This is the gist of today’s Morning Briefing. sign up Get the following in your inbox every morning:

The stock market in 2024 is being defined by one theme: AI.

Not just because people want to talk Speaking of AI, market performance also depends on AI.

In a weekly note to clients published on Monday, strategists at BlackRock Investment Institute led by Jean Boivin highlighted the following chart that shows how technology has dominated market performance since 2023.

Since the beginning of last year, the S&P 500 is up a massive 42%. That’s no mean feat: an annualized return of nearly 26%, nearly three times the index’s long-term average annual gain.

However, a clearer picture emerges when we analyze just the performance of tech stocks.

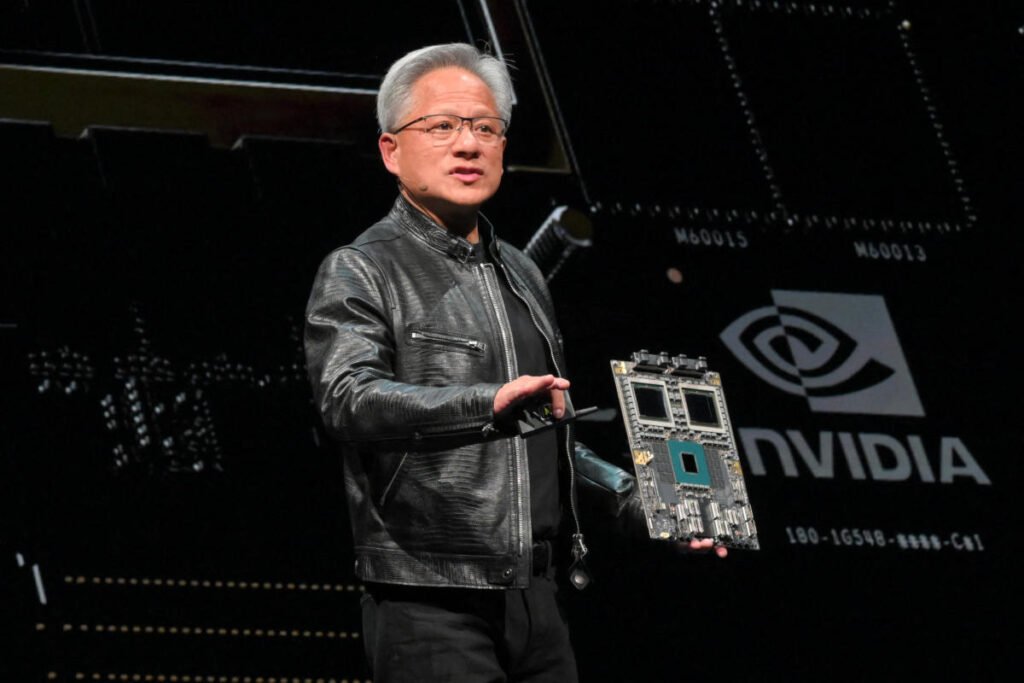

During that same period, the S&P 500 technology index, which includes current market leader Nvidia (NVDA), as well as Microsoft (MSFT), Apple (AAPL), and two other major AI beneficiaries, Broadcom (AVGO) and AMD (AMD), is up 100%. (Though, as Jared Blikre pointed out last week, investors who bought the most popular technology ETFs are missing out on some of this performance.)

Excluding the technology sector, the S&P 500 is up a respectable 24% over the same period, but much closer to its historical average.

“Concentration in U.S. tech stocks is a feature of the AI theme, not a flaw,” BlackRock wrote.

Tech sector stocks overall posted a 23% year-over-year profit increase in the first quarter, analysts noted. Profits for the overall S&P 500 rose 5.9% year-over-year in the first quarter, according to FactSet data.

Over the long term, corporate earnings are the most important driver of stock prices, and tech companies are currently growing their profits at a much faster pace than the index average, so this outperformance is hardly an anomaly.

BlackRock added that “strong balance sheets are another reason we like technology companies and are less concerned about valuation metrics.”

“Data from LSEG Datastream shows that technology companies’ free cash flow (excluding operational costs) as a percentage of sales is almost double that of the overall market, giving tech companies the highest profit margins across the sector. Additionally, many top tech companies are highly profitable and well-funded, allowing them to fund the build-out of AI infrastructure such as data centers.”

As we highlighted late last week, one of the key themes highlighted by JPMorgan’s equity strategy team during the bank’s first-quarter earnings call was the emphasis corporate executives place on continuing to invest in AI.

All of this is part of the reason why three Wall Street banks raised their price targets for the S&P 500 last week in the wake of enthusiasm for AI.

Of course, this trend is not without potential pitfalls: BlackRock cited declining popularity of AI investments, regulatory changes, and unexpected actions from the Fed as potential risks to AI’s dominance.

Still, the firm maintains its overweight recommendation on U.S. stocks with an emphasis on AI.

“In a world where big forces — big structural changes — drive current and future profits, we are focused on the short- and long-term impact of AI on the bottom line,” the company wrote.

For the latest stock market news and in-depth analysis, including stock-moving events, click here.

Read the latest financial and business news from Yahoo Finance