting continued growth that just didn’t materialize.

How the code of fear and greed was formed

An imbalance between long and short liquidations often exacerbates price declines and increases fear and uncertainty in the markets. A surge in short liquidations typically has the opposite effect.

This indicates that pessimistic traders are being squeezed out, which, if sustained, could push prices higher and trigger a shift towards greedy sentiment.

Read Bitcoin [BTC] Price Forecast 2024-25

The recent events represented by these liquidations are a key indicator of market sentiment and trends.

These reflect not only individual traders’ reactions to price movements but also broader market sentiment that may drive future trading behavior.